ACCC Chair Cass-Gotlieb said the regulator identified this conduct through consumer contacts and social media monitoring, followed by an in-depth investigation using its compulsory powers. Photo: Thomas Lucraft, James Coleman.

The Australian Competition and Consumer Commission (ACCC) has launched proceedings against Woolworths and Coles for allegedly misleading consumers through discount pricing claims on hundreds of common supermarket products.

In January, the ACCC was directed by Treasurer Jim Chalmers to conduct an inquiry into the Australian supermarket sector, pricing practices and the relationship between wholesale, farmgate and retail prices.

However, this matter now before the Federal Court was the result of an investigation led by the regulator, which pre-dates the inquiry and considers separate issues.

Woolworths Group Limited and a subsidiary of Coles Group Limited have allegedly breached Australian Consumer Law, which expects businesses not to make false or misleading statements about prices.

ACCC Chair Gina Cass-Gottlieb said the regulator is alleging that each supermarket made “misleading claims about discounts, when the discounts were, in fact, illusory”.

“Following many years of marketing campaigns by Woolworths and Coles, Australian consumers have come to understand that the ‘Prices Dropped’ and ‘Down Down’ promotions relate to a sustained reduction in the regular prices of supermarket products,” she said.

“However, in the case of these products, we allege the new ‘Prices Dropped’ and ‘Down Down’ promotional prices were actually higher than, or the same as, the previous regular price.

“We also allege that in many cases, both Woolworths and Coles had already planned to later place the products on a ‘Prices Dropped’ or ‘Down Down’ promotion before the price spike and implemented the temporary price spike for the purpose of establishing a higher ‘was’ price.”

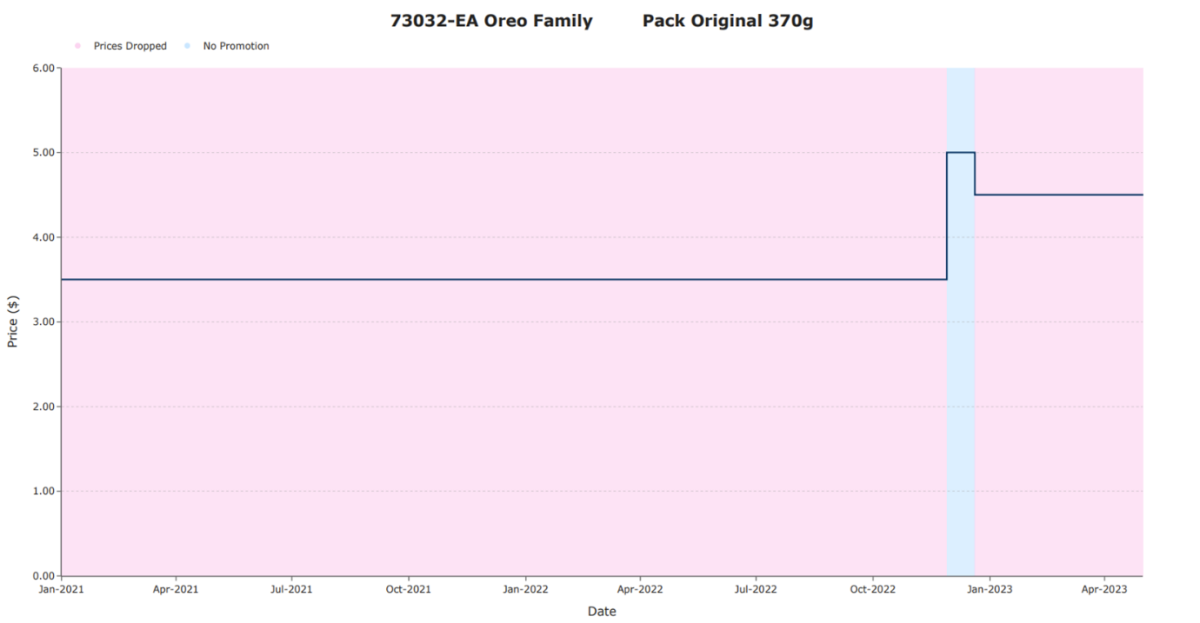

From at least 1 January 2021 until 27 November 2022, Woolworths offered the Oreo Family Pack Original 370 g product for sale at a regular price of $3.50 on a pre-existing ‘Prices Dropped’ promotion for at least 696 days. Photo: ACCC.

The ACCC alleges that the supermarkets offered certain products at a regular price for at least 180 days before increasing the price of the product by at least 15 per cent for a relatively short period of time and subsequently placing it onto their ‘Prices Dropped’ or ‘Down Down’ program.

