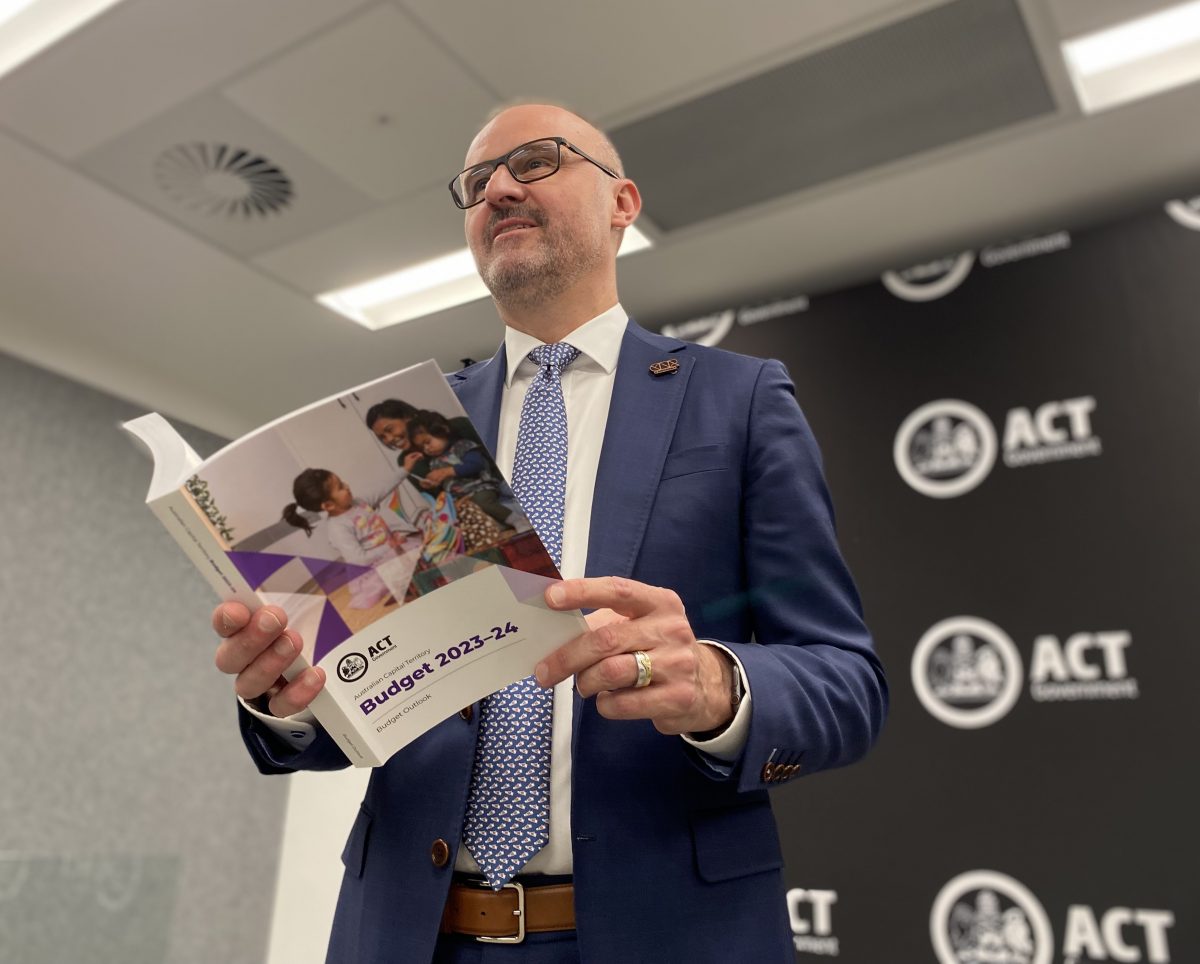

Chief Minister and Treasurer Andrew Barr with the Budget papers: “It’s a comprehensive response that delivers now and for the future.” Photos: Claire Fenwicke.

