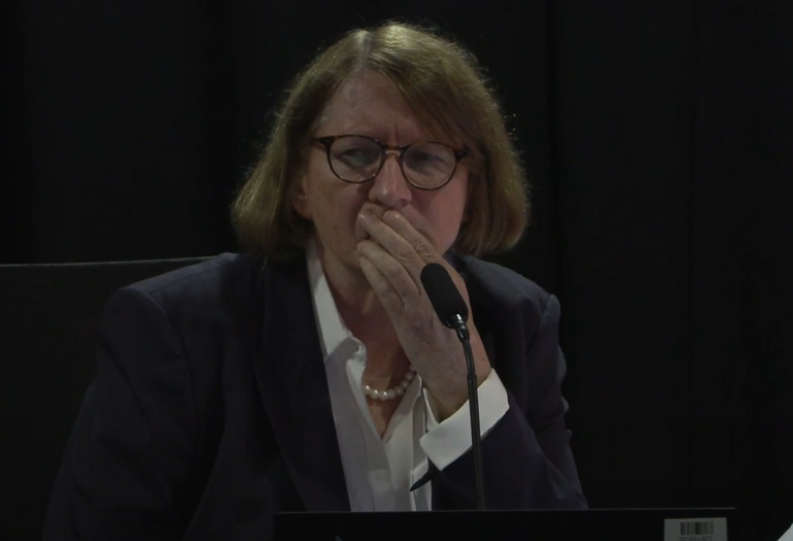

Royal Commissioner Catherine Holmes recommended civil action and criminal charges be pursued against key players in implementing and rolling out the Robodebt scheme. Photo: Screenshot.

The National Anti-Corruption Commission (NACC) will not conduct further investigations into the illegal Robodebt scheme, claiming its decision “would not add value in the public interest”.

Last year, on 6 July, the NACC received referrals concerning six public officials from the Royal Commission into the Robodebt Scheme.

After “carefully” considering each referral and reviewing the “extensive” material provided by the Royal Commission – including the final report and Confidential Chapter – the NACC has decided “it is unlikely it would obtain significant new evidence”.

“In the absence of a real likelihood of a further investigation producing significant new evidence, it is undesirable for a number of reasons to conduct multiple investigations into the same matter,” according to the NACC’s statement released today (6 June).

“This includes the risk of inconsistent outcomes, and the oppression involved in subjecting individuals to repeated investigations.”

The NACC said it is aware five of the six public officials were also the subject of referrals to the Australian Public Service Commission (APSC). This contributed to its reasoning that “there is not value in duplicating work that has been or is being done by others”.

“Beyond considering whether the conduct in question amounted to corrupt conduct within the meaning of the Act and, if satisfied, making such a finding, the Commission cannot grant a remedy or impose a sanction [as the APSC can],” reads the statement.

“Nor could it make any recommendation that could not have been made by the Robodebt Royal Commission.

“The Commission is conscious of the impact of the Robodebt Scheme on individuals and the public, the seniority of the officials involved, and the need to ensure that any corruption issue is fully investigated.

“[However] an investigation by the Commission would not provide any individual remedy or redress for the recipients of government payments or their families who suffered due to the Robodebt Scheme.”

While the NACC has decided not to commence a corruption investigation, it does believe the Royal Commission outcomes will “contain lessons of great importance for enhancing integrity in the Commonwealth public sector and the accountability of public officials”.

“The Commission will continue through its investigation, inquiry, and corruption prevention and education functions, to address the integrity issues raised in the final report, particularly in relation to ethical decision making, to ensure that those lessons are learnt, and to hold public officials to account.”

In its statement, the NACC said it would not be making further comment and that Commissioner Paul Brereton delegated the decision in this matter to a Deputy Commissioner “to avoid any possible perception of a conflict of interest”.

Last week, the APS Commissioner Gordon de Brouwer informed Senate Estimates that another three current or former public servants had been found to have breached the public service code of conduct. Of the seven public servants, four are currently employed in the APS.

They have all been informed and issued with final determinations that their contributions to the Robodebt saga were found to be in breach of at least some parts of the code of conduct.

Updating the Senate last Thursday (30 May), Dr de Brouwer said agencies where the public servants are employed have been notified and counselled regarding what actions should be taken.

He also told senators that he would likely be in a position to provide a public statement on all its findings within two months once all investigations are finalised.

The Robodebt automated debt recovery scheme was piloted in 2015 and fully rolled out between 2016 and 2019 by the Department of Human Services and its successor, Services Australia, with more than 470,000 false debts issued.

It caused extensive grief and trauma. Some recipients are reported to have taken their own lives over the debts.

It was officially scrapped in 2020, with the promise of paid debts being refunded in full.

It cost the Commonwealth $1.8 billion in settlement after the Federal Court ruled it a “massive failure in public administration”.

Following Labor’s federal election win in 2022, Prime Minister Anthony Albanese wiped any debts still under review and established the Royal Commission.

Original Article published by James Day on PS News.