House prices have risen 1 per cent in the June quarter. Photo: Michelle Kroll.

Tomorrow’s interest rate decision looms large for Canberra’s housing market as it continued to creep upwards in June for a second successive month.

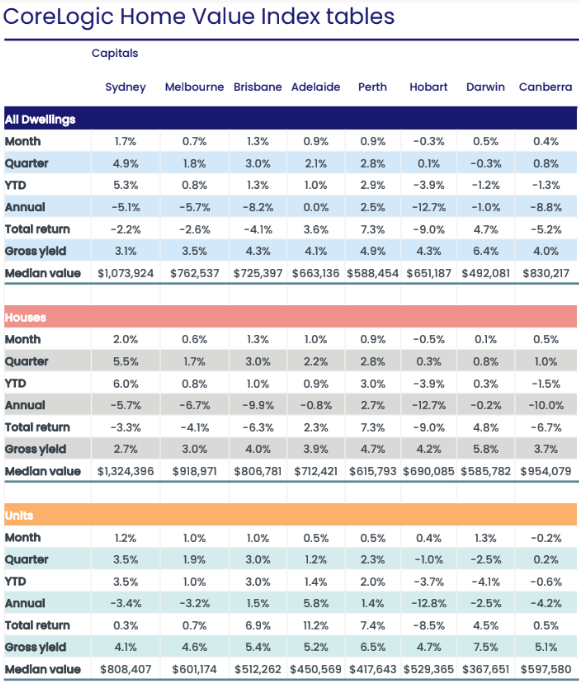

CoreLogic’s monthly Home Value Index showed an overall 0.4 per cent rise for a median of $830,000, with houses again leading the way at 0.5 per cent for a median price of $954,000. In comparison, units and townhouses ($597,000) hardly moved with a -0.2 per cent decline.

The market overall was down 8.8 per cent for the 2022-13 financial year, with houses falling 10 per cent and units and townhouses holding their value much better to be just 4.2 per cent down.

But it was still up about 25 per cent compared to the pre-pandemic figure

Over the last quarter, though, the market has picked up slightly, although not as much as in Sydney or some of the other capitals.

In the June quarter, Canberra defied the higher interest rates for an increase of 0.8 per cent. Houses were up 1 per cent and units and townhouses just 0.2 per cent.

But the recovery could stall if the Reserve Bank decides to lift the cash rate a further 25 points to 4.35 per cent, despite the latest inflation figure coming down to 5.6 per cent.

Three of the big four banks are predicting a rise, with CBA the holdout, and economists are evenly split, although most believe the RBA will definitely raise rates in August.

That interest rate uncertainty combined with Canberra’s winter has the market in mid-year doldrums, according to The Property Collective’s Will Honey.

Canberra prices are still up 25 per cent on pre-pandemic figures. Image: CoreLogic.

Mr Honey said the market was waiting to see where interest rates would go.

“If interest rates do hold it might give a little bit more certainty back into the market that’s needed,” he said.

Last weekend’s low auction numbers reflected this.

Of just 31 properties listed, 27 were reported for 12 sold, a clearance rate of only 44 per cent, compared with 57 per cent and 67 per cent for the previous two weeks.

Mr Honey said winter was traditionally a lower volume season, but the numbers were a “bit more than the normal decline”.

He said it was a waiting game as sellers sit on their hands and buyers worry about their borrowing capacity and repayments.

Mr Honey described a patchy market with no one area standing out.

Nationally, values rose 3.4 per cent to be 6 per cent below peak levels recorded in April 2022.

Every capital city except Hobart (-0.3%) experienced rising values, led by Sydney (1.7%), fed by a lack of supply.

CoreLogic research director Tim Lawless said the balance had tipped in favour of sellers, but interest rates continued to worry potential buyers.

“Forecasts on where the cash rate will land and how long it will stay elevated vary, but it’s likely there is at least one more rate hike to come, potentially more,” he said.

“It’s hard to imagine the recent pace of growth in housing values being sustained while sentiment is close to recessionary lows and the full complement of borrowers are yet to experience the rate hiking cycle in full,” Mr Lawless said.

He indicated there could be more distressed sellers in coming months with an unprecedented peak in the number of fixed-rate borrowers refinancing to significantly higher mortgage rates.

But Canberra, with full employment and higher wages, may be less exposed than other cities.