If you want to buy the median-priced home in Canberra’s most expensive suburb for 2014, you’ll need an annual salary of $116,500.

(The suburb is Griffith, and the median house price is $1.005 million.)

New research by real estate agent comparison service Which Real Estate Agent has revealed how much you need to earn to buy in Canberra, as well as in other Australian capital cities.

Some of the findings are interesting, so we’ll share a couple of relevant local insights here.

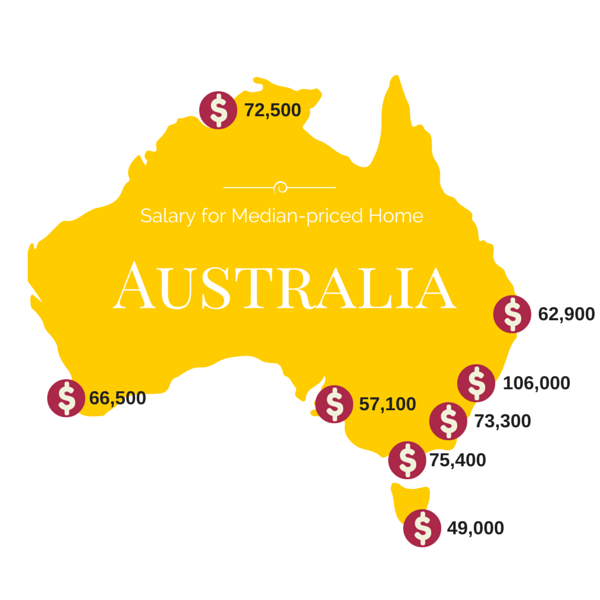

To buy the median-priced Canberra home, you need to earn $73,000 per year. That’s almost on par with the national average – the median-priced Australian home requires an annual salary of $73,500.

As you might expect, buying in suburbs like Griffith, Yarralumla and Deakin require higher annual salaries:

- Griffith: $116,500

- Yarralumla: $134,200

- Deakin: $112,000

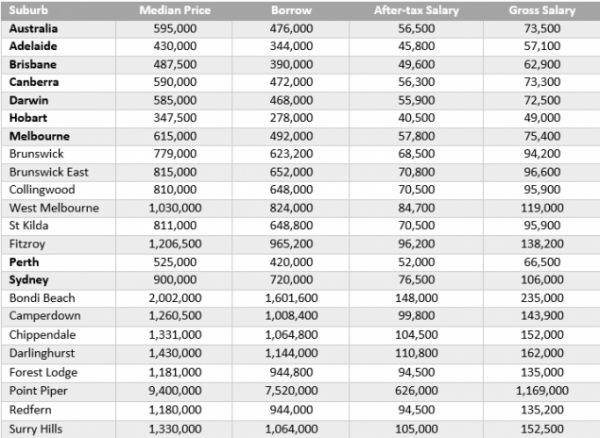

But if you think that’s expensive, spare a thought for our neighbours up the Federal Highway. To buy the median-priced home in Sydney’s Point Piper, for example, a homebuyer needs to make at least $1.169 million per year.

In Bondi Beach? $235,000.

Darlinghurst? $162,000.

In fact, you probably need to earn more than six figures just to enter Sydney’s property market, where the median-priced home requires an annual salary of $106,000.

The good news is that isn’t the case in Canberra. The median-priced Charnwood home, for example, requires an annual salary of $54,700. In Wright, you need $69,000. This figure is a bit of a surprise, as Wright isn’t considered an affordable suburb by many (though a reader has pointed out that the low median price in Wright is likely because it doesn’t include the sale of land).

According to Which Real Estate Agent, these calculations assume that a homebuyer is single, puts down a 20 per cent deposit and has annual expenses equal to $17,907 (the definition of the poverty line). There’s some more info in the table below.

Do these findings surprise you?