Owner-occupiers are now driving the ACT housing market. Photo: File.

The ACT’s 20-year tax reform program has boosted the number of owner-occupiers and first-home buyers, and resulted in a more reliable revenue stream for government, according to a new study.

The report, The Second Interval: evaluating the ACT’s 20 Year Land Value Taxation transition after 8 years, from Melbourne-based think tank Prosper Australia is its second evaluation of the reform program.

The report says the reform is achieving more than its three key aims of predictability, efficiency and equity.

It has found that fears that the reforms would cause ACT land prices to fall have proven unfounded with continued rises in residential land prices and house and unit prices.

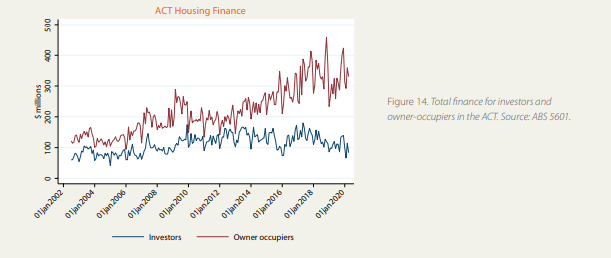

Owner-occupiers, including first-home buyers, had increased from about 60 per cent of the value of purchases in 2012 to 78 per cent in 2020.

The average residential landowner paid $15,039 in rates during the reform period (between 2012-13 and 2019-20) but saw their land value rise by $63,681 over the same period, with more than $6,000 per year in unearned income from land value increases.

Substantial increases in general rates charges have coincided with slower growth of commercial land prices relative to residential land prices.

The average Treasury forecast error for revenue has fallen from 7.9 per cent before the reforms to 2.6 per cent since the reforms began.

Prosper Australia research director Karl Fitzgerald said the transition had delivered subtly but surely.

”Canberra’s revenue stability has improved, the economy is growing strongly and the market is more accessible for homebuyers,” he said.

”As expected, the reforms have made it a lot easier for the Territory to balance its budget and plan for growth.”

Mr Fitzgerald said the ACT economy would now be more than $130 million better off per year as a result of the transition to general rates, which supports Treasury-commissioned studies released earlier this year.

The report found that fears that the reforms would cause ACT land prices to fall have proven unfounded with continued rises in residential land, house and unit prices.

“The warnings of calamity have been avoided, with many property owners actually coming out ahead,” Mr Fitzgerald said.

“Not only is the tax burden shared more evenly across all landowners, rather than concentrated on those who buy and sell property, but more Canberrans will own their own homes as a result of the abolition of stamp duties and the rise in general rates.”

Finance for house purchasers in the ACT. Image: Supplied.

The result is that the cost of provision of services to Territory residents is more evenly shared among all who own land, the report says.

It says the ACT’s property market is now driven overwhelmingly by owner-occupiers, who have possibly been increasing affordable rental supply by leasing, rather than selling, their former homes.

But the report acknowledges that the ACT remains a very expensive place to rent and to buy, and the tax transition has, so far, done little to improve affordability.

Being heavily reliant on property-based taxation gives the ACT Government incentives to keep property prices high and maintain growth.

”These incentives, combined with the government’s unique control over land and housing supply, is a recipe that is unlikely to lead to significant improvements in housing affordability,” the report says.

“The flipside of this is reassurance to homeowners that rising rates have not eroded the value of their properties.”

The report also found that the commercial market had been more tempered.

“It appears that commercial buyers have recognised higher rates require a lower upfront purchasing bid and commercial prices have moderated,” Mr Fitzgerald said.

The report concludes that how things play out over the next four years will depend on both the outcome of this ACT election and the Federal Government’s response to the current recession, and the flow-on impacts of that on the ACT labour market.

”All told, after eight years, this bold experiment in tax reform is achieving all of the objectives that motivated the government in 2012,” the report says.

”It is improving revenue stability and predictability, it is making the tax system and the ACT economy more efficient, and it is sharing the funding of ACT Government services more equitably and more progressively across the ACT population.”