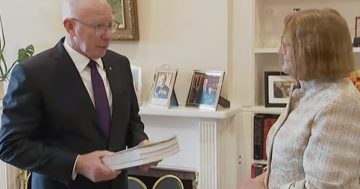

Professor Andrew Podger is investigating the administrative side of the Robodebt scheme. Photo: ANU.

Ministerial responsibility, yes, but the public service itself must also be held to account over Robodebt.

That’s a focus of a high-level study aimed at informing the royal commission about the illegal scheme, and one which could see the unravelling of Services Australia.

Former Australian Public Service Commissioner Andrew Podger is currently knee-deep in a probe into the administrative side of the automatic debt recovery scheme.

Specifically, he is looking into the relationship between ministers and bureaucrats to understand precisely why the illegal scheme got traction.

His appointment was revealed during hearings of the Royal Commission into the Robodebt Scheme.

The culture of the public service and the behaviour of leaders are getting sharp attention, with a report expected to be highly critical of how the scheme was inflicted on so many unsuspecting – and ultimately innocent – Australians.

Relationships between departmental secretaries and government ministers will be exposed in Mr Podger’s investigation.

So too will the behaviour of the senior executive service below secretary level and even lower-ranked executives in the Australian Public Service.

There has been some disquiet over the Podger probe since news of its progress was announced, with questions raised as to why there is a need to have an inquiry within the actual royal commission inquiry itself.

But with the scheme, already described in the royal commission as a “massive failure in public administration” that caused so much grief among welfare recipients – even being linked to suicide – Counsel Assisting the Royal Commission Justin Greggery KC has suggested there cannot be too much investigation.

He told the hearings Mr Podger will look at the structure and design of relevant portfolios.

Public servants’ legal obligations under the Public Service Act, the Public Governance, Performance and Accountability Act and the Public Interest Disclosure Act will also be examined as to how they play out with Robodebt.

Also in the royal commission’s hearings this week, a frontline Centrelink worker gave evidence saying she would never forget what staff were forced to do to Robodebt’s victims.

Jeannie-Marie Blake, a frontline worker for Centrelink: Photo: Screenshot.

Jeannie-Marie Blake said concerns raised by staff were dismissed by those further up the chain of command.

“All the management that I’ve sat and listened to through this, who can’t remember, can’t recall, can’t recollect, ‘couldn’t put your mind to it’ – I can’t forget,” Ms Blake said.

“And I know there are many more staff like me who can’t forget what happened and what we were forced to deliver to customers … We deserve a voice in this room, as much as every manager you’ve heard, everyone who can give you a reason on how they didn’t know … why they didn’t know.”

The Federal Government has extended the royal commission to allow for further witness evidence and the Podger report.

Attorney-General Mark Dreyfus and Government Services Minister Bill Shorten issued a joint statement recently to that effect.

“Royal Commissioner Catherine Holmes AC SC advised the Government that a short extension was needed and the government has agreed,” they said.

“The royal commission will now deliver its report on 30 June 2023.”

Robodebt was an automated debt assessment and recovery program employed for Centrelink compliance.

It began in 2016 and became hugely controversial due to its incorrect calculations and threat to issue illegal notices causing untold physical and mental health issues among notice recipients.

It became the subject of numerous inquiries, leading to the Coalition government scrapping the scheme in 2020 and promising to repay 470,000 wrongly issued debts.

In 2021, Federal Court Justice Bernard Murphy ruled the scheme unlawful.

Following Labor’s election victory this year, Prime Minister Anthony Albanese established the royal commission into the matter.

The Royal Commission has been examining, among other things:

- The establishment, design and implementation of the Robodebt scheme, who was responsible for it, why they considered it necessary, and any concerns raised regarding legality and fairness

- The handling of concerns raised about the Robodebt scheme, including adverse decisions made by the Administrative Appeals Tribunal

- The outcomes of the Robodebt scheme, including the harm to vulnerable individuals and the total financial cost to government, and

- Measures needed to prevent similar failures in public administration.