House prices are holding up better than units and townhouses. Photo: Michelle Kroll.

Canberra residential property prices have ended the spring selling period, which barely changed from the same time last year, but there are key differences between housing types.

While there was hardly any movement in November for houses and units and townhouses, the former is in the black and the latter in the red compared with spring 2023.

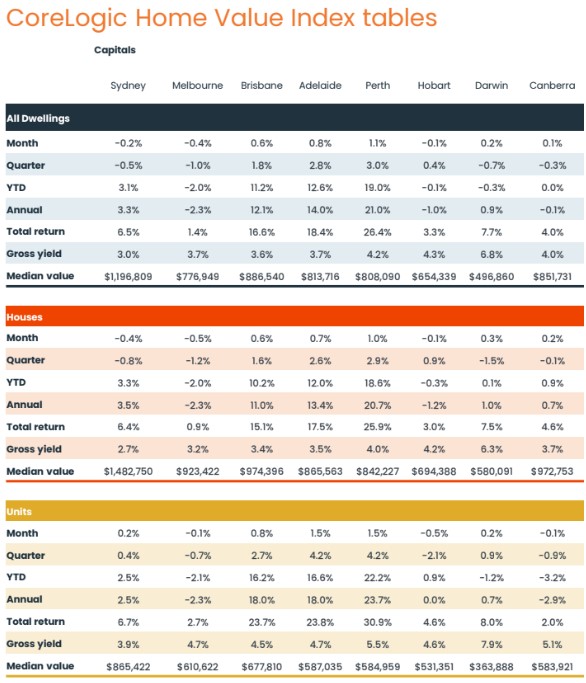

According to the CoreLogic Home Value Index, house prices have risen 0.7 per cent over the past 12 months, while units and townhouses have fallen almost -3 per cent.

Over the spring quarter, all dwellings fell -0.3 per cent, houses are up just 0.1 per cent, and units and townhouses fell -0.9 per cent.

The median value at the end of November for all dwellings was close to $852,000, for houses nearly $973,000 and for units and townhouses almost $584,000.

Factors weighing on the market continue to be a strong supply of listings, especially in second-hand apartments, interest rates and borrowing restraints.

Auction clearances in the ACT continue to be about 50 to 55 per cent.

Well-presented homes requiring little to do continue to sell, but with more choice, buyers are taking their time and can afford to be picky. It also appears some buyers are waiting to see what happens with interest rates.

While this marks the 22nd straight month of growth, CoreLogic says it could be close to the last. Table: CoreLogic.

Prices varied across Canberra’s districts over the 12 months, with Tuggeranong faring best to post a 1.9 per cent rise for a median of $$831,613.

At the other end of the ACT, Gungahlin prices recorded the biggest fall of 2.4 per cent for a median value of $906,263.

Molonglo was also in the black at 1.3 per cent for a median value of $776,817, as was North Canberra (0.9%, $868,226) and Belconnen (0.8%, $821,256).

But Woden Valley slipped -0.9 per cent for a median of $998,151, as did South Canberra (-1.6 per cent, $911,768).

Nationally, the index rose by just 0.1 per cent in November, the weakest Australia-wide result since January 2023.

While this marks the 22nd straight month of growth, it could be close to the last, CoreLogic says.

Canberra (0.3%) was one of four capitals to experience on a rolling quarterly basis a fall in values, led by Melbourne (-1.0%), followed by Darwin (-0.7%), Sydney (-0.5%) and Canberra.

CoreLogic research director Tim Lawless said the downturn was gathering momentum in Melbourne and Sydney while the mid-sized capitals were also losing steam.

“The mid-sized capitals and most of the regional ‘rest of state’ markets continue to provide some support for growth in the national index, but it is clear momentum is also leaving these markets,” Mr Lawless said.

Capital city listings are up 16 per cent since the end of winter.

CoreLogic says the outlook for housing markets has deteriorated over the past month, with core inflation holding high, labour markets holding tight, the chances of a rate cut early next year becoming less likely and a tight rein being kept on borrowing.

It also points to wars in the Middle East and Ukraine, the new Trump presidency in the US, and a federal election, which will add to the uncertainty in 2025.