Caroline Buchan fell victim to a highly elaborate scam. Photo: Shri Gayathirie Rajen.

The National Australia Bank (NAB) told an 80-year-old Wagga customer to “contact Lifeline” after she reported that a man claiming to be an NAB official allegedly scammed her out of $34,000 from her bank account.

The banking giant also told retired businesswoman Caroline Buchan, a loyal NAB customer of 45 years, that it couldn’t recover and refund her money.

“I am very angry with the bank because they wiped their hands of this. They should be responsible for the money that we put in their trust,” Ms Buchan told Region.

“They were essentially saying, ‘We’ve done all we can but if you want help with your mental issues … I mean honestly and truly, who the hell do they think we are?

“All I want is my money back.”

She said she felt like an “imbecile” and was left “insulted” after being told to contact Lifeline.

Region asked NAB why it directed Ms Buchan to a suicide prevention service and why it was unable to recover her money. The bank refused to answer, claiming it couldn’t comment on individual cases.

“Scams are a global epidemic. It’s devastating to see the financial and emotional toll they take on people. We need to make Australia a harder place for these criminals to be successful,” general manager NAB group investigations Chris Sheehan said.

“We will always do whatever we can to try and recover stolen money, including working with other banks involved where necessary. Sadly, in a lot of instances, this can be extremely difficult, once funds are often quickly sent overseas or moved to cryptocurrency platforms which are largely unregulated.

“In the past two years, NAB’s introduced a range of initiatives to help detect and prevent scams and we are starting to see some positive signs of this work.”

