Canberra house prices are rising again. File photo.

Canberra house prices have rebounded from their early winter softening, rising 1.1 per cent in August, according to CoreLogic’s monthly analysis.

After three months of negative results, albeit small, the national capital, along with Sydney and Melbourne, has recovered in time for the traditional spring selling season.

The market lost a total of 1.5 per cent over May, June and July but has now recovered most of that in one month, although CoreLogic says it is still 0.7 per cent off its peak.

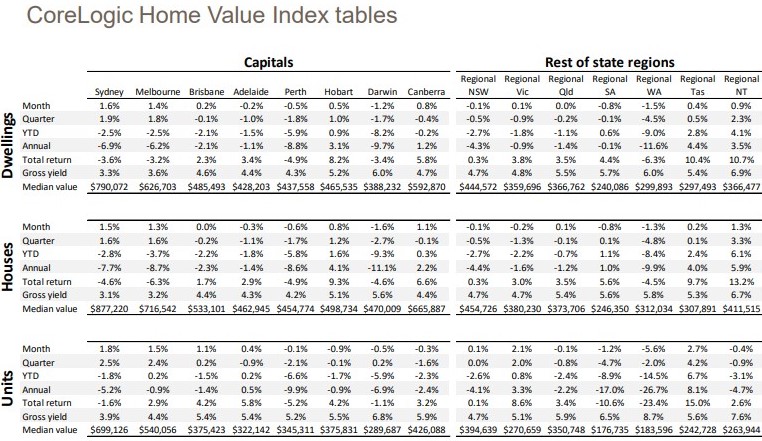

CoreLogic says the median house price rose to $665,887, for 2.2 per cent rise over the year to 31 August. In 2019 so far the rise has been just 0.3 per cent.

However, units remain in negative territory, with prices falling another 0.3 per cent after 0.5 per cent in July, and 0.8 per cent in June.

The median unit value is now $426,088, down 2.4 per cent over the year to 31 August and 2.3 per cent so far in 2019.

Overall, dwelling values are up 0.8 per cent for a median price of $592,870.

Patchy is how Will Honey from Independent described the Canberra market over the past few months but as the numbers suggest in the house sector, better times are ahead in spring.

He said numbers were up at open homes, although there were a few suburbs lacking in stock. But there was a bit more supply in the apartments, which had had an effect on prices.

“The market is starting to see some healthy signs with the warmer weather getting people out,” he said.

CoreLogic says the recovery in housing values accelerated in August with national dwelling values increasing by 0.8 per cent over the month, the first monthly increase in values since October 2017 and the largest monthly increase since April 2017.

Research director Tim Lawless said the lift in values aligned with a consistent increase in auction clearance rates and a deeper pool of buyers at a time when the volume of stock advertised for sale remained low.

“It’s likely that buyer demand and confidence is responding to the positive effect of a stable federal government, as well lower interest rates, tax cuts and a subtle easing in credit policy,” he said.

Housing values increased across five of the eight capitals over the month, but slipped lower in Adelaide, Perth and Darwin.

It was the third successive month of capital gain in Sydney, Melbourne and Hobart and the second successive month of increases in Brisbane.

“While the ‘recovery trend’ is still early, it does appear that growth trends are gathering some pace, particularly in the largest capital cities,” Mr Lawless said.

He said that a slow and steady recovery had been expected but with housing credit restrictions easing and mortgage rates likely to fall further, this rebound could potentially turn into a ‘v-shaped’ recovery.

But he warned that if the strong rises in values continue over coming months, it would not be surprising to see a new round of macroprudential policies introduced in order to keep debt levels in check and encourage spending in other areas of the economy.