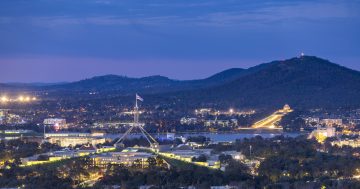

Fewer external consultants to the APS are hitting the ACT Government hard. Photo: Michelle Kroll.

Payroll tax has taken a huge hit following the $3 billion cut to Federal Government spending on consultancies in the Australian Public Service and the ACT Government is paying the price.

Chief Minister Andrew Barr recently told Region that the slowdown in spending due to higher interest rates and inflation also meant GST payments for the territory would be reduced.

The payroll tax slump from the engagement of fewer consultants adds to the pain and what is expected to be a bigger-than-expected deficit.

It all adds up to a $189 million hit to revenue in 2023-24 and $99.2 million over the four years to 2026-27. However, the ACT Government expects the deficit to be temporary.

The Chief Minister expects the budget to return to balance and then surplus over the forward estimates.

“We’ve got some revenue hits, but they’re not anticipated to be permanent,” Mr Barr said.

Revised income tax cuts kick in from July, and interest rate cuts are anticipated in the second half of the year, which should boost spending in the ACT and lift GST revenue.

Core APS work must no longer be outsourced to consultants but done by actual public servants.

Last year, the federal government issued clear instructions to all Commonwealth agencies that the days of over-reliance on external consultants and contracted labour-for-hire are all but over.

All public service bosses must set targets to slash outsourcing by June this year.

The culling of external consultants has been underway for some time, and it is impacting the ACT economy.

When announcing the directive, Public Service Minister Katy Gallagher said the former Coalition government had relied too much on consultants and contractors and wasted too much taxpayer money.

“We have an ambitious plan to reform the APS, and this framework will ensure that from now on, core work will only be done by APS employees,” she said.

“Agency heads will lead this work, determining their core work, setting targets to bring it back in-house and reporting on their progress.

“Information on progress will be publicly available.”

An in-house APS consultancy entity called Australian Government Consulting has been created and is currently running two pilot projects.

One was partnering with the Centre for Australia-India Relations to analyse opportunities for closer collaboration between federal, state and territory governments on economic engagement with India.

The other is partnering with the new Net Zero Economy agency to develop its vision and undertake strategic business planning.

Under the edict, if a job can be done by APS staff, it must be done by them.

Day-to-day functions such as drafting Cabinet submissions, drafting regulations, leading policy development, or occupying a role on an agency’s executive must not be outsourced.

According to the government, if external arrangements are currently being used for these core functions, knowledge must be transferred to the APS.

Core functions should also be expanded to include managing contracts, procurement, cost-benefit analyses, delivering programs and managing grants. These functions should be brought back in-house as a matter of priority.

Outgoing Australian Taxation Commissioner Chris Jordan has publicly lamented the move away from external consultants, saying it could dampen the movement between the private and public sectors.

“I think it’s a shame that you might see less willingness of senior private sector people wanting, for all the right reasons, to come and give back and do good things for the public service,” Mr Jordan said in his valedictory address to the National Press Club.

“I think we might see that there’ll be less interest in that. But you can’t just be a closed shop.”