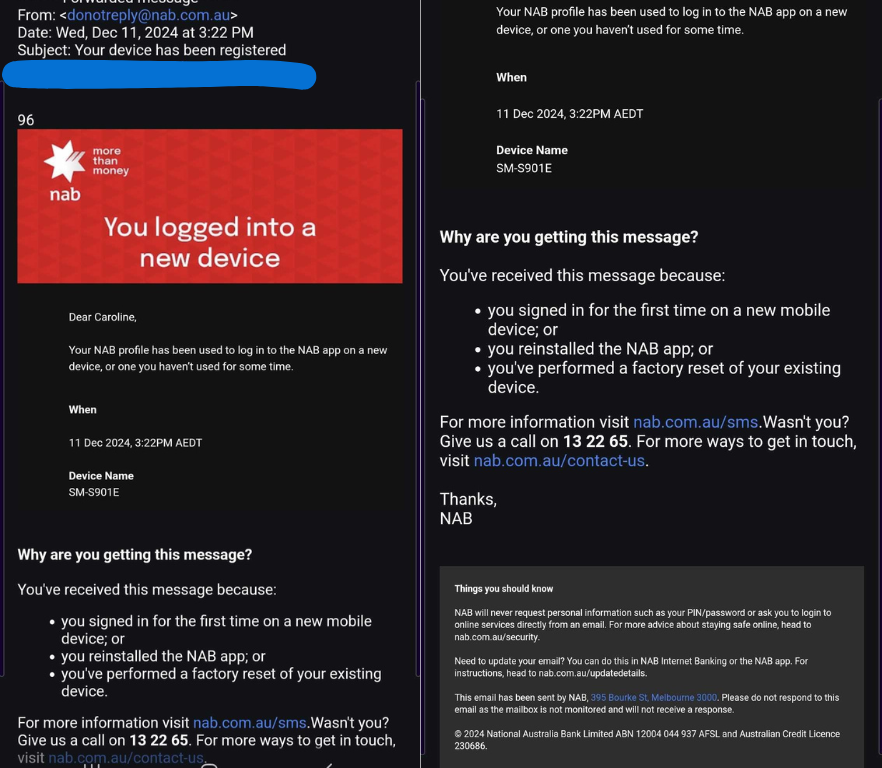

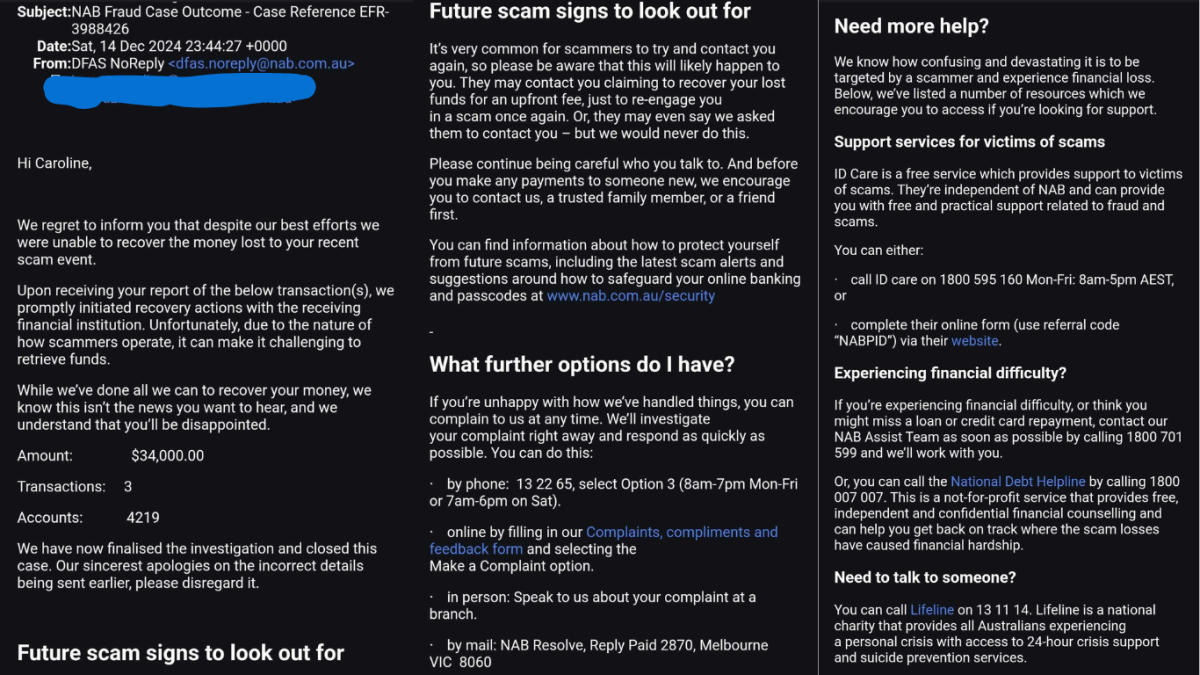

The email Ms Buchan received from NAB while she was at the branch. Photo: Supplied.

The alleged scam

Last year, Ms Buchan said she was manipulated into transferring her money to someone else’s account by a man pretending to be from NAB.

She said it happened after visiting her Wagga NAB branch to reactivate her credit card and online banking, which were blocked while she was overseas. The NAB fraud prevention team helped her with this process.

After leaving the bank, she got a call from someone claiming to be part of the NAB’s fraud prevention team.

“That is why I believe I was almost goaded into believing that it was genuine,” she said. “He told me what my ID number was on the back of my card.”

The caller told her that her account had been comprised and directed her to transfer her funds into another account to protect her money.

While on the phone, she also received emails that looked identical to NAB’s official correspondence directing her to do the same.

She followed the instructions, thinking she was safeguarding her savings.

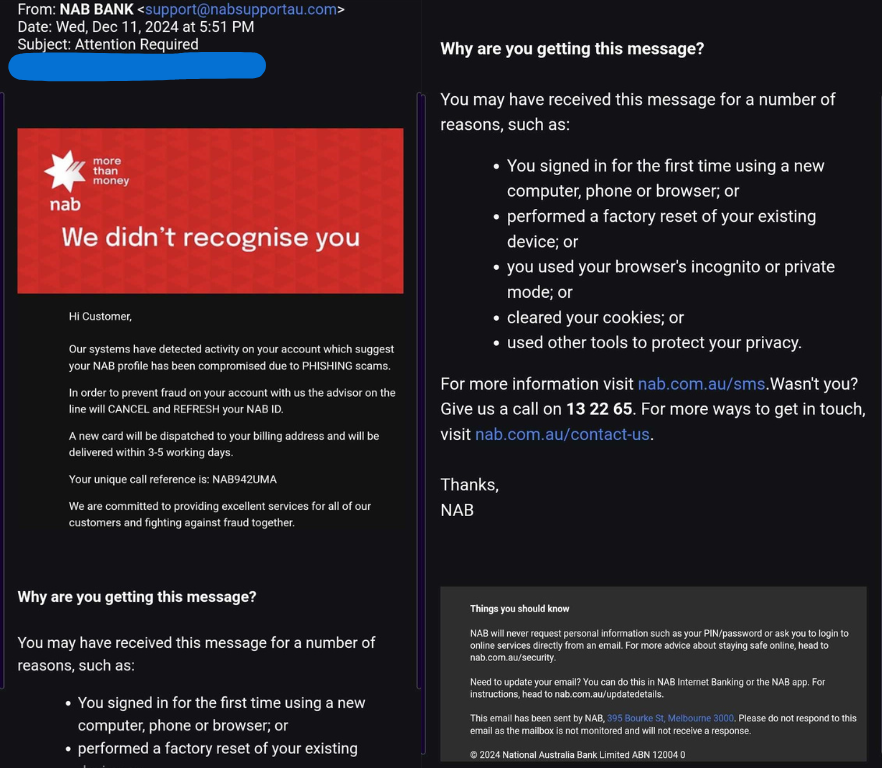

The fake email Ms Buchan received from the scammer appears almost identical. While the original email was sent from ‘donotreply@nab.com.au’, the fake emails were sent from ‘support@nabsupport.com’. Photo: Supplied.

