According to the ANZ/Property Council Survey, industry believes the construction pipeline will improve. Photo: File.

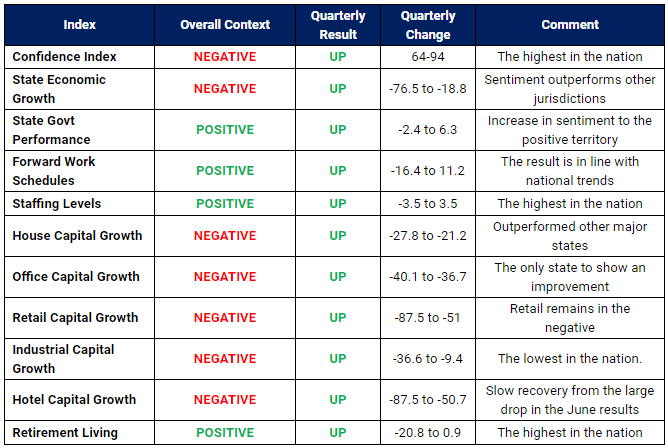

Confidence in the ACT’s property industry has rebounded to be the highest in the nation, but it remains well down on pre-COVID-19 levels, according to the latest ANZ/Property Council Survey from the Property Council of Australia.

The survey shows that despite more optimism, the COVID-19 pandemic continues to significantly affect all ACT property sectors, and the industry is calling for more government stimulus measures.

ACT property industry confidence has increased 30 index points from 64 to 94 during the quarter, well short of the high of 144 points in December 2019. A score of 100 is considered neutral.

Property Council of Australia ACT executive director Adina Cirson said the key to ensuring the property industry leads the economic recovery will be further stimulus measures to encourage development and increase the number of buyers in the market.

”We will continue to monitor the impact of COVID-19 and engage with the government on what further reforms might be necessary to keep the sector growing,” she said.

Ms Cirson said all property sector sentiments, except retirement living, remained in the negative and well below pre-COVID-19 market expectations.

ACT results from the latest ANZ/Property Council Survey from the Property Council of Australia. Image: Supplied.

Survey feedback highlighted a need for relief from taxes and charges, cutting red tape and continued infrastructure spending from government.

“Survey participants reported having greater confidence in the ACT Government’s ability to plan and manage growth than in the past quarter, but cite the top critical issues for the government to stimulate growth are addressing property taxes and charges, planning and regulation, housing supply and affordability, and development around transport corridors,” said Ms Cirson.

She said there had been a positive response to the Federal Government’s HomeBuilder grants scheme now being implemented by the ACT Government, with applications opening this week.

Nearly 60 per cent of respondents believe HomeBuilder will positively impact their businesses, said Ms Cirson.

“The past few months have been a challenge for all sectors across the property industry,” she said. “Managing this crisis has been tough for all businesses so it is good to see there has been an uplift in sentiment and a positive light in this.

“What is pleasing is the forward work schedule expectations for the next 12 months, the belief the construction pipeline will improve and staffing levels will increase, all returning to the positive. They are the only measures to have moved out of the negative index results.”

Ms Cirson said the hotels and tourism sectors had been hit the hardest by the COVID-19 pandemic, followed by retail and commercial office.

”Overall, a significant impact on all sectors is expected, with all sectors reporting a moderate to serious impact with relation to construction schedules and growth expectations during the next few months,” she said.

Nationally, the Property Council of Australia says COVID-19 is keeping property industry confidence at a near record low level despite an improvement in sentiment for the September 2020 quarter.

The national confidence score for the quarter was 76, a 14-point improvement on the record low experienced in the previous quarter.

But expectations around forward work schedules and staffing levels remain negative, and the current impact of COVID-19 remains strongly negative.