According to the regulator, this conduct involved 266 products for Woolworths at different times across 20 months (September 2021 to May 2023) and 245 products for Coles over 15 months (February 2022 to May 2023).

The representations were made on pricing tickets displayed to consumers in-store on supermarket shelves and online, usually with a ‘was’ price displayed showing what the price was during the short-term price spike and the date of that price.

While the ACCC does not regulate supermarket prices, it does have the ability to punish corporate entities for breaching Australian Consumer Law.

None of the supermarket suppliers are under suspicion.

The maximum penalty for each breach of the Australian Consumer Law increased on 10 November 2022 – part way through the period of the supermarket’s alleged conduct.

If the Federal Court finds Woolworths and Coles guilty of violations after that date, the maximum penalty is greater than $50 million.

However, it could be three times that value if the Court can determine the value of the ‘reasonably attributable’ benefit obtained. Even if it can’t, but they’re still found guilty, each corporation could be fined 30 per cent of their adjusted turnover during the breach period.

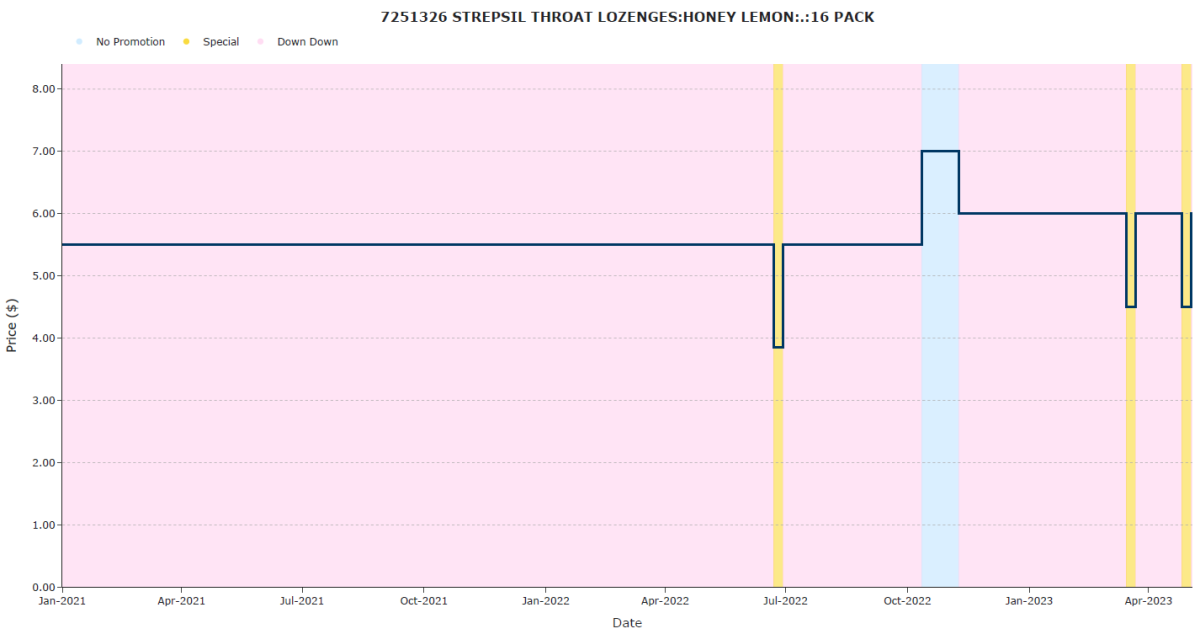

In this example, the ACCC alleges Coles had planned the temporary price spike to establish a new higher ‘was’ price for the subsequent ‘promotion’. Photo: ACCC.

In addition to declarations, penalties, costs and other orders, the regulator is seeking that each supermarket fund a registered charity delivering meals to Australians in need – not including their pre-existing charitable meal delivery programs.

Woolworths Group CEO Amanda Bardwell acknowledged the legal proceedings and said the company will review the ACCC’s claims.

In a statement to the ASX, Coles Group Secretary Daniella Pereira wrote of the company’s intention to defend the proceedings:

“The allegations relate to a period of significant cost inflation when Coles was receiving a large number of cost price increases from our suppliers and, in addition, Coles’ own costs were rising, which led to an increase in the retail price of many products.

“Coles sought to strike an appropriate balance between managing the impact of cost price increases and offering value to customers through the recommencement of promotional activity as soon as possible after the establishment of the new non-promotional price.”

Original Article published by James Day on PS News.