Lovelorn Canberrans being tricked into phoney relationships are paying the highest price when it comes to falling for scams according to new figures released by the Australian Competition and Consumer Commission.

Data from the annual Targeting Scams report shows that dating and romance scams cost ACT residents $886,292 last year, with 11 victims losing more than $10,000 each through the scams.

In total, ACT residents lost more than $2 million from scams in 2016, with scam investment schemes incurring the second highest losses at $501,690.

However, the scam proving most successful in tricking Canberrans involves fake trader websites, with 41.4 per cent of locals targeted by this scam being taken in by it. This contrasts with only 1.7 per cent of targeted ACT people falling for inheritance scams and no one falling for ‘hitman’ scams.

Phishing was the most commonly reported ACT scam but only three people out of the 873 targeted actually fell for the scam, with losses totalling only $628.

Scams involving offers of mobile premium services were the second-most likely to trick Canberrans with 36.8 per cent of those targeted forking out money.

Social media used to prey on unsuspecting lonely hearts

Sadly, the third most successful scam in tricking ACT residents to part with their money was the dating and romance category. This is an area where scammers are increasingly using social media to “contact, trick and prey upon the unsuspecting” according to the ACCC.

“We have witnessed a sharp increase in scams taking place through social media sites. It can be really hard to tell who’s genuine and who’s fake these days,” said ACCC Deputy Chair Delia Rickard.

Last year around 30 per cent of the victims of dating and romance scams were contacted through social media sites, particularly Facebook.

“Dating and romance scammers trick their victims into falling in love with them and then use their victim’s trust to deceitfully take their money,” Ms Rickard said.

“If someone you’ve met through social media but you’ve never met in person asks you for money, your alarm bells should be ringing. Don’t ever wire transfer or send money to someone you don’t know because you won’t see it again.”

Fake trader scams on the rise

Ms Rickard said that fake trader scams also make use of social media and are on the increase.

In this scam, victims tend to see advertisements for online stores on social media selling products made by well-known brands at discount rates. However, the online stores are actually fake and the products people think they are buying don’t really exist.

This scam is easier to fall for because it is harder to spot that the stores are fake but Ms Rickard said there are some tips people can use.

“Wherever you see an offer that seems more generous than normal, do your research on the company, where the product is coming from, check the company’s website and try and find any reviews about the business before making a purchase,” she said.

“Only pay using secure payment methods such as Paypal or a credit card.”

Scams at record levels

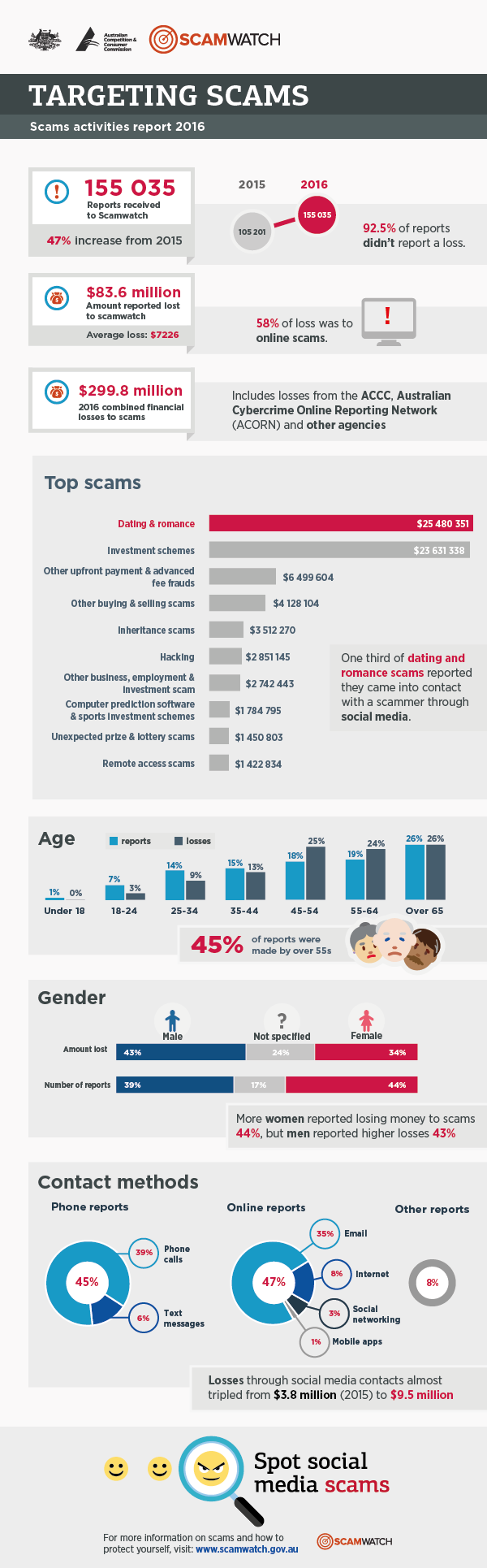

The number of Australians reporting scams reached record levels last year, increasing by 47 per cent compared with 2015. Across the nation, 200,000 reports about scams were made to the ACCC’s Scamwatch and the Australian Cybercrime Online Reporting Network, with reported losses totalling a massive $299.8 million.

