Auction listings are rising as the spring selling season gets underway. Photo: LJ Hooker.

Canberra’s house prices resumed their upward trajectory in August in time for a spring bounce in the market aided by an interest rate pause.

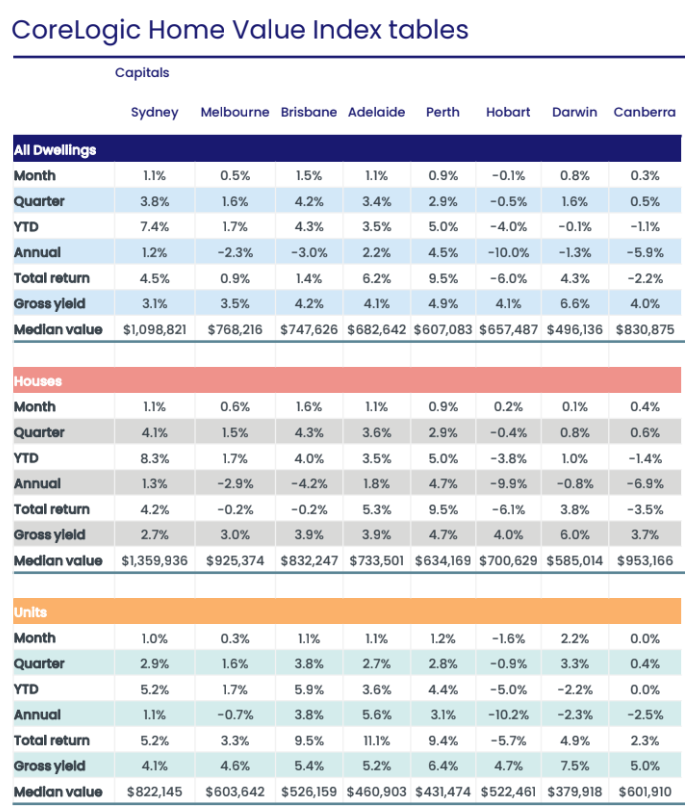

The CoreLogic Home Value Index out today shows prices for all dwellings rising 0.3 per cent. Houses rose 0.4 per cent after an ever-so-tiny blip in July, and units and townhouses were flat after a 0.6 per cent increase in July.

House prices have now risen 0.6 per cent for the quarter after faltering earlier in the year due to the Reserve Bank’s war on inflation that produced a run of interest rate increases.

That war may have been won after the latest CPI figures came in at 4.9 per cent this week, boosting the prospects that the Reserve will leave rates alone next Tuesday.

That would boost market confidence and provide some welcome stability for home buyers.

Ray White Canberra sales director Scott Jackson said there were already signs of confidence in the ACT market.

“Media reports of rates stabilising are giving buyers and sellers the confidence to enter the market,” Mr Jackson said.

“We are seeing a return to more normal listing volumes and auction numbers, pointing to a positive spring.”

While property values have been rising significantly in big capital cities, Canberra’s have been flat or marginally higher.

Confidence is returning to the house market. Image: CoreLogic.

CoreLogic research director Tim Lawless said values across the ACT had risen only mildly, up 1.0 per cent since a trough in April, while Hobart values had not changed since stabilising in April.

“These are also the only two capital cities where advertised supply is tracking higher than a year ago, suggesting a rebalancing between buyers and sellers is a key factor contributing to the stability of values in these regions,” he said

Auction listings for tomorrow (2 September) point to an increase in properties coming to market, as is usually the case in spring.

Fifty-seven properties across the ACT are listed to go under the hammer after last Saturday’s auctions hovered around the 50 mark with clearance rates of 60 to 70 per cent.

The median sale price of $1,130,000 last weekend was the highest of the month.

Properties listed include 7 Timbarra Crescent, O’Malley, a 5-bedroom, four-bathroom home in an area where recent sales have topped $2 million.

The increase in listings could also mean predictions of a bumper selling season could be on the money.

While consumer confidence is a big factor in other markets, Canberra’s strong employment market and high salaries tend to insulate the national capital and maintain demand.

Nationally, the Home Value Index marked a sixth consecutive rise, up 0.8 per cent in August. Since bottoming out in February, the national index is up 4.9 per cent.

“With housing values trending higher over the past six months, it’s clear the Australian housing recovery is firmly entrenched,” Mr Lawless said.

Canberra’s prices remain the second highest in the country after Sydney, and while the market has normalised, that is unlikely to change, especially with a rising population and housing starts falling behind demand.