Do you think there is a need to tweak the way rates are calculated for units in the ACT?

New ACT Treasury ‘modelling’ shows Canberra unit rates increased by up to 60 per cent in 2017-18.

The fact is that this ‘new ACT Treasury modelling’ is a single graph.

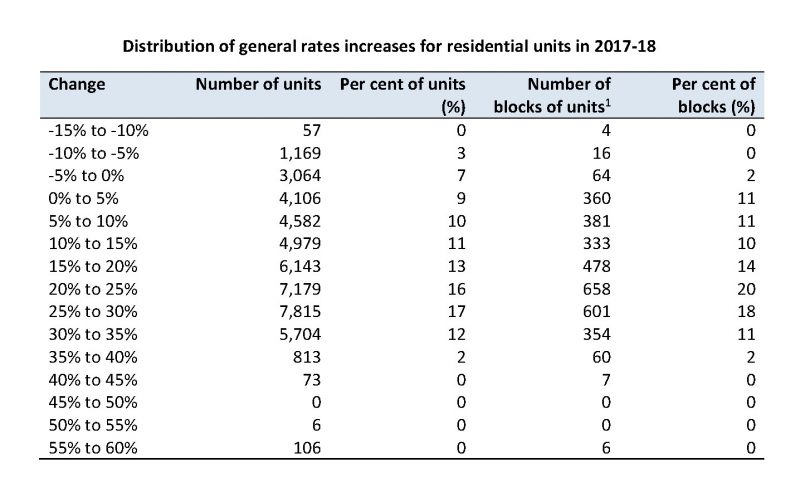

This graph, titled, Distribution of general rates increases for residential units in 2017-18, attached below, shows the number and percentage change in the amount of rates for units and blocks of units.

Distribution of general rates increases for residential units 2017-18 (ACT Treasury).

This graph showed some not so startling facts:

- There were 45,796 units in the ACT

- 41,506 experienced a rate rise

- 4,290 experienced a rate decrease

This means that 90.63 per cent of units received a rate increase and 9.37 per cent received a decrease.

The graph shows that 32,818 units or 71.67 per cent of units received increases of 10 per cent to 60 per cent.

With the largest number of units, 7,815, in the 25 per cent – 30 per cent increase bracket.

But isn’t this what the ACT Government promised Canberrans at the last election: lower stamp duty and increased rates?

Stamp duty should be decreased in the upcoming ACT Budget – and accelerated to account for the large increases in rates.

Rather than concentrating on the rate increases, it is time to look seriously at the formula that is being applied to units and whether it is fair.

The Government should also be looking at the transitional arrangements to the new ‘progressive’ shift from stamp duty to increased rates.

There are plenty of Canberrans that paid extensive amounts of stamp duty that are now being hit with increased rates as well (and yes of course they will benefit, if and when, they sell or purchase again, but for some that could be years away).

The bigger issue is the one being raised by former Deputy Chief Minister and Treasurer and Chair of the ACT Taxation Review 2012, Ted Quinlan AM, and that is, why are units of completely similar value being levied different rates?

This is a simple question that requires urgent action on behalf of the ACT Government.

Do you think there is a need to tweak the way rates are calculated for units in the ACT?