“At 9:30 pm, NAB realised that something funny had gone on, but it was too late. The money was gone,” Ms Buchan said. “And I felt sick.

“I couldn’t believe it happened. I was traumatised because every time I put up an objection he’d come back with a plausible reason.

“I kept doubting myself the whole time because I had been in the bank, and if I hadn’t, I might have had a different attitude.”

The next morning Ms Buchan spoke with the real fraud department based in Melbourne and questioned how the alleged scammer had access to her ID number.

She said the fraud team member said: “It was easy; anybody can get it”.

“Her voice was kind, but she was giving me a lecture on what I should do and what I shouldn’t do. And she said we never ring you after hours,” Ms Buchan said.

“I didn’t consider 5:30 pm as after hours and they [the fraud line] are 24/7.”

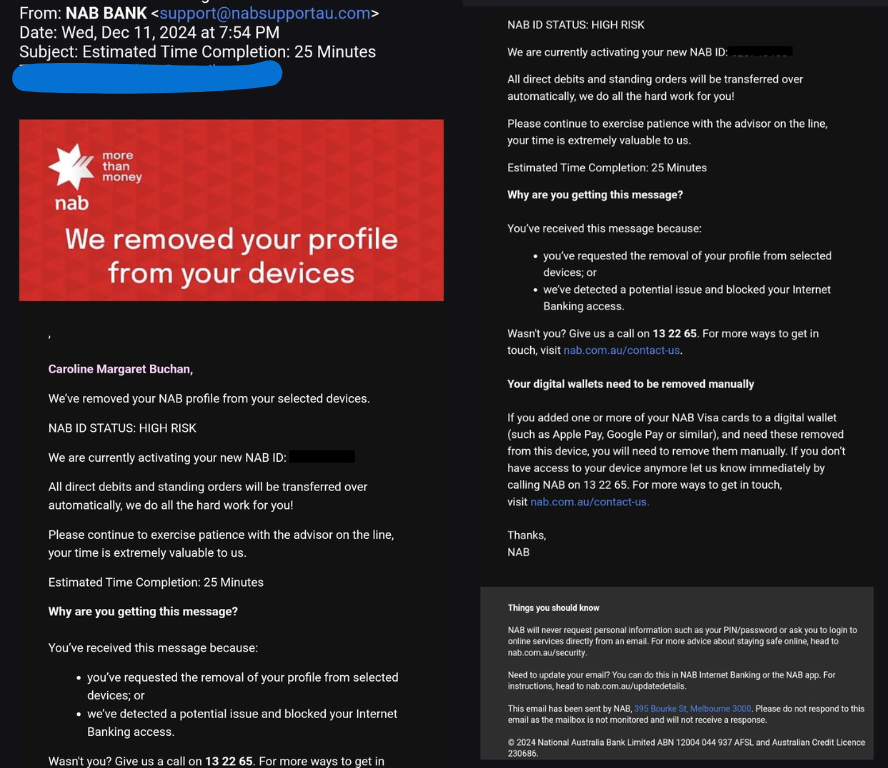

The fake emails also contain NAB’s similar ABN and Australian Credit Licence. Photo: Supplied.

She felt NAB was unhelpful and failed to take responsibility.

“It is so unfair when they’re making huge profits and they should face up to their responsibilities,” Ms Buchan said.

“And if they don’t want to, they should teach people how to avoid getting into these situations.

“The bank is there to provide a service to the community and I don’t believe they are doing it.”

Australia-wide, NAB made a net profit of just under $7 billion in 2024.

Need for reform

Ms Buchan is calling for increased awareness and better security measures and reforms that hold banks accountable for scam losses.

She is in favour of Australia adopting similar policies that were introduced in the UK last year that now require banks to refund scam victims their money within five days.

The letter Ms Buchan received from NAB stating it was unable to recover her money. Photo: Supplied.

“I’m hoping that if I bring it to the public attention knowing that there are heaps of other people who have gone through something very similar, more people will come out and talk about it.

“We can put some pressure on the banks to stand up to their responsibilities, as they do in Europe and UK.

“Any bank in Australia should conduct regular meetings with their customers, three times a year and have a panel of experts talking to the customers and clients about scamming and fraud.”

Ms Buchan’s matter is now also under a police investigation.

Original Article published by Shri Gayathirie Rajen on Region Riverina.