Denman Prospect is providing choice for renters, especially in larger properties. Photo: Canberra Airport.

After a stable year with enough stock to keep rents from rising as they have in most other capitals, the ACT rental market is set to tighten under the impact of an influx of interstate workers and an exodus of landlords.

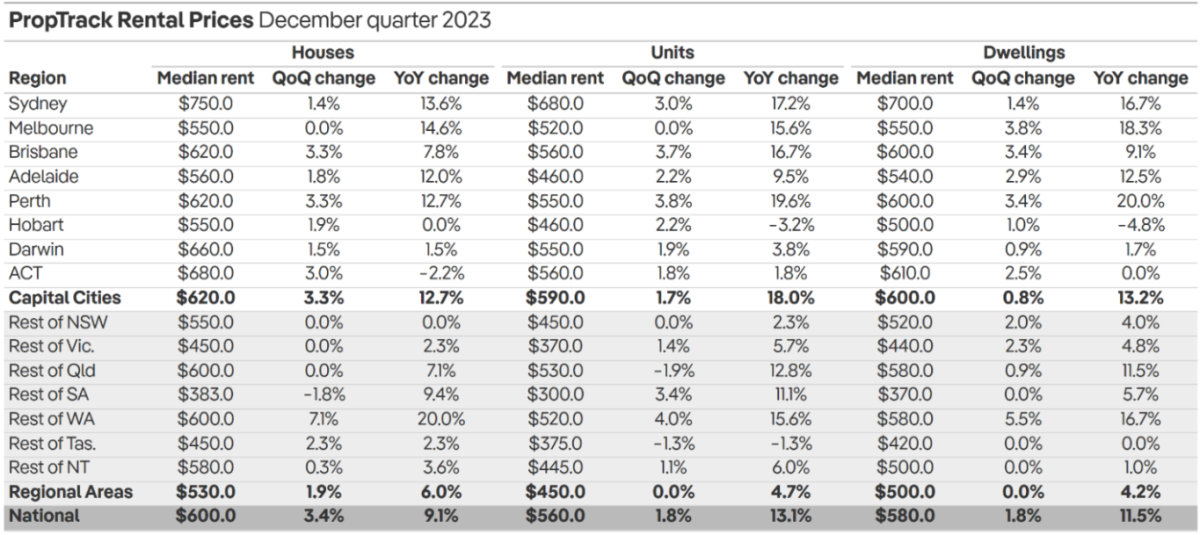

End-of-year figures from PropTrack show rents for all properties unchanged over the year, which has given renters a reprieve after the spike in previous years.

The median rent at the end of December was $610 a week, with houses down 2.2 per cent ($680) and units up 1.8 per cent at $560.

Canberra’s rents are still high and only second to Sydney’s, although Brisbane and Perth are on their heels as insufficient supply bites.

The figures in the last quarter point to a shift, though, with house rents rising 3 per cent and units 2.5 per cent.

That doesn’t surprise The Property Collective’s Director of Property Management Hannah Gill who said the supply of houses, in particular, was starting to taper.

Ms Gill said after a quiet December, interstate workers, especially Defence and other public sector workers, had swamped her agency seeking accommodation, which did not happen this time last year.

Ms Gill said vacancy rates had fluctuated around the 2 per cent mark in the past six months but were coming back down, although there may be a blip in the January changeover.

Canberra’s rents are second to Sydney, although Brisbane and Perth are catching up as insufficient supply bites. Image: PropTrack.

The stable market of 2023 reflected short-term increased supply in the market with new developments settling, but there was not a lot of new rental stock on the horizon, except for a build-to-rent development in Greenway.

Ms Gill said build-to-rent projects would take on more importance as single-dwelling investors look elsewhere.

“It’s really hard for one property investor to create that supply because we know without the influx of larger developments, it’s just not there,” she said.

But Ms Gill said Canberra had challenges to overcome for build-to-rent projects to be cost-effective and a truly viable model for investors, such as planning rules, holding costs and the various rates and taxes.

Ms Gill said the predicted departure of landlords from the market was happening due to changes to standards, legislation, and the biggest driver, increasing rates.

“There’ll definitely be sort of a concentrated percentage of investors in particular developments, but beyond that, I’d say nothing out of the ordinary,” she said.

There was still a fair amount of choice in the market, especially in the newer suburbs such as Denman Prospect, but it was patchy and would not remain for long.

“If things keep going the way they are with January madness, I suspect vacancy rates will be well under 2 per cent again,” she said. “And as a consequence, we’ll probably start to see rents rise.”

Sydney, Melbourne, Perth and Adelaide recorded double-digit rent rises in 2023, while Brisbane was up 9.1 per cent.

Only in Hobart did rents fall.