First-home buyers are looking for entry points at townhouses or apartments. Photo: Ian Bushnell.

The incremental upswing in Canberra home prices continued last month, supported by high household incomes and confidence from interest rates stabilising, with the prospect of a cut later in the year.

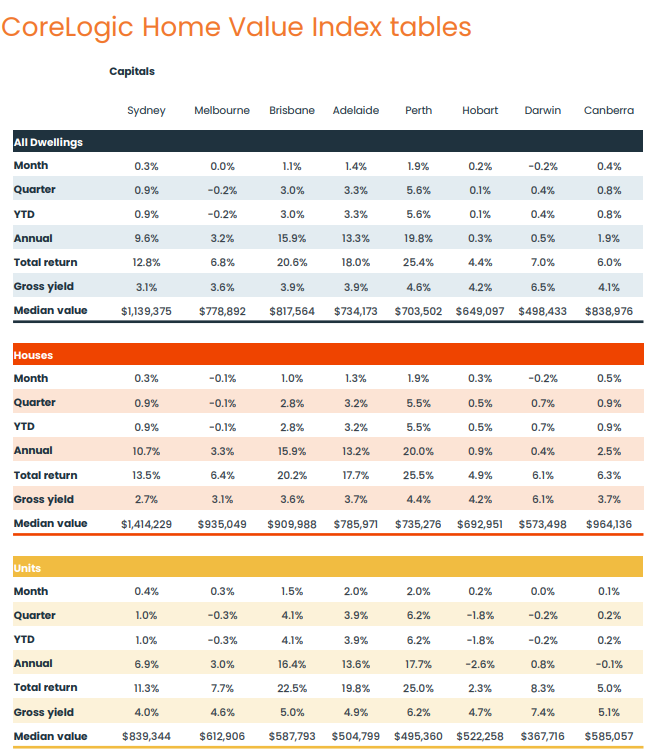

Overall, CoreLogics’ March Home Value Index reported a 0.4 per cent rise in prices, taking the increase for the first quarter of 2024 to almost 1 per cent.

Detached houses led the way with a 0.5 per cent increase, while prices for townhouses and units were just in the positive.

House prices are now 0.9 per cent up for the quarter, and townhouses and units are just 0.2 per cent up.

Canberra’s rising market sits above Sydney and Melbourne but behind Brisbane, Adelaide and Perth.

However, while falling affordability seems to be driving demand for less expensive townhouses and units in the other capitals, that section of the market appears to have plateaued due to reasonable supply.

The Property Collective Director of Sales and Projects Will Honey said some of that supply came from first-home buyers and investors from a few years ago who had built up equity and were now looking for bigger properties or taking a profit.

He said the house price growth came from the demand for prestige homes in the inner north and inner south.

He said rates being kept on hold had ignited buyer activity in higher-end suburbs where they saw value and expected prices to move later, especially if there was a rate cut.

“They’re jumping now rather than waiting until later. Buy now and fix rates later appears to be the strategy,” Mr Honey said.

The Canberra market was in a much healthier state than some of the other capitals. Table: CoreLogic.

He said the market was generally patchy, with good walk-throughs and auction numbers depending on the property.

Most first-home-buyer activity was in the outer suburbs and more affordable townhouse and apartment sectors, but investors were not returning to the market with the same force as reported in other capital cities.

Mr Honey said household incomes were still strong in Canberra and serviceability was better than in other markets.

But if prices kept rising, they would eventually hit a wall, especially if interest rates did not fall.

“There has to come a point where wage growth has to increase or prices will come back because household income can’t sustain the level of mortgage payments,” Mr Honey said.

“It happened during peak and we’ll probably face that again.”

CoreLogic executive research director Tim Lawless said the Canberra market was much healthier than some of the other capitals, with growth only 2 per cent and the median price rising $15,500 over the past 12 months.

“It looks like a much more sustainable rate of growth, roughly in line with income growth,” he said.

The fact that values were not rising too quickly was a reassurance that affordability was not blowing out like other markets.

“Canberra has done a much better job getting supply into the market over the past five years or so,” he said.

“It doesn’t appear to have the imbalance between an undersupply and demand, driving prices higher in most other cities.”