Businesses in the fitness and sports industries will now be included and can apply for the COVID-19 grants. Photo: Viva Leisure.

This week in Canberra business saw the ACT Government announce its long-awaited pathway out of lockdown and the Chief Minister announcing extensions to grant payments for struggling ACT businesses.

But with the federal government also announcing the phasing out of Disaster Payments, businesses are now concerned about staffing levels when normal trading conditions finally resume.

The jointly funded package of business grants from the Commonwealth and ACT governments will now support thousands of small and medium-sized businesses until mid-October, the point at which the ACT is expected to reach 80 per cent vaccination.

Chief Minister Andrew Barr said the extension of the COVID-19 Business Support Grants will provide transitional support for business as the economy is gradually reopened in October and November.

“The COVID-19 Business Support Grant program has been an important lifeline to businesses impacted by significantly reduced turnover. This is the largest and most complex grants program that any ACT Government has ever administered,” the Chief Minister said.

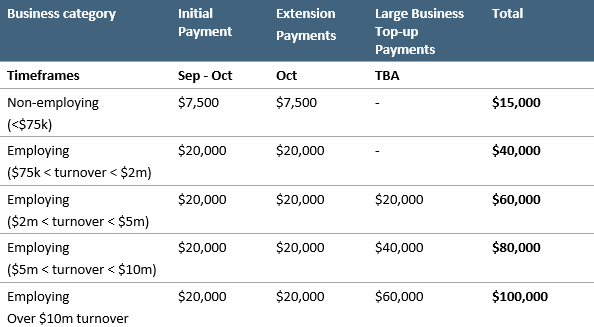

Under the revised agreement announced this week, there will be an additional business grant extension payment of $10,000 for all employing businesses. A further $3,750 will be paid to non-employing businesses that were eligible for the COVID-19 Business Support Grant in industries still significantly impacted by health restrictions.

COVID-19 Business Support Grants. Image: ACT Government.

The extra payments will take the baseline payment to $40,000 for employing businesses and $15,000 for non-employing businesses. In addition to these baseline amounts, further top-up payments will also be made for medium and larger businesses in the ACT.

ACT businesses in the fitness and sports industry will now also be eligible to apply to the grants program. The industry has been calling for assistance and to recognise the disproportionate impact the pandemic is having on these businesses.

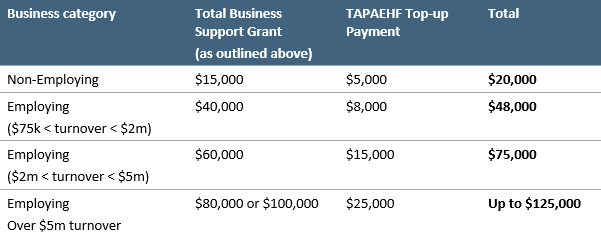

Businesses in the fitness and sports industries such as gyms, personal trainers, dance teachers and instructors will now be included and be able to apply for the COVID-19 Tourism, Accommodation Provider, Arts, Events, Hospitality & Fitness Grants program.

This grant program will offer $5,000 for non-employing businesses, $8,000 for employing businesses with a turnover of less than $2 million, and extra funding for larger employing businesses.

The eligibility criteria will continue to match the eligibility criteria for the COVID-19 Business Support Grant. Note that to receive an extension or top-up payments, you must have applied for a Business Support Grant by 5 pm on 7 October.

COVID-19 Tourism, Accommodation Provider, Arts, Events, Hospitality & Fitness Grants program. Image: ACT Government.

With the federal treasurer Josh Frydenburg declaring the end of Commonwealth support in line with states and territories reaching vaccination targes of 70 and 80 per cent on Friday, Mr Barr said further assistance for ACT businesses will be announced in next week’s Budget, including support for tourism and events, initiatives to support local business innovation and development and, further spending through the Future Jobs Fund.

RSM Australia senior advisor Young Han welcomed the announcement of the extra support but warned while it may be enough for small businesses that will be back on their feet quickly, for businesses that still have a long road ahead to a resumption of full operations, it may not be enough.

Ms Han says the end of the Disaster Payment is another looming problem for those businesses that aren’t back to full operation.

Unlike Jobkeeper, which was paid to the employers to keep workers attached to their business, Ms Han says the Disaster Payment has had a double negative effect for many businesses.

“The $750 a week payment for workers who have lost more than 20 hours a week has in some regards acted as a disincentive for employees to return to work. We are hearing of businesses who have been able to offer some limited work to their staff but then having those staff turn down the hours as they fear they will lose the $750 payment,” Ms Han explained.

The Disaster Payment will begin to taper as each state and territory passes the 70 per cent vaccination threshold and again once the 80 per cent threshold is reached. The payment will end permanently three weeks after that milestone.

RSM Australia senior advisor Young Han warns there may be staff shortages in industries with a long way to resuming full operations. Photo: RSM Australia.

Ms Han says at that point, workers in industries such as hospitality or the arts with a lead time of six months or more to get back up and running will likely leave altogether and move on to other industries with more secure employment.

“At that point, those businesses may not be able to find the staff to operate at their full earning potential even if there are no capacity limits.”