Canberra’s strengthening economy, prudent fiscal management and a bit of good luck have enabled the ACT Government to improve the expected budget deficit by $246 million this year.

A combination of waning fiscal restraint by the Commonwealth, a broader revenue base due to more diversified economy and some strategic pre-election budget management have resulted in the improved outlook and a lowered the territory’s net debt.

The headline net operating deficit is expected to be $232.5 million in 2015-16, an improved projection from the $478.6 million deficit expected at the December Budget Review.

ACT Chief Minister Andrew Barr said: “it’s a Budget that returns to balance and then strong surplus, whilst fully funding the Light Rail project”.

In 2016-17, the deficit projection of $181 million represents a $59.3 million deterioration compared to the last Budget estimate because the government has pre-empted an upcoming $87.7 million hit from lower interest rates (when government bond yields fall, as they are now, the Government’s superannuation liability rises). Without this provision, the headline net operating deficit would have been a much better $94.4 million. It also conveniently allows the Government to avoid that liability showing up, for the first time, in the pre-election fiscal outlook document: never a good look during an election campaign. Broadly balanced budgets are expected for 2017-18 and 2018-19 and a $66 million surplus is projected in 2019-20.

The continuation of the tax reform process that started in 2012-13 has lowered tax revenue estimates by $7.5 million in 2016-17. Through this 20 year process, conveyance and insurance duties are being replaced by higher general rates while payroll tax is also being lowered. In this budget, with updated data (and an election coming up) the government has decided to soften its planned rate of general rates increases.

“Overall general rates will increase by an average of 4.5% for residential properties and by an average of 7% for commercial properties in 2016-17”, the Budget papers note. In the 2015-16 Budget, an 8.75% overall increase in general rates was projected.

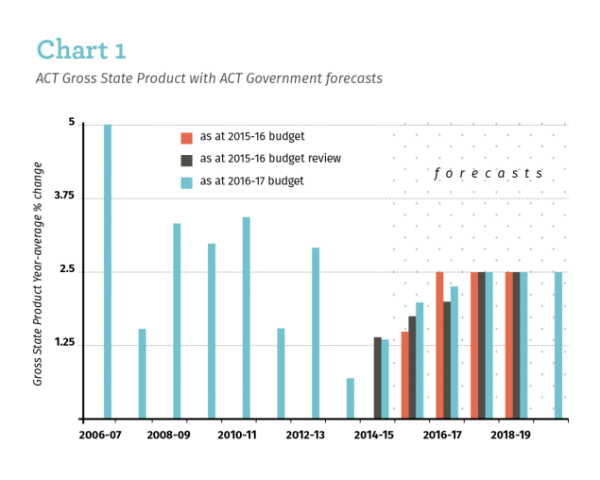

The ACT economy’s better than expected performance and a higher GST grant from the Commonwealth has assisted the revenue projections. Higher than expected sales and prices lifted commercial conveyance duty. The economic growth forecasts for the territory have been lifted by quarter of a percentage point in both 2015-16 and 2017-18. Employment growth forecasts have also been raised in 2015-16 and 2016-17.

“This Budget though represents the culmination of four years of work to keep the ACT economy growing,” Mr Barr said.

“This means a revenue stream that allows us to invest in those important community services”.

The Government’s decision to splash a bit of its surprise revenue has lifted expenses by $110.5 million in 2016-17, with most of that expenditure devoted to health, concessions, public housing and the safer families initiative.

Capital works spending (excluding the Law Courts and Light Rail PPPs) have been downwardly revised, allowing $50 million to be returned to the budget. The territory’s Public Trading Enterprises, however, have revised up capital works spending $12 million higher.

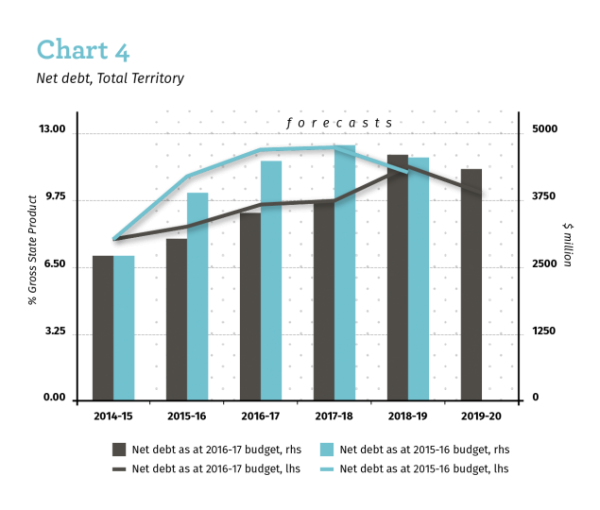

As a result of the slightly improved operating budget and the removal of the provision for stage one of the Light Rail PPP (this had been included as a debt-funded capital project in the 2015-16 budget) net debt has been reduced in the near term. But a large part of this is reversed in 2018-19 when the lease liabilities associated with the PPPs pushes debt back up. But even at its peak in 2018-19, net debt $4.6 billion (around 11.3% of GSP) is below the 12.3% projected peak in the 2015-16 budget.

The chief minister said the implications for the territory’s triple A credit rating are likely to be minimal. “This puts us in a very sound position to retain the highest possible credit rating,” Mr Barr said.