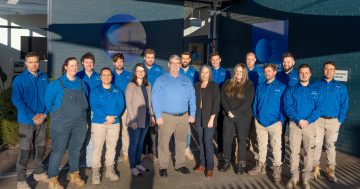

Who are Canberra’s best novated leasing companies? Photo: Thomas Lucraft.

If you’re an ACT or Commonwealth Government employee in Canberra, chances are you’re eligible for novated car leasing. It’s an ATO-approved way to pay for one or more cars using money direct from your salary before it is taxed.

Novated leasing is often the most cost-effective way to operate a motor vehicle regardless of your salary. In almost every circumstance, so long as you pay tax, you save money with a novated lease.

But what do you need to know about novated car leases, and how do you go about arranging one in the ACT? Let’s find out.

Common questions about novated car leases in Canberra

- How much money can I save with a novated car lease? This will depend on factors such as your salary and type of car leased. Areas of savings beyond tax include discounts off a car’s sale price (novated leasing companies deal directly with manufacturers, so a discount of $3,000 on a $25,000 car isn’t uncommon). GST is not paid on leased cars, so that is a $5,000 saving on a $25,000 car. If the fuel costs for a car were $100 per week, then the same car under a novated lease would have fuel costs to you of $75 per week which is a saving of $25 a week or $1,300 a year.

- Do I have to use the car for work? Your car can be 100 percent for personal use. Many people with novated car leases take out one for their partner and another to provide a safe first car for their children. If you do use the car for work, those considerations can further increase your savings.

- Does my employer need to approve the lease? A novated lease requires employer approval. You’ll get the most benefit when running costs such as fuel, services, insurances and registration etc are included in the lease.

- How is a novated lease arranged? Once you have selected a car and agreed on a quote, a three-way agreement between you, your employer, and the novated leasing provider is arranged. Your employer deducts your payments before you pay tax, and pays this directly to the lease provider. These payments include your running costs, so when you need a service you can either pay for it and have that amount reimbursed, or the leasing company will pay the invoice for you.

- Is it safe? Extensive regulation protects novated lease consumers, so novated car leases are generally safe if you go through a reputable company.

- Do I have to pay fringe benefits tax? No FBT is payable provided a small portion of repayments are made in after tax dollars.

- Why would my employer offer novated leasing? Many choose to offer novated leasing to remain your employer of choice. Others offer you use of your work car after hours instead of leaving it garaged at work each night.

What to look for in a novated car lease provider

There are several novated leasing companies supplying ACT employees, including one Canberra-based business. We recommend keeping the following in mind when making your decision.

- Experience and qualifications. Novated leasing laws are always changing, so look at companies that have been providing these services for a long time and – perhaps most importantly – have qualified staff.

- Integrity. Your chosen provider should have your best interests at heart.

- Fees. There’s not much use in getting a novated car lease if the fees outstrip your benefits, so do your research into fees before committing.

- Immediate payments. Ensure your provider pays all reimbursements the day you provide the receipt, and pay car service centres on the same day that your car is serviced – not six weeks later.

- Local. When it comes to salary sacrificing, local can be better. Canberra is too small a place to burn bridges so local companies work hard to protect their reputations. National companies can sell their services elsewhere.

The top novated car lease providers in Canberra according to you

Riotact’s editorial team has combed through 19 years of on-site comments to compile a list of the most recommended businesses according to you.

To be listed in our Best of Canberra series, each business needs to have consistently received positive feedback on Riotact and Facebook as well as maintaining a minimum average of 4/5 stars on Google.

Automotive Lease Packaging

Automotive Lease Packaging (ALP) has serviced over 20,000 customers across Australia since 2004. Part of its appeal is how hard its team works to get you the best deal. Every customer gets a dedicated ALP consultant to negotiate with dealers and help secure the lowest car purchase price - even if that means speaking to up to 15 different dealerships. Fleet discounts are also available, even if you're purchasing a single vehicle.

Customer Dan shared his experience in a website testimonial: "My friend was jealous because I paid $5000 less for my Prado buying it through ALP and I believe he will use your company for his next vehicle."

Fleetcare

Fleetcare is an Australia-wide fleet management and leasing solutions businesses with a strong presence in Canberra. With over 30 years in the business, Fleetcare's supplier bargaining power means that you get exclusive discounts on your vehicle purchase price and ongoing running costs.

ACT Government employees also have their own account manager who actively works to ensure your leasing package is tailored to suit your life.

Customer Melissa shared her experience with Fleetcare in Canberra as a website testimonial: "I will recommend your company, and you personally to my friends and colleagues in the future, based purely on your outstanding customer service."

Easi

Easi offers simple, straightforward novated car leasing solutions that could save you thousands. It's a national company with many customers in Canberra.

Customer Clinton left this glowing review on Easi's Facebook page: "I have used Easifleet twice now and they are brilliant. Darren provides exceptional service accompanied by great knowledge of products. I would highly recommend that if anyone was thinking about a novated lease or any other salary packaging give them a call and they will provide you with all the details you need in order to make the decision that is right for you."

Alliance Leasing

Alliance Leasing is the ACT’s only local novated leasing company, making it a safe bet for Canberrans that want to salary package a car lease. It promises no set up, exit or monthly financier fees; a simple and easy to understand process; market leading lenders and fleet pricing. The team boasts the ability to answer all calls within three rings; they pay your car dealer’s service invoices the day you have your car serviced, and anything that you pay for yourself is reimbursed overnight.

Alliance Leasing is part of the PayMe Group, operated by local business owners Ian and Maria Lindgren. It has its head office in Deakin and second office in Brisbane. It is on the ACT Government novated leasing panel and supplies cars throughout Australia as one of the six suppliers to the largest car leasing/salary packaging panel in the southern hemisphere.

All Alliance Leasing’s consultants have novated leases with their employer, so they back the product they talk to you about. Best of all, Alliance Leasing is competitively priced. Its everyday novated leasing quote will beat any quote in Australia so long as the other quote is given without knowledge that it will be compared to Alliance.

As Steve Gray reviewed on Google, "Dealt with Guy Ewin, absolutely great to deal with - very helpful with the whole process from start to finish and offered up lots of ways to improve the value of the lease proposition that other companies didn't."

Smartleasing

Sydney-based Smartleasing is the specialist car leasing division of salary packaging firm Smartsalary. It manages the novated lease arrangements for over 35,000 employees across Australia.

Smartleasing has simplified processes like lodging claims, registering your car and arranging a service. It also provides award-winning customer service with the ability to get in touch when and how suits you best.

Your experience with novated car lease providers in Canberra

Thanks to our commenters who have provided insightful feedback. If you believe we have got it wrong, please let us know.

Have you had experience with any of the novated car lease providers listed above? If so, share your feedback in the comments below.