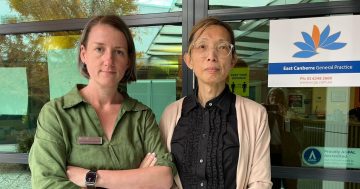

RACGP vice president Dr Bruce Willet, Senator David Pocock, RACGP president Dr Nicole Higgins and Garema Place Practice principal Dr Felicity Donaghy. Photo: Lizzie Waymouth.

A new additional payroll tax on general practices would sound the “death knell” for GP services, according to the Royal Australian College of General Practitioners (RACGP), who met with ACT Senator David Pocock to raise their concerns.

General practices already pay a payroll tax on admin staff, nurses and trainee doctors. The college says the new tax obligation would mean tenant GPs would also be counted as employees for payroll tax purposes.

The RACGP has warned that this additional ‘sick tax’ would leave many surgeries with the choice of either passing on the costs to patients or closing their doors.

The college has also raised its concerns with Federal Health Minister Mark Butler.

“The added burden of an extra payroll tax, which is above and beyond the threshold that they have, could actually ultimately result in closure,” RACGP president Dr Nicole Higgins said.

“It will add an extra $15 per consultation just to be able to cover that extra tax,” Dr Higgins said.

“Practices already pay payroll tax. This is an additional tax on the Medicare income, so it is effectively double taxing the practices.”

With the recent news that the Hobart Place GP – which was used by many ANU students and offered bulk billing and discounted appointments – will be closing on 30 April, there is a risk that other surgeries will follow.

“Losing another general practice in Canberra would be an absolute disaster when people are really struggling at the moment with the cost of living. Seeing a GP is now becoming out of people’s reach. The gap is the biggest it’s ever been. And [the number of people] able to access bulk billing in Canberra is one of the lowest in the country.”

According to a survey of GPs conducted earlier this year by Cleanbill, the ACT has the lowest rate of bulk billing for new patients, at 5.5 per cent. In comparison, the national average was 35.1 per cent.

“What we’re calling on from the Federal Government and from Minister Butler through Medicare is to increase the Medicare rebate for those longer consultations, especially for those people who are vulnerable and disadvantaged.

“We’re also calling on increasing and tripling the bulk-billing incentive so practices are able to serve those in need. If we don’t stem the bleeding and general practice, people aren’t going to be able to see their family doctor.”

Patients who saw GPs at Hobart Place have been absorbed by the Garema Place General Practice. As the practice’s principal, Dr Felicity Donaghy, explained, the practice has been doing its best not to raise costs, but an additional tax would leave them no choice but to increase fees to remain open.

“I think we’ve reached a tipping point,” Dr Donaghy said.

“We are a privately billing practice. We bulk bill patients where we can, but we are aware that if we don’t charge a gap, we wouldn’t be able to remain viable.

“The possibility of a payroll tax is a major issue for us. General practices operate on a margin of about 5 per cent, payroll tax in the ACT is 6.85 per cent. We simply would not be able to absorb that cost; we would have to pass that cost on to patients.

“We have tried very hard over the last three or four years to not increase our costs because we are aware of the pressures on families and we want to remain accessible. But if this tax were applied to us, we would have no choice but to pass that cost on.”

The Territory already has some of the highest out-of-pocket costs in the country. The average patient in Canberra spends $51.59, compared with the national average of $40.42.

If an additional tax is imposed on general practices in the ACT, these costs could climb even higher – a concern shared by Senator Pocock.

“When you’ve got the lowest number of GPs per capita, the lowest bulk-billing rates and the highest gap fees, to add that payroll tax to general practice doesn’t make sense to me,” Senator Pocock said.

“There should be more consultation. We should be investing more in GPs at this time. Canberrans know how hard it is to get in to see a doctor and they know how expensive it is.”