The ACT Budget is forecast to return to surplus the year after next in a document handed down today that combines fiscal repair with cost-of-living assistance and major infrastructure investment.

“It’s a comprehensive response that delivers now and for the future,” Chief Minister and Treasurer Andrew Barr said.

The budget remains in deficit this year at $442.7 million, $50 million better than predicted, but over the forward estimates the position improves to a $141.9 million surplus in 2025-26 which grows to $212.1 million in 2026-27.

The operating cash surplus will also return to surplus and improve to $712 million by 2026-27.

But the Territory’s debt will also grow from $6.5 billion in 2023-24 to $10.6b in 2026-27, which Mr Barr said reflected the government’s decision to invest in multi-generational and one-in-50-year infrastructure projects such as the new northside hospital, light rail, the Canberra Theatre redevelopment, a stadium and a convention centre over the next decade.

Mr Barr said it made sense to borrow for those kinds of assets.

“So effectively, what we’re doing by borrowing is saying to the community, well, multiple generations of Canberrans are going to utilise this asset,” he said.

“It’s not fair to ask this current generation, you know, in this four-year period, to entirely pay for it upfront. And so that’s why we borrow and our level of debt is very comparable, in fact, better than most other states and territories.”

That staggered infrastructure program is valued at $8.2 billion over the next five years.

Mr Barr said that the Territory’s bottom line would be even better when those one-off projects were completed and public service superannuation was fully funded in the 2030s.

The keys to the improving budget position are Canberra’s growing population, expected to be 10,000 a year and recognised through greater GST payments, higher by $774.9 million over the forward estimates, and full employment lifting payroll tax to be the highest source of locally generated revenue.

Chief Minister Andrew Barr at his Budget press conference: sensible borrowing for multi-generational infrastructure.

Mr Barr said the ACT continued to press the case for how the ABS calculates population to be reviewed because using Medicare addresses consistently understates the Territory’s numbers, translating to tens if not hundreds of millions of dollars.

The budget papers say total own-source taxation revenue is estimated to be $2.6 billion in 2022-23, $109.6 million higher than the 2022-23 Budget estimate, and over the four years to 2025-26, it is now expected to be $492.9 million higher.

Payroll tax receipts will now reach $1049.9 million in 2026-27, boosted by the introduction of a 0.25 per cent surcharge for big businesses – 0.25 per cent for businesses with Australia-wide wages above $50 million and 0.5 per cent for businesses with Australia-wide wages above $100 million.

Tax measures are estimated to raise an additional $121.4 million over the forward estimates.

Rates, levees and fees will rise on average by 3.75 per cent, the former as part of the government’s tax reform program, resulting in another cut to stamp duty.

General rates revenue is forecast to be $757.6 million in 2023-24, growing annually by 5.3 per cent to reach $896.2 million in 2026-27.

According to the budget papers, the government will collect $20 million more stamp duty than expected over the four years to $225.7 million, but this will be $400 million less than it would have been before the tax reform program began.

The Lease Variation Charge for property developers will also be increased to reflect higher market values, the first update since 2017

Mr Barr said a decade of suppressed wage growth had hit families hard as the cost of living soars, and measures such as the expansion of utility concessions and free preschool were designed to help them.

“Of course, every household in Canberra benefits from an energy concession,” he said.

“Basically, the biggest benefits go to the lowest-income households, but every single household will benefit, particularly when compared with what’s happening across the border in NSW, or indeed elsewhere on the east coast of Australia.”

The budget assumes that inflation has peaked but that higher interest rates and cost-of-living pressures will continue to temper household consumption and business investment in the short term.

It expects ACT exports to continue to be strong, along with robust growth in employment and wages.

Growth is expected to fall below 3 per cent in 2023-24 to 2.25 per cent but resume at 3 or more per cent in the following years.

The government previously announced record spending on health, education, housing and police.