There has been much talk of what is likely to be included in the next budget, the pain, the sacrifice – taking our medicine to prevent the illness that seems to have formed in our National economy. If Mary Poppins is right and the Government listens to what the Audit Commission has to say, we’re going to need more than a spoon of sugar to swallow some of this medicine!

The Audit Commission recommendations released today can be broken into three categories, according to the ABC’s Chris Uhlmann, ‘the brave, the crazy brave and political suicide’ and headlines include:

- Medicare co-payment of $15

- High income earners required to take up Private Health cover

- Cuts to Medicare rebates

- Pension age raised to 70

- Eligibility to access superannuation raised from 60-65

- Wind back NDIS

- 15,000 APS jobs cut

- Changes to Government bodies

- States & Territories to collect income tax

- Schools spending capped at 2018 rates, handing responsibility to the States

- Changes to Pharmacy Benefits Scheme

- Lower Paid Parental Leave threshold

- Child care Benefit & Rebate merged and means tested

- Family Tax Benefit Part B abolished, Part A to have tighter eligibility

There will be an element of this report that is telling us what our illustrious leader Tony wants us to hear and I’m sure we can all see some of this as scare tactics to provide a softer landing for the upcoming budget.

What it does certainly show us is strong will for change and some of those changes are certain to be fairly harsh.

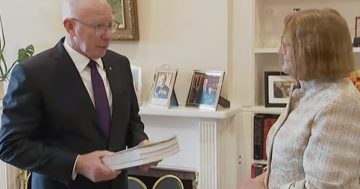

The ABC shared some interesting quotes from the Commission Chief and former head of the Business Council of Australia, Tony Shepherd who said ‘Let’s spend the taxpayers’ money as though it were our money. Let’s spend it carefully and frugally.’

I really hope that’s not new advice for our Government.