City and town centre apartments are in demand as worker new to Canberra want to live close to where they work. Photo: Zango.

After a year of slightly more benign conditions during 2023, Canberra’s rental market is back to where it was at this time last year with the vacancy rate slumping and rents on the rise again.

Canberra tended to buck the national trend last year with more choice and rents softening, but the market has returned to pre-COVID conditions in January, with both PropTrack and SQM Research recording tight vacancy rates of 1.66 and 1.7 per cent, respectively.

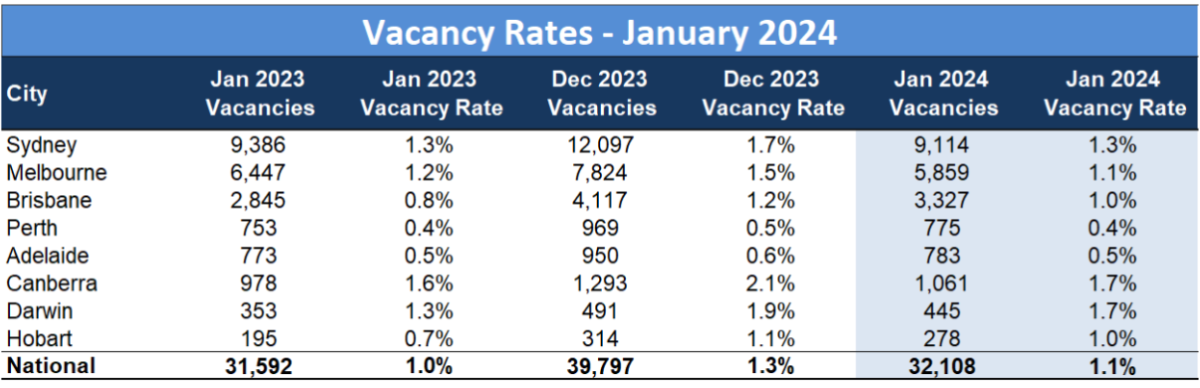

That’s a significant contraction from December when SQM recorded a vacancy rate of 2.1 per cent, aided by not a lot of new stock hitting the market.

It said there were 1061 vacancies in January 2024 compared with 1293 in December. The January 2023 vacancy rate was 1.6 per cent with 978 vacancies.

Rents also rose during the month, particularly for in-demand apartments, up 2 per cent and 1.1 per cent over the past 12 months, with a median of $570 a week.

House rents also rose, by 1.4 per cent, clawing back some of the losses over the year. They are still down 2.4 per cent, reflecting the for-sale market conditions of 2023. The median was $750 a week.

While Canberra’s rents remain high, SQM data shows booming Perth has overtaken it as the second most expensive capital to rent in after Sydney.

The Property Collective’s Hannah Gill said the month had confirmed her view that the market would tighten with the influx of people coming into Canberra to take up work.

Ms Gill said many were coming to Defence roles but, interestingly, there had also been a number of overseas househunters taking up appointments in the national capital.

“I had one today from London, one yesterday from Fiji,” she said.

“There are quite a lot coming to work in the Canberra, which we’re seeing right across the ACT.”

“I’ve got a new boarding house in Braddon, 36 micro apartments, where we’re getting a stack of people new to Canberra using it as a base while they find their feet.”

Capital city vacancy rates. Image: SQM.

Unlike other capitals, students were not figuring in the mix.

Ms Gill said while there were not 50 people lining up to view properties, there were consistently five to six groups going through apartments and fewer for houses.

Price-sensitive renters were focused mainly on apartments in the city and the town centres, but families were still looking for houses, eschewing larger townhouses where there were stairs to negotiate.

The ACT Government recently launched a community housing project in Phillip where half the 140 apartments will be let at lower than market rates, with Chief Minister Barr flagging a big increase in the community housing sector for Canberra and suggesting that government policies had contributed to last year’s easier conditions.

Mr Barr also said when releasing the mid-year Budget review that the government would be bringing forward new land releases to help boost housing supply to meet demand in the growing city.

But Ms Gill said that while the government was heading in the right direction, there remained a big time lag between talk and delivery.

“I don’t think it will be at the speed we actually need,” she said.

“We can’t just rely on community housing, we can’t just rely on new greenfield suburbs that don’t suit everybody’s needs, we can’t just rely on apartments in town centres.

“There needs to be a balance … and that’s the biggest challenge.”

New stock in the pipeline includes Amalgamated Property Group’s build-to-rent project in Woden, Empire Global’s 146-unit BTR building in Greenway and the investor-bought units in Geocon’s WOVA development in Woden.

“But a long-term, sustainable pipeline is still lacking,” Ms Gill said.