Disturbingly, the Targeting Scams report states that ACT residents reported nearly double the number of scams that might have been expected given our population size.

Older Australians tend to be the most likely to fall for scams with people aged over 55 accounting for 45 per cent of reports to Scamwatch. People between the ages of 55–64 were the most vulnerable in terms of falling for dating and romance scams, while those aged between 45–54 were the most likely to be affected by investment scams.

The ACCC says that education and awareness are the best defence against scams. Anyone who is concerned about scams should visit www.scamwatch.gov.au to find out about common scams to watch out for, as well as to report scams and get information about what to do if they are a scam victim.

Scam case studies

The following case studies of scam victims were taken from the Targeting Scams report. Each story is based on one or more genuine scam reports received by the ACCC but the names of the victims have been changed for privacy purposes.

Daniel’s relationship with an online femme fatale

“Daniel reported that a woman seeking a relationship had contacted him through a private message on Facebook and he instantly fell for her charm. The scammer was intimate with him on Facebook and they were regularly messaging for three days. At first, Daniel thought something might not be right, but after moving to Skype and seeing the scammer in person, all hesitation was gone. During one Skype conversation, Daniel was filmed by the scammer while performing compromising acts in front of the camera. Almost immediately, the scammer’s attitude changed and she threatened Daniel, stating that if he didn’t pay a large sum of money, the video that had just been recorded would be shared on his Facebook profile so that all his friends and family could see. Daniel sent a wire transfer of almost $2000 immediately to the scammer in Manila. However, even after paying the scammer, the compromising video of Daniel was still shared on Facebook and YouTube for all his family and friends to see.”

Sierra and her clients feel the sting of a business email scam

“Sierra owns a plumbing supplies business. One day she received an email with an attachment, from what appeared to be a prospective supplier from China. Sierra opened the attachment but nothing happened and the document was blank. Believing it was an error she thought nothing of it.

A week later, Sierra received a call from a customer. He was calling to follow up on an email he had received from Sierra advising him that her payment details had changed and she was seeking payment of his outstanding account. Sierra had never sent this email but after calling around she found that all her regular customers had received one and unfortunately, one customer had paid almost $25 000 to the ‘new account’.

Sierra then discovered that she had been scammed, along with her clients.”

Paula scammed of pension payment

“One day Paula received a phone call from someone who said they were calling from Centrelink. The scammer told her that there had been an error in her pension payments. The scammer advised Paula that she was actually owed money, but first she would have to pay back her last pension payment before she would receive the money that she was owed.

The scammer asked Paula to pay the money back straight away on her credit card. However, Paula didn’t have a credit card to pay with so the scammers instructed her to purchase $600 worth of iTunes cards. Once she had purchased these, the scammer instructed Paula to call back and gave her ‘Centrelink’s’ phone number.

Paula went out and purchased the cards, when she got home she called the number that she had been given. Someone answered confirming that it was Centrelink. Paula was then directed to another scammer, who took the iTunes numbers and pin codes. Paula was given a receipt number of the transaction and an appointment was made for the next day at her local Centrelink office.

When Paula turned up to the Centrelink office for her appointment she was told that she had been scammed. Centrelink had never called her and there was no issue with her pension payments.”

Dianne’s dream man turns out to be a dud

“Dianne was ‘friended’ on Facebook by Emil. She accepted his friend request and they began chatting. Emil expressed his desire to be in a relationship with Dianne and said that as soon as he had returned from India for business, he would come to Australia to collect Dianne and take her back to America. Emil’s business was in cargo transport and he was travelling to India for three months to sell $9 million worth of high-end motor vehicles.

Dianne was excited at the prospect of spending her life in a new country with Emil. Soon after they began chatting on Facebook, Emil advised her that the Indian government would not release his cargo until he paid the outstanding tariff of $150 000. He asked Dianne to help pay the $150 000, with promises that he would pay her back. Dianne initially gave Emil $800 and after he received this, he asked for a further $20 000. Dianne didn’t have a lot of money and when she said she couldn’t afford this Emil got very angry. He harassed her constantly trying to get money out of her, always insisting he still wanted to marry her. Dianne paid the further $20 000 and didn’t hear back from Emil again. She realised that Emil was not her dream man, but a nightmare scammer.”

The following ACCC infographic provides a snapshot of information about nationwide scams in 2016.

Have you ever been scammed? Did you realise what was happening or did you get ripped off? Do you know someone who has had their heart broken by a romance scam? Tell us your story in the comments below. Also, let us know if you have any particular tips for detecting scams.