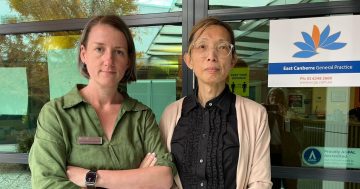

Opposition Leader Elizabeth Lee has accused Chief Minister Andrew Barr of misleading voters about the Liberals’ payroll tax cut. Photo: Michelle Kroll.

If you thought ACT Treasury’s costing of party policies would settle matters for voters, think again.

The Canberra Liberals launched an attack on Chief Minister Andrew Barr’s economic credentials for claiming the cost of its payroll tax cut would be half a billion dollars when Treasury costed it at just $48 million.

Opposition Leader Elizabeth Lee said Mr Barr had either deliberately misled the public or was so incompetent he did not understand his own budget papers.

“For Andrew Barr to put those figures out last week was desperate and disingenuous, and Canberrans should expect better from someone who has controlled the budget for over a decade,” Ms Lee said.

“Treasury has confirmed that the policy put forward by the Canberra Liberals, which has remained the same since it was announced, would cost a fraction of what Andrew Barr very publicly stated it would.

“If Andrew Barr had bothered to do a simple fact check before going out so public with his outrageous figures, he could have saved himself the embarrassment.

“Instead of having a genuine debate on policy and a vision for Canberra, Andrew Barr has continually run a fear campaign, and he has once again been found to be misleading the public.”

However, Mr Barr said voters needed to check the terms and conditions of Liberal policies because they can change and come with unseen caveats.

Mr Barr said Labor’s first estimate was based on the initial announcement in a media release that the Liberals would reduce the rate of payroll tax on payrolls up to $5 million from 6.85 per cent to 5.45 per cent but did not provide details of how it would be implemented.

Labor assumed that there would be a new marginal tax rate after $5 million before the Liberals clarified that there would not be a cut applied to payrolls above that figure.

“We costed that. We’ve then seen the policy change twice,” Mr Barr said.

“What happens with the Liberals is that they announce something and they don’t go to the terms and conditions, and what’s submitted for costing is often different from the announcement.

“They’ve been caught out on this on a few policies now where it sounds great with the big announcement, but they don’t include any of the details.”

Mr Barr said the revised policy was bad tax policy and would deter businesses from growing because as soon they went over $5 million the higher tax rate applied back to the $2 million tax-free threshold.

“So a business faces a decision when their payroll goes $1 over 5 million, that the amount between $2 million and $5 million will revert back to a 6.85 per cent taxation rate,” he said.

“So the benefit, if you like, of this payroll tax cut is lost.

Treasury’s costing would be an accurate reflection of the policy submitted, Mr Barr said.

The Liberals deny any change being made to the policy, which they estimated in their submission to Treasury would cost $80 million over four years.

The Liberals also criticised Labor for not submitting its plan to hire 800 more healthcare workers for cost.

Mr Barr said the 800 health workers comprised many different types of health workers and individual initiatives had been submitted as they were announced.

“We were clear when we announced this policy months ago that we would hire 800 additional workers to go from 9333 to over 10,000 over five budgets,” he said.

“The first of which was announced in June this year outlined in the forward estimates and the further commitments that we’ve made that contribute towards that total number of 800 have been submitted in the costings process.”

The budget allocated $86 million over four years to pay for more than 137 full-time equivalent nursing and midwifery positions, with net new spending of $9.6 million.