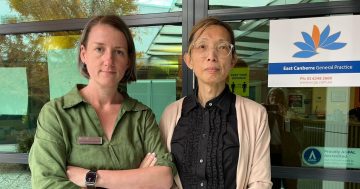

The ACT has the lowest rate of bulk billing in the country – only 5.5 per cent – and some of the highest out-of-pocket costs. Photo: File.

General practitioners have slammed the ACT Government’s decision to impose an additional payroll tax and say the recently announced temporary payroll exemption will only help a small minority of practices.

GPs have long been critical of the tax, which the Royal Australian College of General Practitioners (RACGP) called a “death knell” for GP services.

General practices already pay a payroll tax on admin staff, nurses and trainee doctors. The RACGP says the new tax obligation would mean tenant GPs would also be counted as employees for payroll tax purposes.

The college has warned that this additional ‘sick tax’ would leave many surgeries with the choice of either passing on the costs to patients or closing their doors.

The territory’s payroll tax-free threshold is the highest in the country at $2 million, meaning that most small and medium-sized businesses are not liable to pay. This includes the majority of GP clinics. According to the ACT Government, less than 10 general practices are affected.

On Saturday (26 August), the ACT Government announced it would be introducing a temporary payroll tax exemption aimed at addressing the impact of the payroll tax and creating an incentive for practices to bulk bill patients.

The ACT has the lowest rate of bulk billing in the country, at only 5.5 per cent, as well as some of the highest out-of-pocket costs. The average patient in Canberra spends $51.59 per visit compared with the national average of $40.42.

The two-year exemption would apply to GPs who are bulk billing 65 per cent of patients.

Several other measures were announced, including waiving payroll tax liabilities until 30 June 2023 for practices that have not previously paid payroll tax on GPs to avoid being subject to back taxes and extended time for compliance to ensure general practices can implement necessary changes and review their arrangements.

While the ACT Government has engaged with GPs and representative organisations to assess the impact of payroll tax on the practices affected, the RACGP and Australian Medical Association say it isn’t enough and the measures don’t address the difficulties GPs operating in the territory continue to face.

The ACT has the lowest number of GPs per head of any Australian capital city and is struggling to retain staff, resulting in some practices being forced to close. GPs are concerned that their practices will no longer be viable if an additional payroll tax is imposed. An RACGP poll of GPs across Australia found that 78 per cent said they would need to raise fees to absorb the cost of the additional tax.

“We have consulted with the ACT Government, and their new policy shows they have a limited understanding of how general practice works or the pressure GPs are under in the ACT. They also don’t understand how bulk billing works,” RACGP president Dr Nicole Higgins said.

“Canberra is one of the most expensive places to run a practice and we have already seen practices forced to close because they simply can’t afford to keep the lights on. It will be absolutely devastating for the community if more of their local practices are forced to close and GPs leave town.”

The temporary exemption will also only benefit a small number of practices that can reach the 65 per cent bulk-billing threshold, which is unobtainable for many GPs, even with the Federal Government’s tripling of bulk billing incentives for pensioners, children and healthcare card holders.

“It would not be possible for us to bulk bill 65 per cent of patients and stay financially viable,” RACGP spokesperson Dr Felicity Donaghy said.

“The ACT Government’s policy is out of step with other jurisdictions and will not encourage GPs to work in the ACT. It will have quite the opposite effect.”

Canberra Liberals leader Elizabeth Lee has also criticised the move and said it shows the ACT Government is not listening to industry stakeholders.

“The reality is that GPs will now be faced with a grim choice. They will either be forced to pass the cost on to patients, which will see Canberrans paying up to $20 more per consultation during a cost-of-living crisis that is impacting so many already, or they will be forced to cut services and perhaps even shut their doors,” she said.

Ms Lee will be putting forward a bill in the Legislative Assembly later this week to exempt clinics from the tax and reverse any retrospective application of the tax.

“If Andrew Barr is serious about ensuring all Canberrans have access to essential health care; if he is serious about addressing the cost of living pressures for Canberrans, he must support my bill,” she said.