The ACT’s fiscal position is expected to remain strong and its growth in debt to be manageable.

International ratings agency Standard & Poor’s has confirmed the ACT’s AAA credit rating for another year, attributing its decision to the Territory’s robust financial management, high-income economy, and exceptional level of liquidity.

S&P said the ACT was budgeting for a relatively large infrastructure program over the next few years, but it expected its fiscal position to remain strong and its growth in debt to be manageable.

“The stable outlook reflects our expectation that the ACT Government will continue to deliver on its priorities broadly within budget, while maintaining a high level of liquidity and containing its debt burden at a manageable level,” it said.

But S&P said it might reappraise the situation if the ACT’s deficits turn out to be much larger or more prolonged than expected, resulting in a steeper rise in its debt burden.

Despite headwinds, the local economy remained strong, it said.

“The ACT maintains a high level of cash available to service debt, and its economy is very wealthy compared with its peers,” S&P said.

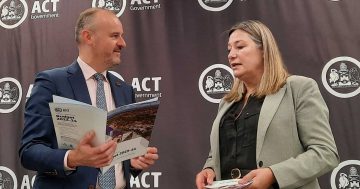

Chief Minister Andrew Barr said the ACT’s rating is the highest awarded by Standard & Poor’s, and recognises the Territory’s very strong fiscal position following the release of the 2019-20 ACT Budget.

The ACT was one of only three states or territories in Australia – and among only a handful of jurisdictions around the world – to hold a AAA rating.

“Through the 2019-20 Budget, the ACT Government is investing to build the hospitals, schools and transport infrastructure Canberra will need in the 2020s and beyond,” Mr Barr said.

“We are getting on with these important investments now to ensure we can deliver the services Canberrans expect as our city grows. This will allow the ACT Government to hire more nurses and more teachers, keep our assets in public hands and plan for our future in a fiscally responsible way.”

“In the coming weeks, the ACT Government will release a comprehensive Infrastructure Plan, outlining the investments required to cater for a growing population in both our town centres and our suburbs.”‘

S&P expects the ACT’s fiscal position to weaken slightly during the next two years as the Government ramps up its infrastructure spending, and says delivering this infrastructure program could be a challenge, given capacity constraints in the engineering and construction industry.