The supply of apartments and townhouses is starting to slow. Photo: Michelle Kroll.

Canberra’s residential property market has arrested its downward slide, led by a resurgence in the apartment and townhouse sector.

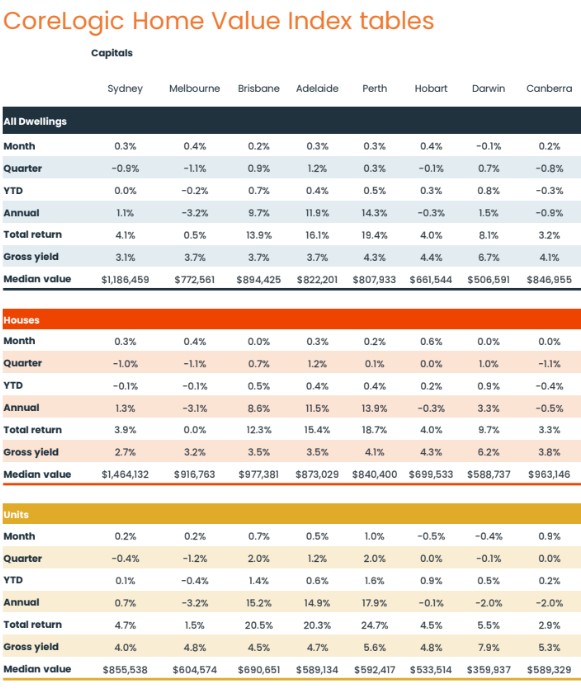

CoreLogic’s Home Value Index, out today, shows medium and high-density homes gaining nearly 1 per cent in February, an almost 2 per cent turnaround from January.

The median value in that sector was almost $590,000, which is now about the middle of the capital city pack due to the boom in the Adelaide, Brisbane and Perth markets.

Overall, the Canberra market was just in the black at 0.2 per cent for February, with house prices flat.

The Property Collective principal Will Honey said last month’s rate cut would have helped but the movement was where he had expected.

“That’s where the affordability sits – in apartments and townhouses in our market,” Mr Honey said.

“So it doesn’t surprise me if there is an increase of 1 per cent. I feel on the front line that there’s definitely active buyers out there in those apartments and townhouses.

“It feels since the rate drop there has been a bit more activity in that space.”

Mr Honey said that as the market improved, that was where the growth would be, not so much in standalone houses.

He said it would be in the affordability range where people’s borrowing capacity was more and they could meet deposit requirements.

While buyers had not been knocking down doors, Mr Honey had seen more of a spring in their step after the rate cut.

He didn’t expect to see a surge in prices after just one rate cut, but properties would probably take a bit less time to sell because there were still plenty of homes available, particularly apartments and townhouses.

CoreLogic said listings in the ACT were 6.8 per cent higher than the previous five-year average.

Mr Honey said that was across all sectors, but it was the affordable component where that supply would first be absorbed.

CoreLogic head of research Tim Lawless said the unit turnaround was surprising given the softness in the sector and could be caused by data volatility, but some of the excess supply could also be starting to be soaked up.

“I wouldn’t be surprised if we do start to see some mild growth returning to the marketplace in trend terms, just against the backdrop of improved affordability across the market,” he said.

“Obviously, from the sentiment boost we get from lower interest rates alongside the subtle borrowing capacity improvement as well, and the fact that we’re really starting to see supply-side challenges becoming more apparent across the Canberra market after a period of generally very strong apartment construction that looks to be done.”

Mr Lawless said Canberra didn’t have the same sort of affordability constraints as some other capital cities, but people on a tight budget would be looking to the cheaper apartments and townhouses.

“That’s where they’ll be looking, as well as first-home buyers looking to get into the marketplace,” he said.

Mr Lawless expected growth to be slow, and buyers and lenders to be cautious, given the Reserve Bank’s conservative approach to easing interest rates.

But given Canberra had experienced one of the bigger price declines at 7 per cent, it had the capacity for price gains.

Nationally, there was a 0.3 per cent rise to break the short and shallow downturn that lasted just three months, led by Melbourne and Hobart.

CoreLogic said the return to growth across Sydney and Melbourne was being driven by the more expensive end of the market, usually the most sensitive to rate cuts.

Mr Lawless said the improved housing conditions had more to do with improved sentiment than any immediate increase in borrowing capacity.

“Expectations of lower interest rates, which solidified in February, look to be flowing through to improved buyer sentiment,” he said.

“Along with the modest rise in values, we have also seen an improvement in auction clearance rates, which have risen back to around long-run average levels across the major auction markets.”