Hi all,

I have today been told by Colliers International, the multinational corporation handling the release, that they are under orders from the ACT Government to tell people that house block prices start between $300,000 and $400,000 in the new Molonglo land development.

Canberra has a young population. Given that most land in Canberra to be released over the next 30 years will be in this district, how will anyone from the younger generations afford those prices without getting themselves into too much debt?

Land in new outer suburbs is barely affordable now. This is an early indication to me that there will be no more affordable land in the ACT – leaving me with the impression that the powers that be care very little about land supply and affordability.

Adding insult to injury, the ACT Government’s 2010 homebuyer concession applies to land valued at $194,800 or less; $100,000-200,000 short of starting block prices in Molonglo.

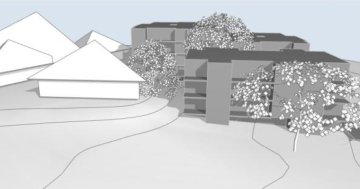

It now seems that the 60,000-70,000 future residents of Molonglo all be cashed-up baby boomers – renting out their older properties to younger folks caught in the rent trap. I am not opposed to wealthy enclaves – but future land should be available to the common man, not just aristocrats.

If these early price indications are true, then it will only deepen the current intergenerational cost disadvantage flagged in the Government’s Intergenerational Report.

Agreed?