Molonglo Valley prices grew the most over the past year. Photo: Michelle Kroll.

A window is opening for buyers to take advantage of falling prices and lower interest rates before a re-energised market picks up steam later in the year.

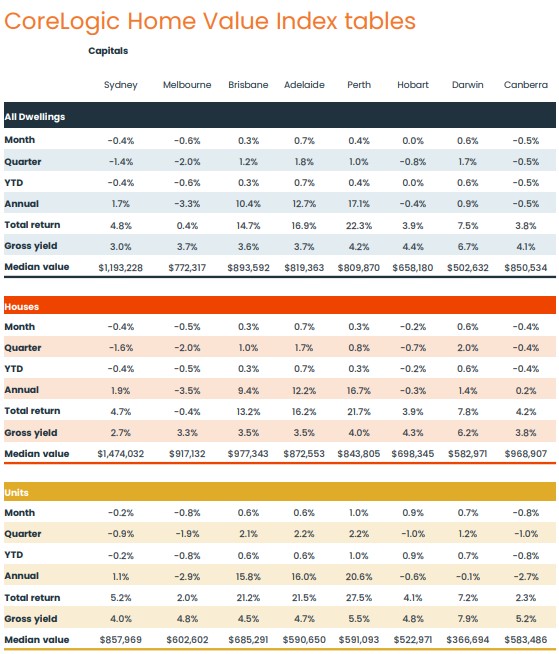

CoreLogic’s Home Value Index shows residential property prices in the ACT falling again by 0.5 per cent, with houses slipping -0.4 per cent and units and townhouses dropping 0.8 per cent.

The median value in Canberra is now $850,000, with houses costing about $970,000 and units and townhouses costing about $584,000.

CoreLogic says this represents a 7 per cent fall, or $65,000 from the peak, the second-largest decline among the capitals, but most of the significant increases from the COVID boom will remain baked in even if there are further falls before interest rate cuts bring buyers back to the market.

Financial markets are factoring in three rate cuts this year, the first of which could be decided today (and announced on 18 February).

The Property Collective Director of Sales and Projects, Will Honey, said the prospect of rate cuts had been enough to stir inquiries from potential buyers doing their research over the holiday break.

Mr Honey believes it may take two cuts for these buyers to commit, so it may not be until the latter part of the year when prices start to rebound.

“It’s on people’s radar that interest rates will potentially come down, so I think people have been sitting on the fence and waiting to make their moves,” he said.

“If interest rates do come down, that’ll be their trigger.”

He said last week’s auctions, the first real action of the year, had a strong start with 131 properties listed for a 68 per cent clearance rate.

“There’s definitely people with intentions this year,” Mr Honey said. “We’ve had a decent start as far as numbers of people coming back from holidays and being signed up to come to market.”

Despite the prospect of rate cuts, the likelihood of a significant growth cycle over the coming year remains low. Image: CoreLogic.

CoreLogic says properties are coming onto the market with listings for the ACT above the five-year average.

Mr Honey said the amount of supply, particularly for units and townhouses was continuing to drive the price falls, as well as buyers biding their time.

“Buyers are being picky because they have got a bit of choice, so they are focusing on better position and better-presented properties rather than going for something that needs a bit of work or is not in a desirable location,” he said.

“Turnkey sort of properties are definitely getting a lot of the numbers.”

Mr Honey said interest wasn’t simply focused on particular suburbs but on how and where properties were positioned within them.

He said one property in Monash on a roundabout could only attract two bidders, while another home nearby would have 10 registered bidders this weekend.

CoreLogic says that while all dwellings were down 0.5 per cent over the past year, houses remained flat, and units and townhouses fell 2.7 per cent.

Areas that fell the most were Gungahlin with a 2.9 per cent drop for a median of $893,451, South Canberra (-2.6%, $996,496), Weston Creek (-1.3%, $906,273), and North Canberra (-1.2%, $739,062).

Areas where prices rose were Molonglo (1.8%, $764,425), Tuggeranong (1.8%, $842,773), Belconnen (0.8%, $824,824) and Woden Valley (0.3%, $962,226).

Nationally, prices were steady, but Sydney (-0.4%) and Melbourne (0.6%) both joined Canberra in recording falls.

CoreLogic research director Tim Lawless said that despite the prospect of rate cuts, the likelihood of a significant growth cycle over the coming year remains low.

“Lower mortgage rates and a subsequent lift in borrowing capacity as well as an undersupply of newly built housing could be setting the foundations for a relatively shallow housing downturn,” Mr Lawless said.

“But the easing cycle for interest rates is likely to be a gradual one, and we also have the ongoing headwinds of affordability constraints, normalising population growth and generally soft economic conditions to contend with.”