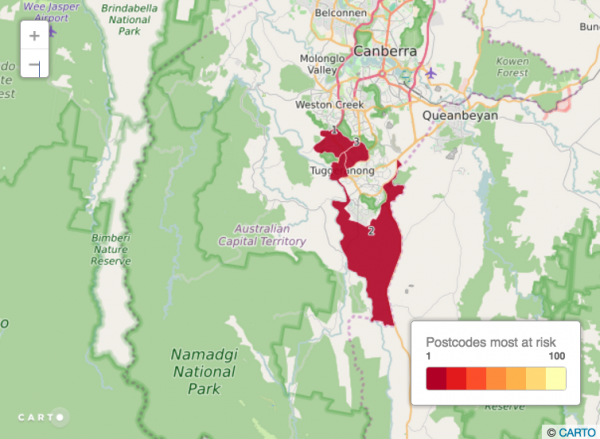

Homeowners in Kambah, Tuggeranong, Greenway, Oxley and Wanniassa are at the highest risk of mortgage default in Australia.

That’s according to 2015 research by consultancy firm Digital Finance Analytics, which used housing finance data, employment data, loan default data and arrears information to calculate the top 100 Australian postcodes where people could face financial collapse when interest rates rise.

Canberra postcodes 2902 (Kambah), 2900 (Tuggeranong and Greenway) and 2903 (Oxley and Wanniassa) topped the list, ahead of all Tasmanian suburbs, Queensland’s mining belt and the outer suburbs of Melbourne.

The Australian Financial Review commented that like Southern Tasmania, Darwin and Southern Gippsland, Canberra’s outer suburbs have “been hit hard by a mix of industrial closure, high unemployment and low wages growth, which leaves residents vulnerable to financial collapse.”

Homeowners under 35 were found to be most at risk of default.

Digital Finance Analytics principal Martin North told the Australian Financial Review that young homebuyers have been lured into the market by record low interest rates and rising property values.

“My view is these are households that are maxed-up because of the debt they’ve got and with current low interest rates they are just getting by,” Martin said.

“But if interest rates go up this is where you’ll see the first impact. If interest rates are two percent higher, it would create significant pain for households.”

The median income in Tuggeranong is $57,993, compared to between $66,000 and $78,000 in Canberra’s richest suburbs like Forrest and Deakin. According to Roy Morgan research, the tendency for a borrower to default was 83.2 percent for households earning under $60,000 per year.

However, Mr North stressed that there was more to calculating mortgage default risk than annual earnings, as buyers with lower incomes usually took out smaller loans and had a more conservative loan-to-valuation ratio.

Instead, the postcodes at the highest risk of default were those where workers would have the most trouble finding employment if they lost their job.

When the research findings were released last year, ACT unemployment was at five percent and a public sector hiring freeze had just ended. The current ACT unemployment rate is 3.6 percent – the lowest in the country.

With lower unemployment and the hiring freeze over, it would be reasonable to assume that Canberra’s southside homeowners are under less mortgage pressure now compared to 12 months ago.

However, many are still financially vulnerable – a recent Roy Morgan analysis found that 17.4 percent of Australians with a mortgage on the home they are living in are at risk of default.

Image via Australian Financial Review.