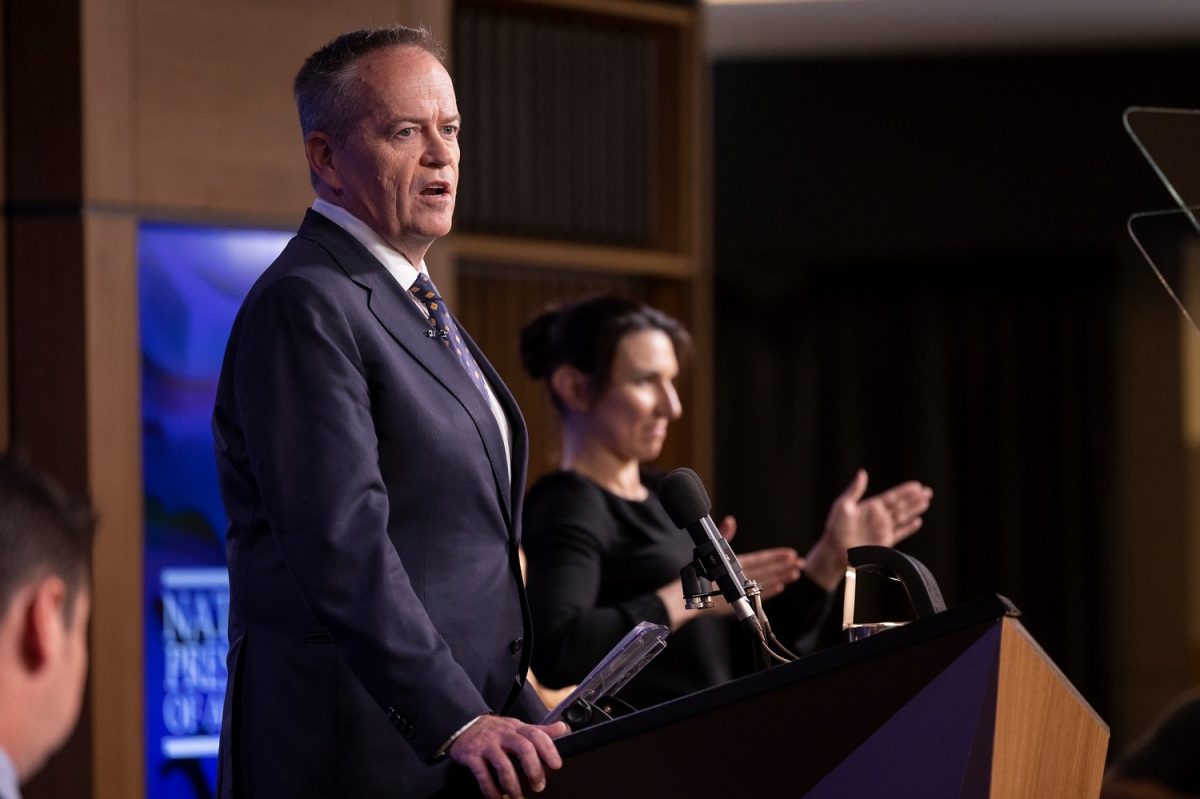

NDIS Minister Bill Shorten has proposed a list of major reforms to reboot the NDIS. Photo: Screenshot.

If you’ve ever trawled through bank statements trying to throw light on a mysterious transaction, you’ll know how frustrating it can be.

Even searching online, you usually see a bare-bones transaction line item with a merchant identity that’s often different from a retail trading name. If you use paper records, you might search for a transaction months after it occurred only to find it has faded beyond usefulness or only contains limited information.

Help is at hand in the shape of a clever piece of Australian-developed software that could dramatically reduce National Disability Insurance Scheme (NDIS) fraud and save hundreds of millions of dollars from our national social services budget.

The technology is called Digital Transaction Intelligence (DTI) and connects retail sales line items to online banking services, creating rich, informative and actionable data.

Brad McKendry: Digital Transaction Intelligence offers a simple way of flagging or even stopping many fake or inflated transactions at the point of payment. Photo: Supplied.

DTI can give customers detailed purchase information and digital receipts via their secure banking app, email, SMS and in real-time.

Imagine if the same rich information was made available to a participant or their carer when a service was supplied as part of the NDIS.

Australian Criminal Intelligence Commission chief Michael Phelan has warned as much as $6 billion of NDIA funding might be being misused annually, including by organised crime syndicates.

In August last year, NDIS Minister Bill Shorten announced the formation of a multi-agency task force to tackle the problem.

Mr Shorten suggested ‘ghosting’ – where fraudulent providers create fake NDIS clients and issue invoices for undelivered services – is one issue.

Another concern he raised was invoices being ‘padded’ by contractors, with participants being charged more for services than were delivered because the NDIA is a government agency.

In his National Press Club address, he revealed that the Task Force has 38 investigations underway involving more than $300 million in payments.

Digital Transaction Intelligence offers a simple way of flagging or even stopping a significant number of fake or inflated transactions at the point of payment.

Notably, the technology handles anonymised data so it can only be seen by enabled organisations.

With customer permission, DTI will flag unusual transactions with them or, in the instance of an NDIS participant, with the NDIA. It can be set up to instantly block fake service providers, helping address Mr Shorten’s ghosting concerns.

DTI is ‘platform agnostic’, meaning it can be integrated into almost any transaction system and does not compete with any service providers. The technology also complies with Australian Government security and privacy regulations and standards.

Empowering NDIS participants by giving them or their carers real-time information at the point of service can only be a good thing. Not only could it save billions of taxpayer dollars, but it could give people with a disability more control over their own lives.

Brad McKendry is a Canberra-based Account General Manager for DXC Technology.