Most people want to remain independent throughout retirement and to stay in control of where and how they live. But your ability to do so may depend on your health and physical well being. As we age, some things become harder to do on our own.

For many people navigating the aged care area can be emotionally and financially stressful. Partners, children and carers often need to work their way through a system that to them seems unfamiliar, daunting and financially complex. Their decision making is made more difficult because these decisions are often made when their own physical and mental energy is already depleted in caring for an aged or disabled family member or friend. So if your family member’s ability to live independently starts to decline and they need help with daily living activities such as cooking, cleaning and personal care, this where ‘aged care’ comes into play.

As a Financial Adviser I provide financial advice in the aged care area, within the Canberra region, to assist families to make the best decisions possible. We look at maximising Centrelink entitlements, reducing some care fees where possible and increasing overall cashflow. People that I work with have said trying to navigate choices with Aged Care is much easier when they have complete information about the ramifications of the different lifestyle and financial choices open to them.

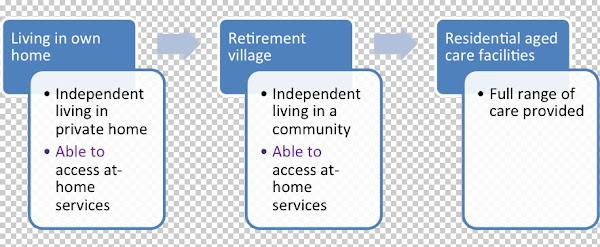

‘Aged care’ is the term for daily living and nursing care services provided to retirees who are no longer able to live independently. Services are generally divided into two categories:

- • At-home services

• Residential care services

‘Aged care’ should not be confused with retirement villages which are independent living options.

This article looks at some of the realities about accessing care as we get older and what we might expect. The best plan is always to understand your options and be prepared.

The difference between retirement villages and aged care

Choices to live in retirement may depend on individual’s financial situation as well as personal preferences, desired lifestyle and physical needs. Over time there may need to move between different types of accommodation to access services that meet your changing needs.

Retirement villages

Retirement villages provide a community environment for retirees with accommodation choices such as units, villas or separate houses.

The cost to enter a retirement village is a private commercial arrangement between you and the village operator. The government does not subsidise the cost so you need to be able to afford the full cost.

Villages are governed by state legislation but conditions and fees can vary widely. It is important that you read the contracts carefully to understand the full costs and how much money will be returned to you when you move out. I always recommend that you have the contract explained to you by a property lawyer so you fully understand the contract you are signing as you would with any property purchase.

You can access at-home services while living in a retirement village through either the HACC program (see below) or from private operators. Some villages may provide aged care facilities and services.

Residential aged care

Residential-aged-services provide full care for people who can no longer live independently, including:

• On-call staff for assistance

• Meals

• Basic accommodation-related services such as furnishings

• Cleaning services and general laundry

• Bedding

• Maintenance of buildings and grounds

• Nursing care.

Within all areas and Canberra is no different, to access subsidised care services, you need to receive an approval from an Aged Care Assessment Team/Service (this is where the ACAT acronym is derived from and an ACAT assessment is the first step in determining what level of care you can access in a subsidised situation). This will specify whether the need is for low-level care (hostel care) or high-level care (nursing home care).

At-home services

The Home and Community Care (HACC) Program provides a range of at-home care services. The services are designed to meet the needs of an individual. The government may subsidise the costs with a contribution from the care recipient.

HACC services include:

• Home help – cooking, cleaning, washing and ironing

• Home modifications and maintenance

• Social support – such as banking and transport

• Food services – Meals on Wheels, help with shopping, centre-based meals

• Personal care – help with bathing and dressing

• Community respite – to give carers a break or for people living alone.

• Health services – such as home and community nursing, physiotherapy and podiatry.

The government also provides a number of at-home care packages which suit someone who has family members or friends to support the care. These packages are also subsidised. A part-pensioner or self-funded retiree may pay a higher contribution. This is in addition to normal household and personal expenses.

The fees you can currently expect to pay to enter residential aged care are shown below

* The average bond across Australia is around $230,000. In Canberra this fee can be as high as $550,000 for some facilities.

The future of aged care

The demand for aged care services will increase rapidly over the next 40 years with baby boomers moving through retirement and the number of informal carers declining due to smaller family sizes and children more likely to be living away from parents.

The average cost of low-level residential care is around $35,000 a year and high-level is around $66,000 a year. But how much of the cost you pay depends on your level of assessable income, as determined by Centrelink or Veterans’ Affairs.

A person with a home and the full age pension may need to pay the entry cost (with the home to support payment of these fees) and $43.22 a day ($15,775 per year – set at 85% of the full single pension) to pay for their care. The government pays the rest.

A person with higher levels of income will pay a higher cost for care. For example, a single person with assessable income of $1,000 a fortnight (including any age pension) may pay around $46.43 per day plus any entry costs.

If you have questions relating to aged care options and the financial considerations, post them below.

Katrina Wybrow Dip FP CFP

Wybrow and Associates

Contact me

Disclaimer: The information in this article is general and does not take into account your particular circumstances. We recommend specific tax or legal advice be sought before any action is taken and refer to the relevant Product Disclosure Statement before investing in any product. Katrina Wybrow Authorised Representative of Fitzpatricks Private Wealth AFSL Lic No 247429.