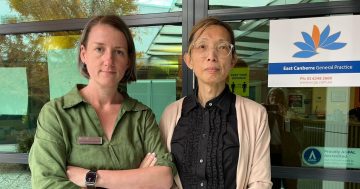

Elizabeth Lee says the GP payroll tax will have a devastating effect on access to health care for low-income families. Photo: G Jacobs.

Andrew Barr has blatantly ignored stark warnings that imposing a payroll tax on GPs will make it more expensive for Canberrans to access essential healthcare.

GPs are the bedrock of our health system. We all have a GP who is usually our first contact point when we get sick. Most GPs lease rooms in clinics and have a contractual relationship with those clinics. Accordingly, payroll tax did not apply to them. Earlier this year, a tax ruling (and its unsuccessful appeal) saw this practice overruled, leading to many State and Territory governments scrambling to understand what this would mean.

Some jurisdictions moved fast. Some clinics in NSW and Victoria have already been issued notices demanding retrospective payroll tax. Others have confirmed a “pause” while GPs and governments can sensibly work together to find a long-term solution.

In the ACT, Andrew Barr issued a threat to all GPs that they would be provided a two-year amnesty on the condition that they bulk bill 65 per cent of patients.

In issuing this threat, he has blatantly ignored the warnings from the Royal Australian College of General Practitioners (RACGP), the Australian Medical Association (AMA), the GP Alliance, the Primary Care Business Council (PCBC) and countless GPs that this target is unrealistic and unachievable.

We already have the highest out-of-pocket costs in the country to see a GP. We also have the lowest bulk billing rates of all capital cities. The cost of running a practice in the ACT is incredibly high and any additional tax burden will force GP clinics to pass on those costs to patients.

Instead of listening to the genuine concerns raised by GPs, Andrew Barr has unilaterally imposed a condition that he was explicitly warned would not work.

And instead of listening to the pleas of our hardworking GPs, Andrew Barr has accused them of making “wild accusations” to try to “minimise tax” and chastised them for a “lack of ambition in relation to bulk billing”.

On 30 August 2023, the RACGP and AMA confirmed that “the ACT government doesn’t understand how bulk billing works”.

“Their exemption from the new patient tax for practices that bulk bill 65 per cent of patients is flawed. It’s almost certain to fail at its first test with very few practices able to make it up and remain viable. If this happens, it will be devastating for the patients and communities that lose their GPs.”

At a time when Canberrans are facing a cost-of-living crisis, Andrew Barr will make it even more costly for Canberrans to access essential healthcare.

At a time when Canberra is facing the lowest number of GPs per capita in the country, Andrew Barr will make it harder for existing GP clinics to keep their doors open.

At a time when Canberra’s health system is on the brink of collapse, Andrew Barr will put more pressure on hospitals that will see a sharp increase in presentations as more and more Canberrans find themselves unable to afford to see their GP.

On 29 August 2023, I tabled a bill to provide an exemption for GPs on a contract from payroll tax. This is not special treatment for GP clinics. GP clinics already pay payroll tax for their employed staff – receptionists, nurses and admin staff. GPs who hire rooms in these clinics are contractors and clinic owners cannot dictate to GPs on contract to bulk bill. My bill is about maintaining the status quo for GPs.

On 31 August 2023, every single Labor and Greens member voted to throw out my bill and not allow it to be debated. This government will stop at nothing to avoid scrutiny and transparency of its decisions and actions.

Imagine what we could achieve as a community if this government spent as much effort and time on actually getting things right for Canberrans. GPs are an integral part of not only our health system but of our community.

The Canberra Liberals will abolish this tax if we are successful at the election in October 2024 because we will support our GPs to continue delivering the high-quality essential health care to all Canberrans.

Elizabeth Lee is the Liberal leader in the Legislative Assembly and an MLA for Kurrajong.