Tom Chen and Kim Huynh do a fact check on residential rates in the ACT.

With the Liberal Party claiming that our rates are skyrocketing, excessive and unfair, you would be excused for thinking that we pay the highest rates in the country or soon will.

In fact, this view has been expressed to us on the campaign trail and in response to our RiotACT assessment of light rail. We decided to find out if it’s true.

Overall, our analysis shows that:

- There are jurisdictions in Australia that charge residents significantly more than the ACT.

- The rate of increase in the past few years and as projected over the next few years is high, but not as dramatic as the Liberal Party would like us to be believe.

- When you look at all the state and council level taxes together, Canberra residents pay per capita less than the national average.

How do our rates stack up?

Unfortunately, there’s no central information source for Australian council rates and the degree of transparency varies significantly among councils.

Earlier this year The New Daily identified the 10 highest rate charging councils in Australia. The Gold Coast City Council topped the list with the City of Hobart closely behind. Their investigation apparently missed or excluded the ACT. And there were few details on how they came up with their figures.

So we developed our own approach and applied it to ACT rates for 2016/17.

Our analysis shows that residents in the Gold Coast and Hobart pay significantly higher residential rates than we in the ACT. Yass property owners also pay higher rates, something buyers interested in the Ginninderry development, which straddles West Belconnen and Yass, should keep in mind when selecting their block.

But aren’t our rates skyrocketing?

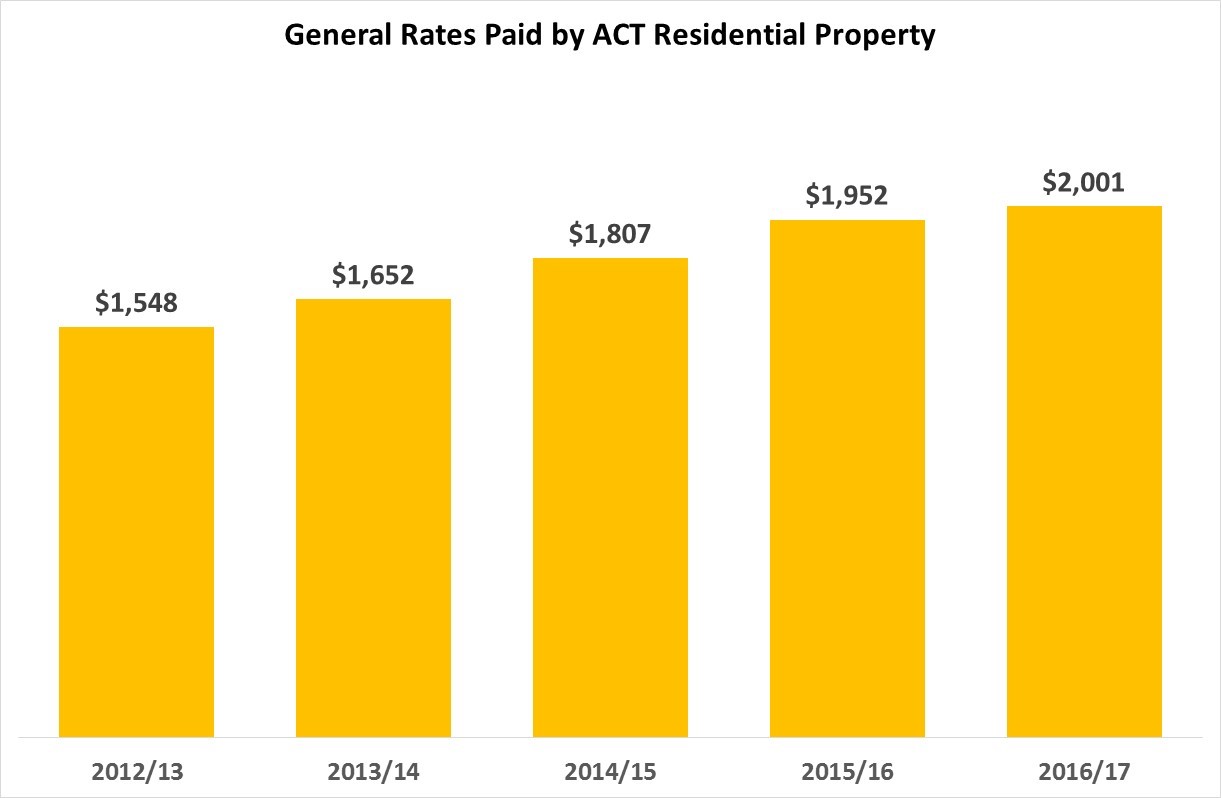

At the previous ACT election, critics of the government argued that its proposed taxes would increase our rates dramatically. The chart below shows the rates payable for a property with an assessed land value of $350,000 (see GoKimbo for full details of our methodology).

From 2012/13 to 2016/17 the annual rate charge for this property increased from $1,548 to $2,001. This represents an average annual increase of 6.6% pa, which is much higher than inflation and average wages growth, but not astronomical.

Of course rates paid by individual property owners will also be determined by changes in land value. But these increases aren’t directly determined by the ACT government.

What is determined by the government is that the ACT is one of the few Australian jurisdictions where rates are structured progressively. This means that like income tax, higher value residential properties pay higher marginal rates.

We support this approach because it gives less wealthy land owners a fair go.

What about all the other fees and charges?

A more complete measure of taxation needs to include not just rates, but also other charges including business rates, registration costs, usage fees, levies and duties. Moreover, because the ACT government operates as both a state and a local council it’s important take into account taxes such as payroll tax and stamp duty.

ACT Treasury has done this analysis and provides the results in the Fiscal Strategy document released as part of this year’s budget. Using 2014/15 tax and population data from the ABS, the analysis shows that during 2014/15 we each paid approximately $3,500 in state and local council level payments.

This is lower than the national average of $3,750. WA topped the list at over $4,100 per person. Tasmanians enjoy the lowest level of taxes at $2,700 per person, which shows the importance of looking at the whole picture given that Hobart Council placed second on The New Daily’s list of highest charging councils.

There’s no doubt that rates rises can affect the cost of living, especially for people whose property value has increased much faster than their income. Retirees can be particularly at risk.

It doesn’t help the economically vulnerable to know that others are paying more. However, alarmist claims about exploding rates only obfuscate the problem. It’s important to realise exactly why we’re feeling the pinch if we’re to have any hope of relieving the pain.

How do you rate the ACT when it comes to rates and taxes? Will rates affect how you will vote in the upcoming election? Do you believe that rates would be substantially lower under a Liberal government?

Tom Chen works as a research officer at the Australian National University and believes that people are capable of making the right choices when presented with the right information. Kim Huynh is a RiotACT columnist and is also running as an independent for Ginninderra in the ACT election. Check him out on Facebook at gokimbo or GoKimbo.com.au