A bird’s-eye view of Weston Creek, which led the housing market price growth figures in 2023-24. Photo: Region.

Weston Creek has overtaken South Canberra as the pacesetter for the ACT residential market, chalking up a 5.24 per cent growth in prices for the 2023-24 financial year.

The conveniently located leafy district dominated by family homes has become more attractive to homebuyers looking for value as inner-south prices escalate, particularly in the last quarter when it surged 2.8 per cent.

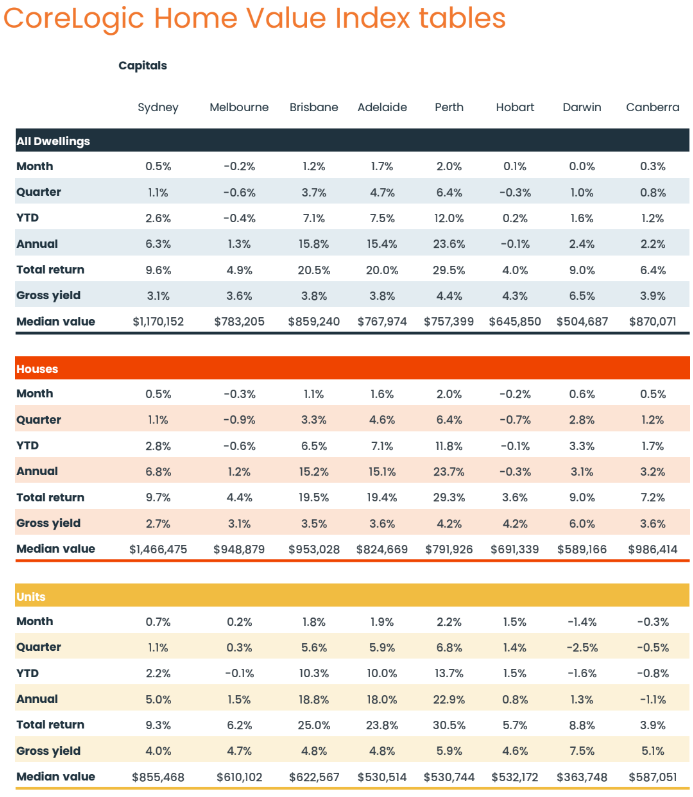

According to the latest CoreLogic Home Values Index, Weston Creek’s median price in June reached $937,740, nearly $70,000 more than the ACT median of $870,000.

Over 2023-24, the Canberra market recorded a 2.2 per cent rise, finishing the year flat with a negligible 0.3 per cent increase in June.

Houses performed better than units and townhouses, posting a 3.2 per cent rise over the year to finish with an increase of 0.5 per cent and a median price of $986,000.

In the last quarter, house prices picked up by 1.2 per cent.

Prices for medium and high-density homes slipped -1.1 per cent over the year, edging down in June (-0.3%) to finish with a median of $587,000.

Tuggeranong was also a mover in 2023-24, rising 3.79 per cent, followed by South Canberra ($920,384/2.77%), North Canberra ($888,922/2.60%), Belconnen ($835,173/2.03%), Molonglo ($846,083/1.86%), Woden Valley ($1,033,194/0.47%) and Gungahlin ($915,496/0.03%).

Director of sales and projects at The Property Collective, Will Honey, said Weston Creek was attracting buyers looking for bigger blocks than in neighbouring Molonglo and people priced out of Woden Valley.

“It’s mainly those two audiences colliding,” he said. “It’s a segment of the market that’s got a bit of demand at the moment.”

But overall, the market was patchy, suffering from a little bit of winter hibernation and lots of interest rate uncertainty.

Mr Honey said some properties were attracting large turnouts, while others only had one bidder or none at all.

“People are finding it hard to know what things are worth in the current market,” he said.

CoreLogic executive research director Tim Lawless said the Canberra market was experiencing steady conditions, a marked difference from most of the other capitals.

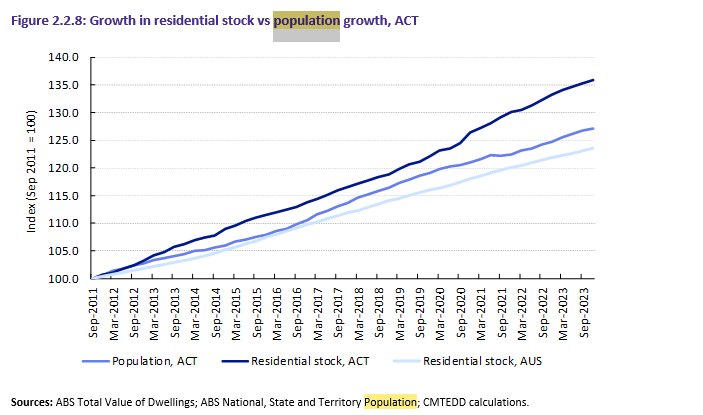

Mr Lawless attributed this to greater supply, mainly thanks to a build-up of medium and high-density homes, which was keeping a lid on unit price growth.

The rental market was also more stable, with rents even falling for part of the financial year before coming back slightly in the last quarter for a 2.4 per cent growth figure, which Mr Lawless said was about average.

Again, quite different from other capitals, where migration was driving rents up.

“Whichever way you cut the Canberra data, whether you’re looking at purchasing prices or home values or rents, we’re not seeing the same sort of affordability pressures emanating like in the other capitals,” Mr Lawless said.

“It looks like Canberra’s done a much better job of delivering supply to the market, especially in the units sector.

“You can see that in the values as well, where the units sector has underperformed compared to houses.”

A housing and population graph from the 2024-25 Budget papers.

Chief Minister Andrew Barr told Region before the Budget that an acceleration of land release in 2024-25 sought to oversupply the market to put downward pressure on rents and prices.

Mr Honey said there was a lot of relatively new unit and townhouse stock up to about five years old on the market.

He said owners were selling due to interest rate pressures, cashing in after riding the growth period and/or upgrading to a bigger property or a house.

Mr Lawless said that in other capitals, price pressure was boosting the lower end of the market, but in Canberra, it was the upper quartile where growth was most evident, with a rise of 1.4 per cent in the last quarter.

“In the ACT, even though prices are quite high, when you adjust for incomes locally, it’s still quite an affordable market,” he said.

“That explains why the upper quartile is stronger.”

Mr Lawless said Gungahlin was the only sub-market where values did trend lower over the last quarter, by -0.7 per cent.

He said there was quite a bit of diversity across the Canberra market and the more affordable sub-markets seemed to be lagging.

“Maybe that’s a reflection of subsequent buyers becoming more active, or downsizers with a little bit more equity or savings built up being more active, whereas other segments of the market that might be more price sensitive or finding it difficult to save for a deposit are probably going to be constrained,” Mr Lawless said.

He predicts interest rates will stay higher for longer.

Nationally, values increased a further 0.7 per cent in June, taking growth to 8 per cent across 2023-24.

The mid-sized capitals continue to record the strongest growth conditions, especially Perth, where values surged another 2 per cent, Adelaide increased 1.7 per cent and Brisbane was up 1.2 per cent.

However, CoreLogic said these cities were suffering severe housing shortages, with listings significantly below average in June.