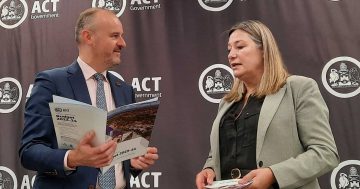

So the ACT’s sitting on a debt bomb? No big deal, right? Well, it’s kind of a big deal. Photo: Dragon Claws.

Something has been concerning me for many years and is curiously absent from pamphlets about the October 2024 ACT election.

Typically, candidates are offering a dizzying array of new and better things to tempt us towards their platform. At some point, an official-sounding document will give us election costings, and someone will claim victory for the least additional spending.

My concern? Under any scenario – whether it is increasing staff, building infrastructure, or providing grants to the community – every additional dollar of spending will be borrowed, require additional revenue from the ACT population, or require the sale of assets.

Over the last 10 budgets, nine have recorded deficits using the ACT’s bespoke headline measure. The consequence has been that since 2014-15, net debt, excluding superannuation investments, has grown from $909.6 million to a budgeted $8.9 billion in 2024-25. More deficits are expected, and by 2027-28, net debt is projected to increase to $12.5 billion.

This is not news. ACT deficits and debts have been reported well.

What is different for this election is the 11 September announcement that global ratings agency Standard & Poor’s (S&P) shifted the ACT from a ‘stable’ to a ‘negative’ outlook.

They noted, “the loosening of expenditure control and lack of clear fiscal targets has weakened our view of ACT’s financial management” and that the “ACT’s operating performance has been weaker than all ‘AA+’ rated subnational governments globally”.

This is a bit like the look you get from your parents when you tell them how you are going to blow your tax refund— they know they can’t stop you, but they are aggressively frowning, hoping you change your mind and save.

The issue, seriously, is that if this downgrade pushes the ACT below AA+, it will increase the cost of the growing debt. For example, the 2023-24 Budget expected the average cost of borrowings would be 4.45 per cent per annum. In 2024-25, after the first S&P downgrade from AAA+, the budgeted cost of borrowing was 5.25 per cent per annum—an extra 0.8 per cent.

To put the impact in perspective, between 2023-24 and 2027-28, the interest bill will have increased from $386.8 million to $832.3 million per annum. By 2027-28, interest will consume 85 per cent of expected land rates revenue.

What does the increase mean in practice? Alternatively, what could the ACT do with the $445.5 million increase in interest? As a rough guide, if the budget were otherwise balanced, alternatives that could be funded from the increase in interest include:

- An additional 2,270 teachers (level 8) in schools, or

- 1,890 extra Nurse Practitioners in the health system, or

- An extra 2,705 police (AFP band 6.1), or

- Double the entire spend on road transport (construction and maintenance).

For those outside the ACT, the increase in interest would fund the entire combined annual operating costs budgeted for the Yass Valley, Queanbeyan-Palerang, Snowy Valleys and Snowy Monaro councils in 2027-28.

Whichever of these you prefer, in my mind, is a better alternative than paying dead money to institutional bankers and bondholders for no community benefit.

If, like S&P and me, the state of the budget concerns you, please reach out to your preferred candidate to ask a simple question: How will you prevent further increases in the ACT debt position over the term of the next Assembly? If any candidate wishes to respond on behalf of their party, I urge you to be specific.

Adrian Makeham-Kirchner is the Head of Data and Economics at Purdon.