A strong supply of apartments is helping to keep rent rises down. Photo: Michelle Kroll.

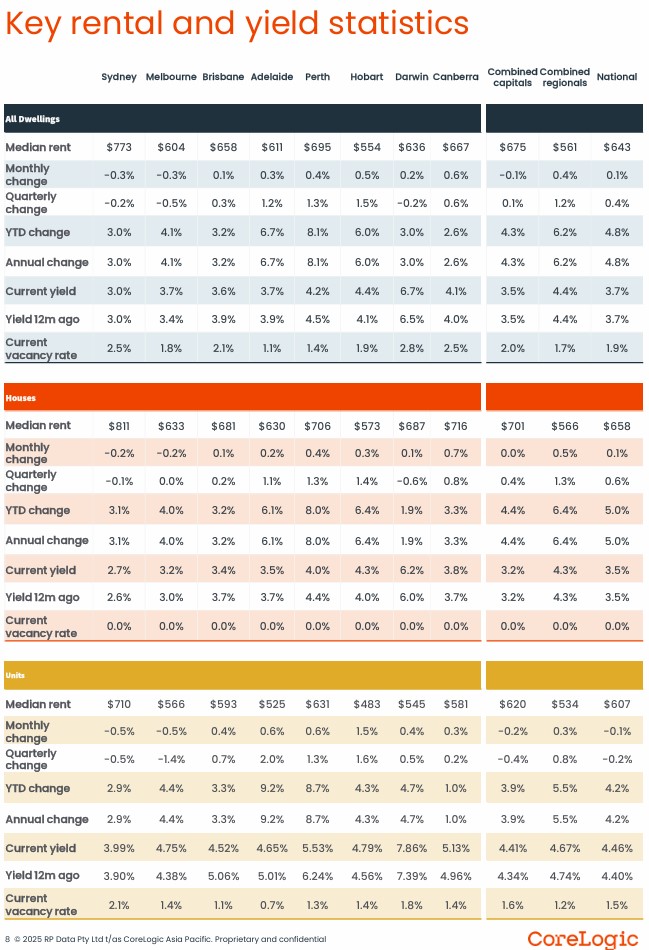

Canberra rents picked up in the last quarter of 2024 as the national capital moved into the seasonal changeover period for public servants and students, but the annual rise of 2.6 per cent was the weakest in the nation.

While rents for both houses and units remain among the highest in the country, Canberra has been a triumph of supply over demand, particularly in the units sector, as tenants in other capital cities faced steepling rises in the past few years.

CoreLogic’s Quarterly Rental review said that surge started to dissipate in 2024, with annual growth falling from 9.5 per cent in 2022 and 8.1 per cent in 2023 to 4.8 per cent over 2024.

Canberra rents actually fell in 2023 and the 2024 rise remains below inflation. The vacancy rate sits at 2.5 per cent.

Last month, Canberra recorded a 0.6 per cent rise for a median rent of $667, dropping to third highest in the country after being overtaken by the still-tight Perth market ($695). Sydney remains the least-affordable city to rent in by a long shot with a median of $773.

Canberra houses attracted much higher rents than units, rising 3.3 per cent in 2024 and 0.7 per cent last month for a median of $716, second only to Sydney. CoreLogic says there is a push nationally to larger households as tenants look to share the rent burden, reversing the COVID trend of shrinking households.

But demand is also strong in the house-dominated regional markets.

Canberra unit and townhouse rents remained reasonably steady in 2024, rising only 1 per cent to a median of $585, fourth highest now among the capitals. This was the lowest annual change overall. The quarterly change was 0.2 per cent and in December it was slightly higher at 0.3 per cent.

This reflects the amount of new stock that came on to the market in 2024, which has provided more choice for renters, particularly in the town centres.

Generally, the market tightens at this time of the year as new workers and students come into town and need accommodation, but compared with a few years ago when queues were common at open houses, they face much more benign conditions.

Director of Property Management at The Property Collective Hannah Gill said it was busy but nothing like the insane kind of influx seen in the past.

“There’s lots of movement, people coming and people going, but we don’t have 40 groups lining up at open homes or anything to that degree,” she said.

Ms Gill said prospective tenants were benefiting from a diverse range of stock available at present

She said many were looking for convenience in the home and being close to their workplace.

“They’re just here really for work, and they don’t want to worry about gardens or travel, but we also are getting a lot of inquiries right now for families who are looking for homes close to school catchment homes right across North and South Canberra,” Ms Gill said.

The rising rents reflected the demand at this time of the year.

“It’s certainly a cycle that we go through each year and we typically do see rents peak into the end of the year into the new year and that’s consistent with what I can see this year as well,” she said.

But affordability, like elsewhere in the country, remained an issue in Canberra.

CoreLogic figures show that the 10 most expensive suburbs to rent, by median weekly rents, are Ainslie ($940), Deakin ($935), Campbell ($911), Garran ($901), Denman Prospect ($867), Whitlam ($853), Hackett ($847), Coombs ($824), Wright ($815), and Turner ($806). These are all houses.

The 10 most affordable suburbs, all units, are Lyons ($497), Gungahlin ($527), Chifley ($536), Phillip ($543), Belconnen ($550), Greenway ($520), Franklin ($552), Harrison ($554), Lyneham ($555), and O’Connor ($557).

The most affordable houses to rent are in Belconnen with a median of $575, Greenway ($604), Isabella Plains ($606), Charnwood ($607) and Evatt ($614).

Belconnen experienced the highest rental growth in 2024 with 10.5 per cent, while the Gungahlin suburb of Taylor saw the biggest drop, -2.2 per cent.

CoreLogic says that at September 2024, renters on median household incomes were spending about a third of annual pre-tax income on a median rent, the highest portion since CoreLogic started tracking rental affordability in 2006.

Nationally, CoreLogic says more supply due to investors returning to the market and an easing of immigration-fed demand is behind the pace of growth cooling and an easing of vacancy rates.

The value of new investor lending increased by 26.3 per cent over the year to September 2024, outpacing a 10.7 per cent rise in owner-occupier financing.

Investors made up 37.2 per cent of the value of new housing finance, well above the decade average of 34 per cent, suggesting a potential net increase in rental stock, CoreLogic said.

The easing in net overseas migration and an increase in the average household also contributed to a softening in rental demand.

After peaking at around 555,000 net arrivals in the year to September 2023, the annual trend fell to about 445,000 over the 12 months to June 2024 and is expected to normalise around the pre-COVID decade average of 225,000 by the 2026-27 financial year.

This pullback is likely to reduce rental demand from the peak by about 90,000 households.