Prestige sale: 35 Roebuck Street Red Hill went for $2.7 million at the weekend, the kind of sale Chief Minister Andrew Barr says is driving the headline housing growth figures. Photo: Peter Blackshaw Manuka.

Chief Minister Andrew Barr has rejected claims that government policies are driving up house prices in Canberra as new data shows both standalone properties and townhouses and units adding almost another 2 per cent last month.

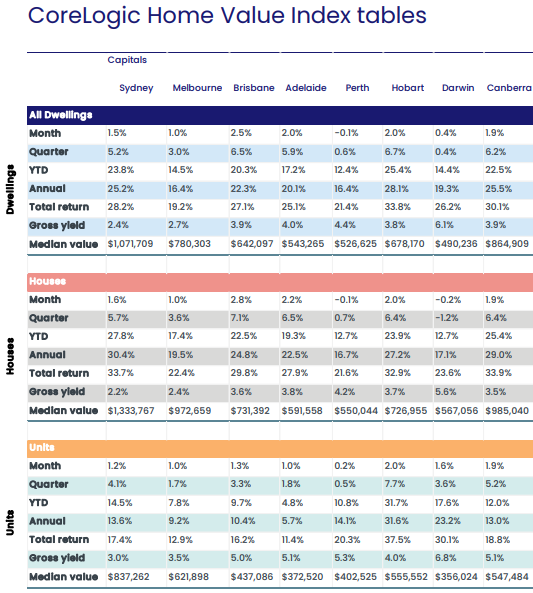

Houses have appreciated by nearly 30 per cent over the past 12 months, with 25 per cent added in 2021 alone, according to CoreLogic.

But that growth rate has slipped slightly from the 2.2 per cent of August, while units and townhouses have gathered steam as budget-stretched buyers look elsewhere.

The Canberra Liberals continue to hammer the Labor-Greens commitment to 70 per cent of new housing being infill development, saying it has contributed to a lack of land supply for detached housing.

“The demand is for houses, and the Labor-Greens Government has been underdelivering and restricting the supply of land for detached houses for years,” Canberra Liberals planning spokesperson Peter Cain said.

But Mr Barr said the housing boom was not limited to Canberra and was mainly due to ultra-low interest rates and tax settings that favour property.

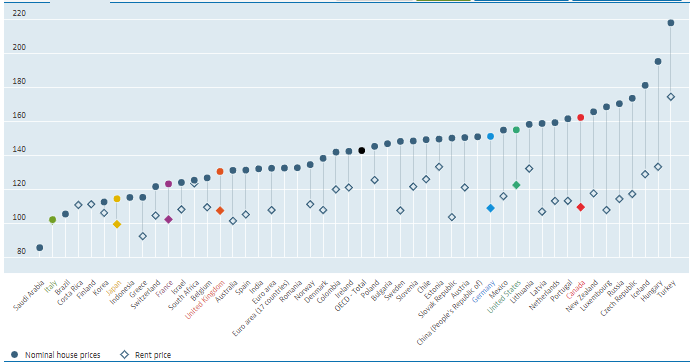

“It’s a national and global phenomenon, and in fact, Australia’s house prices are the lower end of the OECD,” Mr Barr said.

Mr Barr said it was an asset price bubble fuelled by low-interest rates because “it’s never been cheaper to borrow in the history of Australia”.

CoreLogic Home Value Index Tables. Image: CoreLogic.

He said the main price rises were in the established market, especially prestige properties, not necessarily new areas and “they ain’t making any more Forrests or Yarralumlas anymore”.

“Canberra has the biggest houses in Australia, and some of the biggest houses in the world and they are amongst the best fitted out,” Mr Barr said.

“We’ve seen in the last two years hundreds of millions of dollars being poured into home renovations that have increased the value of individual properties.”

Mr Barr rejected claims that the government was not releasing enough land.

“We’ve got 185,000 properties in the city and the new land release each year is 2 per cent of the total market, so it’s established houses that drive the headline figures,” he said.

Mr Barr said demand could not be blamed for the ACT boom because the fall-off in international migration over the past two years had contributed to the rate of ACT population growth plummeting.

“The usual suspects are the government doesn’t release enough land, and it must be migrants. Well, neither of those things are true,” he said.

This graph of OECD house prices provides some context for the Australian situation. Nominal house prices / Rent price, 2015=100, Q3 2021 or latest available.

Mr Barr warned that any fall in house prices could find many people who had borrowed for big mortgages in negative equity.

The Reserve Bank meets today (2 November) amid speculation that interest rates are on the rise as inflation picks up, but Mr Barr said it would probably hold the line for a time as it has other issues to consider, such as employment.

The median price for houses is heading closer to the million-dollar mark at $985,000, higher than Melbourne, while the median unit price is nearing $550,000.

In the last quarter, houses have surged 6.4 per cent and units not far behind at 5.2 per cent.

The lack of listings for established houses has contributed to high prices, but more properties are finally coming on to the market with a large number of auctions back on site at the weekend.

Eighty-four properties were listed, with 71 reported and 62 sold for a clearance rate of 87 per cent and median price of $1,000,300.

The top price was for a Red Hill home sold by Peter Blackshaw Manuka for $2.7 million, followed by an Angas Street, Ainslie property ripe for redevelopment that brought $2.17 million.

CoreLogic says the key to continuing market growth will be when interest rates go up, and the Commonwealth Bank and Westpac have already increased their fixed home loan rates.

The other issue is tightening loan rules with APRA’s 50 basis point lift in the serviceability buffer coming into effect this month.