Chief Minister Andrew Barr wants to know the impact of his tax reforms on households. Photo: Michelle Kroll Region Media.

The ACT Government is seeking an independent analysis of the impacts of its tax reform program on households and the property market, including rents.

A tender has been released for one or more consultants to undertake the analysis, which the Government will use in the framing of the 2020 Budget when it will announce the next phase of reform.

The 20-year tax reform program began in 2012-13 and involves what the Government says is a revenue-neutral switch from insurance and conveyance duty to annual property taxes through the general rates system.

The Government says the review has always been planned and is timely given the reform program is at the halfway point.

The Standing Committee on Public Accounts report into the methodology for determining rates and land tax for strata residences also requested that the Government undertake further analysis.

Chief Minister Andrew Barr has consistently rejected the Canberra Liberals’ claims that the rate rises are hurting many sections of the community, driving homebuyers across the border and pushing up rents, arguing that ratepayers have benefited from cuts to stamp duty and other taxes and charges.

While the analysis may have been planned, it will also give the Government room to move in the Budget to assuage disaffected voters or provide an effective counter to what will be a ferocious campaign from the Opposition, which has already pledged a rates freeze.

The Government wants to know the impact of its rate rises on different sections of the community including first-home buyers, low-income homeowners, median-income homeowners, pensioners and fixed-income retirees, renters and women, as well as whether tax reform has been equitable and affected people’s ability to pay.

It also wants to see if residential property prices or property turnover are higher or lower than they would have been without tax reform, if home buyers are spending less overall on property purchases or buying higher-priced properties by adding the stamp duty saved to their purchasing budget, and whether the changes have made it easier for people to move to properties more suited to their needs, such as downsizing.

The analysis will also tell the Government if rental housing is more or less affordable and if rate rises are being passed on to tenants.

Economists have supported the ACT Government’s tax reform program and the Government has won two elections since it began but Opposition Leader Alistair Coe has put rates at the centre of his campaign for next year’s October poll.

While he has promised to freeze rates, Mr Coe has not said how he would pay for the policy.

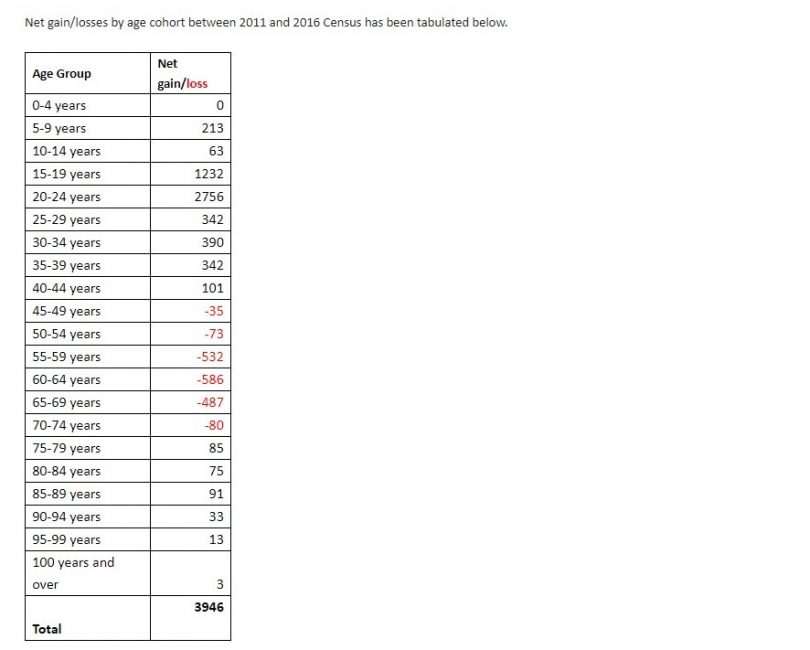

The Government also challenged Mr Coe’s charge that Canberrans are moving across the border, saying that between 2011 and the 2016 Census the ACT gained 3946 people from NSW, releasing this table to support their claim:

Population moving into and out of the ACT between 2011 and 2016.

“The only age groups that have seen any significant movement out of the ACT are those of retirement age heading to the coast,” a spokesperson said. “Young people have been flocking to the ACT. We are one of the fastest-growing regions in Australia. Our population in 2011 was 357,220. In March 2019, the ABS estimated our population reached 425,700.”

The spokesperson reiterated that rates increases would be lower in the next phase of tax reform, with the heavy lifting complete now that insurance taxes in the ACT have been fully abolished and the payroll tax threshold has been lifted.

The tender says a final report will be due by 21 February 2020.