No rate cut in the first half of the year, a slowdown in growth and a change of government could all conspire to hit housing prices in 2025. Photo: Michelle Kroll.

Canberra dwelling prices are set to fall by up to -6 per cent in 2025, the largest in the country, according to forecasts from SQM Research.

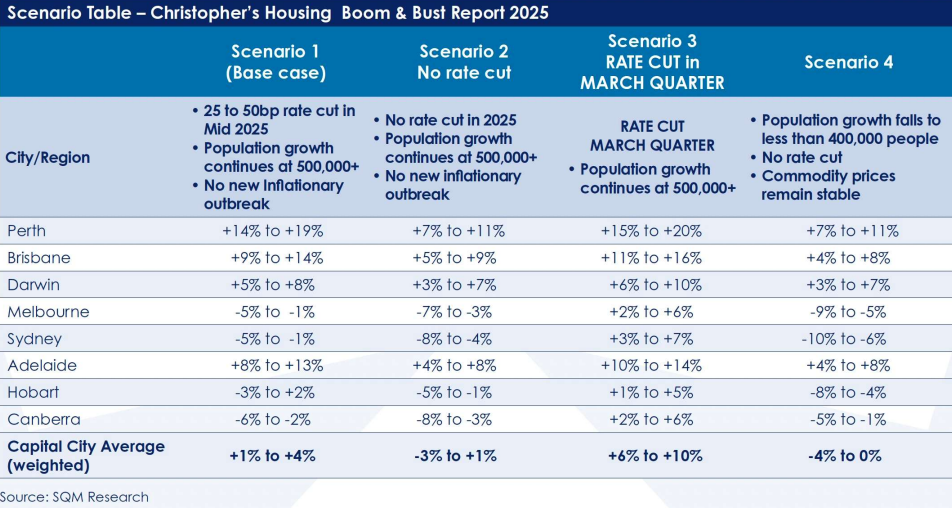

Its Housing Boom and Bust Report 2025 poses four scenarios, but its base case predicts price falls ranging from -6 to -2 per cent in the national capital, with an interest rate cut mid-year of 25 to 50 basis points as inflation continues to moderate and economic growth stalls.

This scenario also has population growth continuing at more than 500,000 nationally for 2025.

SQM Research managing director and report author Louis Christopher said the other factors included a surge in sales listings, a slowdown in the ACT economy and a change of federal government.

Mr Christopher said total listings over 2024 had increased by 15 per cent, including older listings. Listing growth for units and townhouses had outpaced that for stand-alone houses.

“So the older stock that’s been on the market for over 180 days, that’s getting up to roughly around 800 properties,” he said.

“Now, that’s fairly high for Canberra, and it indicates there are fewer buyers in the marketplace.”

Mr Christopher said ACT Treasury was projecting Gross State product to slow to 2.75 per cent, jobs growth to fall to 2 per cent and population growth to come back to 1.75 per cent.

“That doesn’t bode well for strong property price gains,” he said.

SQM is also predicting a change in government next year.

“And if that does happen, if we are right about that, you generally find incoming governments, particularly if they’re LNP governments, they start cutting back on public expenditure in the first year of their government, which might not bode so well once again for the ACT economy,” Mr Christopher said.

ACT Treasury forecasts also don’t bode well for strong property price gains. Table: SQM Research.

Mr Christopher said the bulk of Canberra’s housing price falls would occur in the first half of 2025, with a recovery in the second half after an interest rate cut but not enough to offset the earlier falls.

He said auction clearance rates also pointed to fewer buyers in the market.

The auction clearance rate in Canberra last week was 46.6 per cent compared with 62.9 per cent in June.

Mr Christopher said potential buyers might be putting their plans on hold until interest rates start to fall.

Two other scenarios also point to price falls, but one has them rising between 2 to 6 per cent if there is a rate cut in March and population growth continues at 500,000 plus.

The early rate cut is SQM’s third most likely scenario.

“It would have to be an almost emergency situation,” Mr Christopher said.

“So, like, we have a big rout in the equities market, but it could also be that every CPI rate we get from this point onwards is a lot better than expected, and the economy starts to slow quicker than expected.”

Without a rate cut and population growth at 500,000 plus, price falls could be worse at -8 to -3 per cent. However, if population growth falls to less than 400,000 and commodity prices stay stable, price declines could be as little as -1 per cent or as high as -5 per cent.

Under the base case, Sydney and Melbourne housing prices are predicted to continue to record moderate housing price falls of between -5 to -1 per cent, while nationally, there would be a rise of between 1 to 4 per cent.

Perth, Brisbane, Adelaide and Darwin are expected to outperform the national housing market with Perth forecasted to record the fastest dwelling price rises of between 14 to 19 per cent.