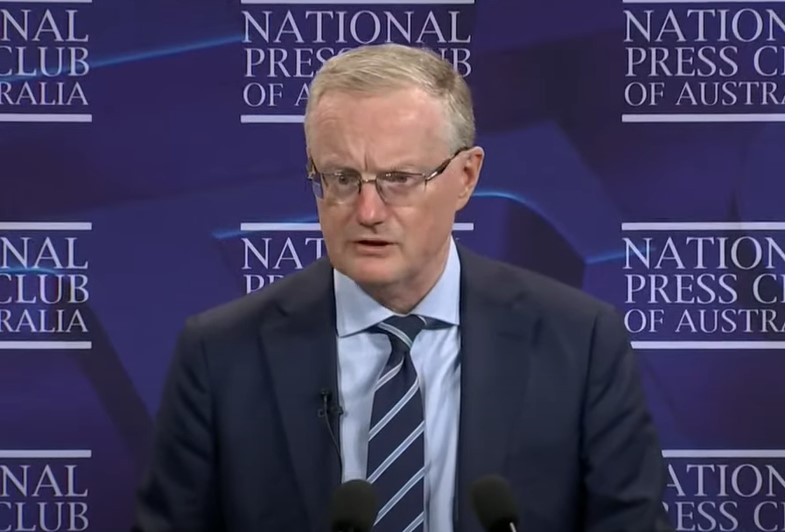

Philip Lowe has lots of ‘useful’ tips for Australians doing it tough. Photo: Screenshot.

Is Philip Lowe the most hated man in Australia?

The Reserve Bank Governor isn’t out to win popularity contests, that’s for sure, and he remains committed to his ultra-orthodox approach to crushing inflation.

No one really believed that cheap money would last forever or even until 2024, to be honest, but the relentless, almost monthly chipping away at confidence and the economy in general, along with his gratuitous advice to the Australians who are bearing the brunt of interest rate rises in the middle of a cost of living crisis, has everyone reaching for the pitchforks.

Lowe tries to explain that he is really looking out for our best interests and always offers some useful tips, such as shacking up with a few extra people to save on rent. Or the latest – spend less and work harder, or words to that effect – so we can reduce consumption and boost productivity, which apparently is plummeting.

Nice to know that after 30 years of neo-liberalism, the loss of collective bargaining, collapsed wages, a casualised workforce and soaring energy and house prices, that Australian workers are bludging again.

And every month, the grounds for jacking up rates seem to shift. The latest is the minimum wage decision, despite even the OECD confirming the Australia Institute’s much-criticised assertion that profits have been feeding inflation.

What will it be next month? Because Lowe has already flagged more rate rises are on the way.

It’s not just what he says but the manner in which he says it that is a turn-off. That exasperated tone as he tries to simplify matters to people who can’t grasp what is obvious to him.

What’s obvious to them is that the repayments for the humungous mortgage they’ve had to sign their lives away for have burst through what buffer they may have had, or their landlord has decided the already sky-high rent can go stratospheric, or their job may not be that secure because the price of getting inflation down will be 100,000 of them.

What many can’t quite follow is that Lowe seems to rely on out-of-date data but won’t pause to see how previous rate rises are washing through the economy or what other factors may be having an effect, especially with all of the future indicators pointing down and growth evaporating.

That soft landing is looking more precarious with every rate rise.

We know that the crunch is being borne disproportionately by the young, while older Australians who have small mortgages or none at all are doing nicely, thank you.

Reserve Bank governors aren’t great communicators, and at present, their only tool seems to be the blunt one Lowe is wielding, but is it really like the 1970s?

Do we have to have a recession?

Because the way economics seems to work, according to Lowe and others, is that it’s the same people who cop it in the neck, and we’re really sorry but that’s just the iron law.

No wonder they call it the dismal science.

Perhaps it’s time to start looking at the problem differently, more creatively and not through the eyes of the past.