After a year in decline, house prices are again on the rise in Canberra. Photo: Michelle Kroll.

Canberra property prices are rebounding, but the recovery might be shortlived if the Reserve Bank jacks up interest rates again after yesterday’s nasty inflation numbers.

The Consumer Price Index figure unexpectedly rose to 6.8 per cent in April from 6.3 per cent in March, driven by higher fuel and house prices, particularly in the bigger capitals.

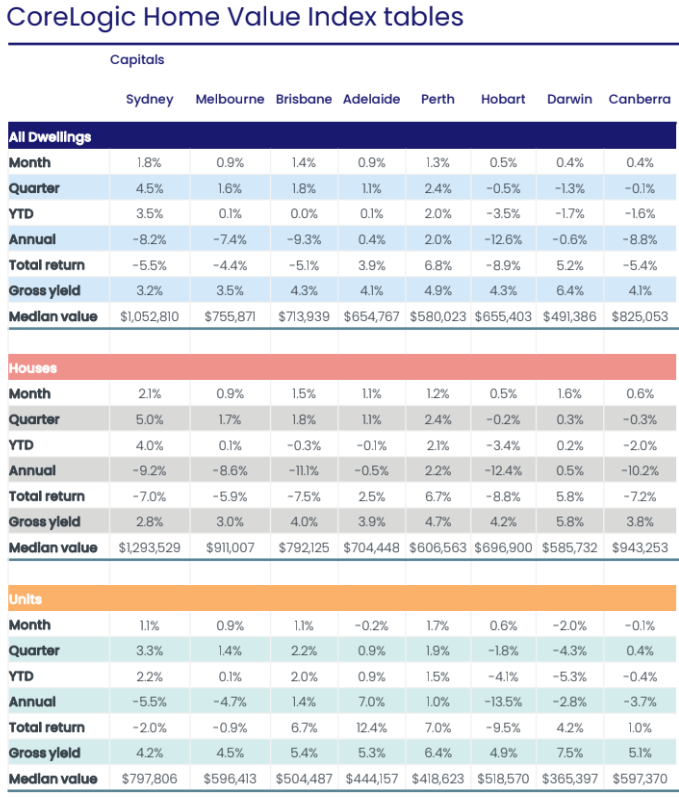

CoreLogic data for May showed Canberra’s values rose for the first time since June last year, up 0.4 per cent for all dwellings.

This time houses led the way, rising 0.6 per cent for a median of $943,000, while units and townhouses remained flat at just under $600,000.

Over the quarter, units and townhouses were up 0.4 per cent, while houses were just down at -0.3 per cent.

While over the past year, house values fell 10.2 per cent, and the more affordable units and townhouses just 3.7 per cent, overall Canberra values are still up 25.7 per cent on those in March 2020.

The Property Collectives Will Honey said the market was basically in a holding pattern with continuing uncertainty around interest rates.

“There are still some good results happening but sporadically throughout Canberra,” he said.

“People are holding off and looking for a bit more certainty in the world.”

Mr Honey said it was still a robust market, but people were watching interest rates very closely and looking for value, particularly around the serviceability of loans.

He said properties were holding their value and there was demand for anything at an entry-level.

“There’s not one type of property that people are looking for,” Mr Honey said.

Around 50 to 70 properties a week are going to auction and clearance rates were averaging about 65 per cent, but some sellers could be waiting until spring.

CoreLogic Home Index Tables for Australian capital cities. Image: CoreLogic.

CoreLogic’s Tim Lawless said houses were now recording a stronger recovery trend than units and townhouses, which had been quite resilient during the downturn, but nothing like Sydney or the other big capitals.

Mr Lawless said the comparatively strong listings numbers – 11 per cent above what they were a year ago and only a little lower than the five-year average – might explain why Canberra property prices were not recovering as quickly as other cities.

“It doesn’t have that scarcity or undersupply in available listings that some of the larger cities are showing,” he said.

The growing Molonglo Valley led the way with a 1.8 per cent rise in May, up 4.5 per cent for the quarter, while North Canberra recorded a 1.1 per cent monthly rise.

The north and south of Canberra remained flat, with Gungahlin and Tuggeranong down marginally by -0.3 per cent.

Mr Lawless said values in the wealthy Inner South and Woden Valley were edging up but not as much as more mainstream areas.

He said the inflation data made a rate rise from the Reserve Bank more likely and would make it harder for people to decide, whether buying or selling.

“The combination of a sticky inflation reading and asset prices would be weighing on their minds,” Mr Lawless said.

“The data is pointing to a 25 basis points [future interest rate increase] and maybe more if we don’t see inflation coming down.”

Nationally, the CoreLogic Home Value Index surged with the strongest monthly growth since November 2021.

It recorded a third consecutive monthly rise, with the pace of growth accelerating sharply to 1.2 per cent in May.

Sydney continued to lead the recovery trend, posting a 1.8 per cent lift in values over the month, recording the city’s highest monthly gain since September 2021.