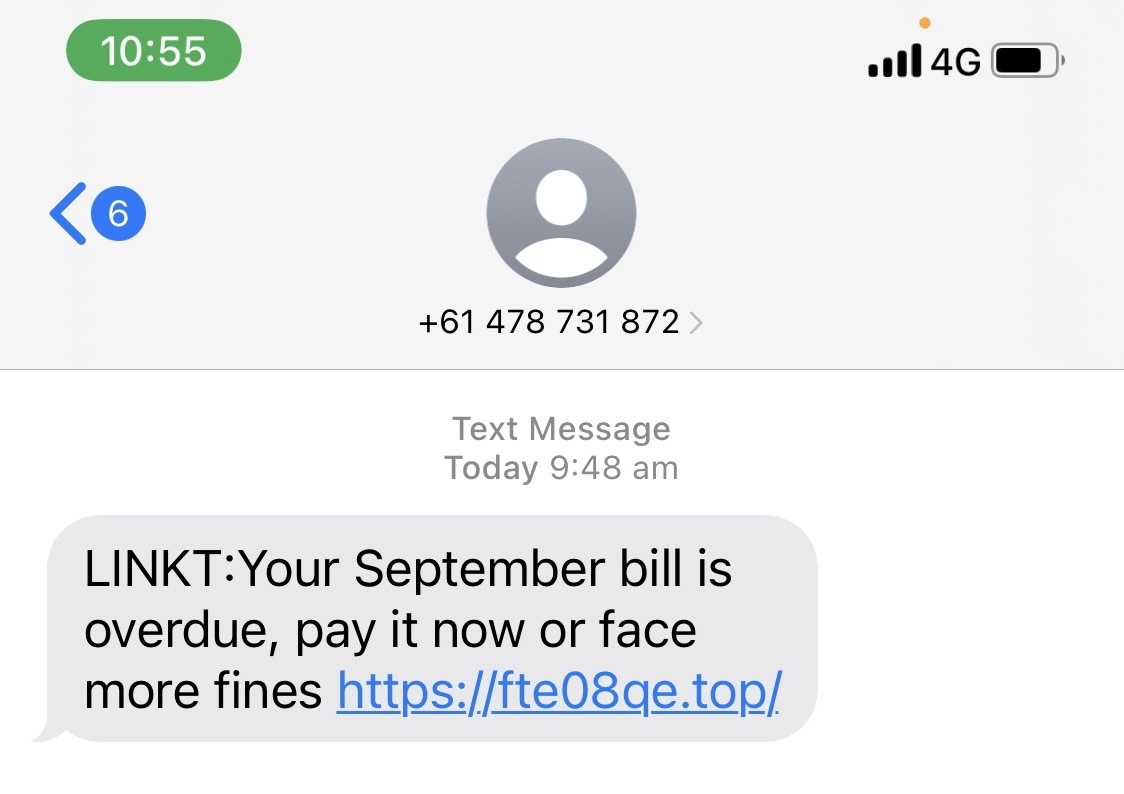

Linkt scam, asking for payment of a $5.83 late fee when it really wants $1500. Photo: James Coleman.

“Your September bill is overdue, pay it now or face more fines.”

Dani (surname omitted) received this text message last month claiming to be from Linkt, a NSW toll payment collector. She had been to Sydney in September but was out of the country when the toll payment fell due so she knew she had a late fee to pay.

“I clicked on the link in the text message and it took me to the Linkt website and it had $5.83 as the amount to pay,” she says.

“I put in my card details but when I accepted the transaction, $1500 came out of my bank account. I then went into my recent transactions and it came up as a Wish Gift Card from Woolworths, worth $1500. But I have never bought a Wish Gift Card.”

Dani is still in talks with her bank to recover the money, but she’s far from alone.

Canberrans are being encouraged to learn to identify the key scam signs to protect themselves as part of Scams Awareness Week (7-11 November). More than $7 million was lost in reported scams in 2021 within the ACT.

The Australian Competition and Consumer Commissioner (ACCC) reported Australians lost about $2 billion to scams in 2021, an 84 per cent increase compared to the previous year. The average loss was $12,742.

The top three scams reported to the ACCC’s Scamwatch were phishing (50,015), false-billing (16,263) and online shopping scams (13,068), while the highest losses went to investment scams ($292.9 million), dating and romance scams ($29 million), and remote access scams ($18.7 million).

Looks can be deceiving. Photo: Screenshot.

And they’re becoming unnervingly clever.

ACT resident Samantha (name changed) fell victim to a bank phishing scam after someone claiming to be a supervisor within her bank’s fraud department called about unusual activity in her account.

“They asked if I had opened any suspicious links lately and I told them about the link I had clicked about a month earlier,” she says.

“They informed me that malware had been installed on my phone and asked me to transfer my savings of $20,000 from my existing account to a new account they told me was linked to my current one but with updated credentials so the scammer couldn’t access it.”

But it was all a lie.

Then there’s Theo (name changed), who “met a nice girl on a dating app” only to fall, not in love, but for a romance baiting cryptocurrency scam.

“We had been speaking for a month and a half when she brought up cryptocurrency and said she could show me how to trade,” he says.

“I signed onto a legitimate cryptocurrency platform and transferred $30,000 into the account. She asked me to change the currency into USDT and into a new wallet.”

But when Theo tried to change this back into Australian dollars, he received a message demanding he pay $112,000 to make the withdrawal. A friend stepped in to help, but it was too late – his cryptocurrency account was frozen and the money lost.

The Australian Federal Police (AFP) Cybercrime Operations unit has seen a global increase in the volume and severity of cyber attacks, including scams, ransomware and business email compromise.

It seems Australia’s relative prosperity and widespread internet connectivity make it an attractive target for cybercriminals.

Assistant Commissioner Justine Gough heads up the AFP’s Cybercrime Command. Photo: Claire Fenwicke.

AFP Commander of Cybercrime Operations Chris Goldsmid said cybercrime was the “break-and-enter” of the 21st century and scams, and cyber attacks more broadly, were on the rise as more services and personal data moved online.

“Recent cyber attacks on several major businesses resulted in the release of personal data belonging to thousands of Australians, leaving them vulnerable to more targeted attacks,” Commander Goldsmid said, referencing the Optus data breach in September.

But as the tools and tactics cybercriminals continue to evolve, so do the defences.

Since the AFP Cyber Command was established at the start of the year in Canberra, 35 disruption activities have been carried out against criminal syndicates and particular scams. Among these were Operation Hurricane and Operation Guardian for the Optus breach.

The Federal Government has also committed $9.9 million in seed funding to help establish the National Anti-Scams Centre.

The centre will be led by the ACCC, in collaboration with the AFP and other government agencies, to protect and inform Australians about the dangers of scams.

After all, prevention and education remain the most effective ways to mitigate the threat and cost of cybercrime.

“If something doesn’t feel right, take the time to look a little deeper,” Commander Goldsmid said. “There are a lot of tell-tale signs of a scam that can be picked up on when you look closely, such as poor grammar, an incorrect email address or suspicious links.”

Visit Scamwatch for more information or to report a scam.