Shadow treasurer Ed Cocks called for the government to “immediately halt retrospective eligibility assessments”. Photo: Facebook.

The Canberra Liberals are claiming “thousands of honest Canberrans” could be in for a “nasty financial shock” in coming years after it was revealed the ACT Revenue Office can reassess stamp-duty concessions and exemptions years after they were granted.

During Annual Report Hearings on Monday (17 February), government officials said it’s up to the taxpayer to ensure they’re eligible for stamp-duty exemptions or concessions.

In the ACT, these include first-home buyers with an income under $170,000 buying a property under $1 million, pensioners buying a property valued below the median ACT’s property value, and people with a long-term or permanent disability buying a principal place of residence.

If it’s later found a taxpayer wasn’t eligible for any of these, the government can chase them for the full stamp-duty amount, as well as interest and potentially thousands of dollars in penalties.

“It’s a self-assessment regime,” ACT Treasury executive group manager Kim Salisbury told the panel.

“The taxpayer is responsible for accessing their eligibility … They would do that after consulting our website and also getting legal advice from the solicitor acting on their behalf.

“At nine months after the assessment, we contact the taxpayer and ask if they’ve met all the requirements … about the income threshold and the previous property ownership threshold.

“There’s still three months to go for the residency requirement, which is 12 months.”

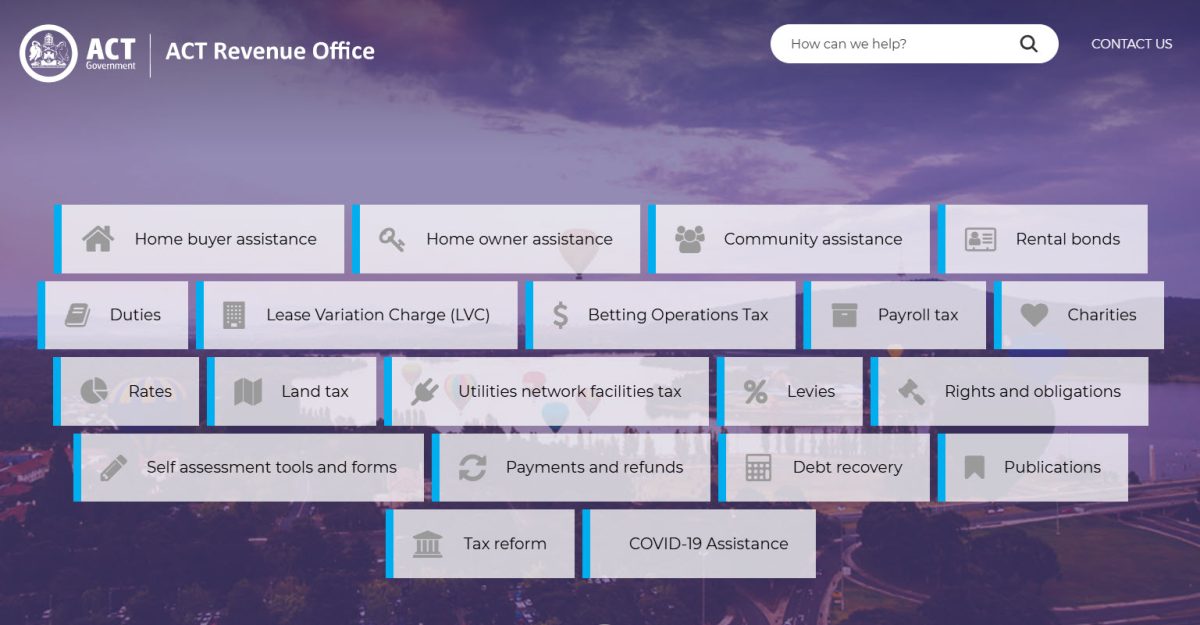

The ACT Revenue Office website includes an “eligibility questionnaire” for stamp-duty exemptions. Photo: Screenshot.

Mr Salisbury then confirmed the Revenue Office may go through the applications at a later date to see if the taxpayer was indeed eligible, but there’s no timeline on how long this can take.

“I don’t think there’s a legislative provision that prohibits the revenue office from doing that,” he said, before adding, “Whether we do debt recovery depends on the individual case.”

Shadow Treasurer Ed Cocks has strongly criticised the revelation, calling it “an attack on honest Canberrans”.

“Imagine getting government approval for a stamp duty concession, buying your first home, and then — four years later — receiving a massive bill in the mail, followed by government debt collectors,” he said.

“This is unfair, unreasonable, and completely out of touch. How many first-home buyers and pensioners could be blindsided by these retrospective assessments when they genuinely believed they were eligible?”

He also criticised the government for failing to verify applications before it approves them and called for them to “immediately halt retrospective eligibility assessments”.

“Even if it’s legal, [the process] is certainly morally questionable,” he said.

“No Canberran should have to live in fear of a surprise bill years after they are told they are eligible.”

In a statement, the ACT Government confirmed it was “aware that, unfortunately, there have been a number of recent examples of conveyancing agents making incorrect concession claims on behalf of home buyers”.

But it compared the stamp-duty concessions and exemptions to any other “tax liability, deduction or concession”.

“Anyone who has ever completed a tax return will be aware that the Tax Office can subsequently audit and check information provided and can seek payment of taxation owed with interest and penalties applied where appropriate. This is also the case with the ACT Revenue Office.”

The spokesperson said the Revenue Office webpage includes an “eligibility questionnaire” and clearly states that “all concessions and exemption applications at the ACT Revenue Office are self-assessed”.

“Canberrans are encouraged to seek professional advice before claiming the concession as part of their purchase,” the spokesperson said.

In cases where solicitors or accountants have provided incorrect information to the prospective home buyer, the government said there have been cases where the home buyer has then sued the company and won.

“Agents have professional indemnity insurance and can put in a claim against their insurance if they have engaged in negligent conduct and their client has suffered an economic loss, such as penalty tax and interest being imposed,” the spokesperson said.

“The ACT Revenue Office is aware of law firms that have made claims against their professional indemnity insurance due to negligence in advising on home purchases wherein a concession or exemption from duty was incorrectly claimed, resulting in some firms having compensated their clients for penalties and interest.”

The spokesperson concluded by saying the Revenue Office is “actively monitoring” compliance with the homebuyer concession requirements to prevent people from getting caught out.

“If Canberrans are required to repay the concession, they are encouraged to engage with the Revenue Office to discuss their circumstances and seek appropriate financial counselling to understand options available to them.”