New apartments are welcome but Canberra needs more diverse rental stock, says REIACT. Photo: Michelle Kroll.

Renters are again queuing up to put a roof over their heads as the amount of available properties shrinks, and the situation may only get worse as international students start returning to Canberra.

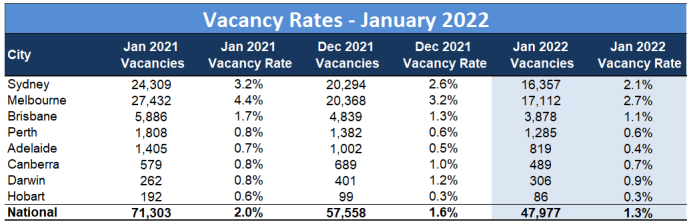

In December, according to SQM Research, the vacancy rate was an already tight 1 per cent, but since then, the squeeze has been on, with January posting 0.7 per cent.

Last month there were just 489 vacant properties, compared with 689 in December and 579 at the same time in 2021.

Tuggeranong in the far south is now the tightest market with a vacancy rate of just 0.3 per cent, coinciding with a surge in rents there.

Canberra’s already sky-high rents are on the move across most areas. Units continue to pull the highest rents in the country at $540 a week on average, while houses attracted nearly $750 a week, falling behind a resurgent Sydney.

Agents are reporting large groups at open homes as a mix of people from public service and Defence staff to students vie for the few properties on offer.

Real Estate Institute of the ACT president Hannah Gill fears the situation will get worse before it gets better, particularly when international students return after the reopening of Australia’s borders to double-vaccinated visa holders from 21 February.

“It’s a genuine concern because we’re already seeing people who can’t afford to find suitable properties to meet their needs,” Ms Gill said. “There’s no short-term reprieve in pricing, it’s not about to drop any time soon, and that supply issue isn’t going to be improved.

“We’re talking rental stress for many households and potential homelessness in severe circumstances.”

ACT Vacancy Rates 2022. Image: SQM Research.

Ms Gill said the challenge was the variety and style of rental properties and their location.

“We can’t just have apartments in [inner] Canberra. We can’t just have three or four-bedroom houses in the outer suburbs,” she said. “We need real diversity because that meets the needs of our community.”

Ms Gill said there was still a huge demand for houses from families wanting to be near schools and people with pets but little stock.

“That market is really suffering,” she said.

Many people who would rather be more centrally located were now having to look further out.

Agents were having to manage groups of 30 to 40 people at open homes while staying compliant with COVID-19 requirements.

Ms Gills said that was proving a real challenge and some had dropped weekend showings for certain properties.

Ms Gill expects rents to continue to hold strong if not rise overall for at least the first half of the year, simply due to the supply issues.

In January, the biggest rises in house rents were in Weston Creek (6.5%) where asking rents breached $800 a week and the Woden Valley (4%) at $745 a week, while units were up nearly 10 per cent to almost $550 a week in Tuggeranong. Houses in Tuggeranong were the cheapest in Canberra, if you can find one, at $627 a week.

The inner south and north remain the dearest areas to rent, whether a house or a unit. Renting a house in the inner north will set people back on average more than $840 a week, while the inner south can command $870 a week. A unit will cost more than $600 a week.

Gungahlin may be an outer area, but a house there brings more than $730 a week and units $530 a week.

Belconnen provides the best value for a unit at $508, while a house is only slightly dearer than Tuggeranong at $646 a week.

Nationally, vacancy rates are at a 16-year low of 1.3 per cent as capital city vacancy rates returned to normal longer-term averages recorded before the COVID-19 outbreak.

Managing director of SQM Research Louis Christopher said the January drop was larger than expected and February listings in Sydney and Melbourne had fallen further.

“All this represents an acute shortage of rental properties, and the shortage has already been translating into large surges in weekly rents across the country,” he said.

“It is now very likely market rents will rise by over 10 per cent this year. Indeed, it could actually be much more than this as we are recording a rise in capital city combined rents of 5.2 per cent just in the last 90 days.”