The first article in this series challenged some common perceptions about the Australian property market. In particular, I have explained why property prices had the capacity to grow so strongly in the past and that there is still plenty of potential for prices to go even higher in the future. Today we will examine if there are any near term impediments to that growth.

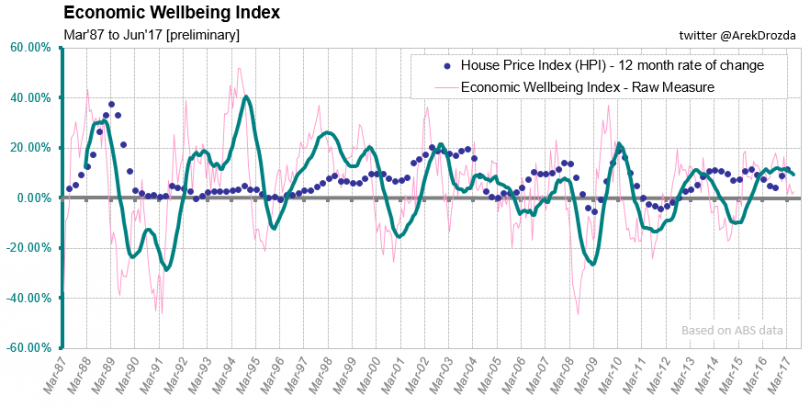

Let’s begin with a review of a couple of nation-wide indicators – the first being The Economic Wellbeing Index (EWI). It has been constructed specifically to reflect the perceptions of Australians about the current and near-term economic conditions, and most importantly, whether changes occurring in the economy will have a likely positive or negative influence on property purchase decisions.

The Economic Wellbeing Index (EWI).

The indicator (green line) is positive, which means the changes occurring in the economy are perceived as having a positive impact on the property purchase decisions. However, the raw measure (pink line) is in decline since late 2016, which means there is not enough ‘good news’ around so the jubilation about the future is starting to wear off (i.e. the indicator is approaching a neutral level).

Historically, this situation signalled a slowdown in growth of property prices but until the indicator goes negative, the probability of declines in property prices is low.

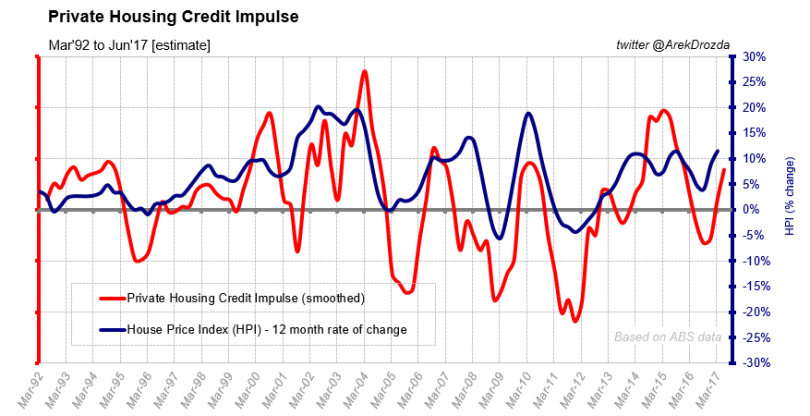

The Private Housing Credit Impulse (PHCI) provides an indication of the overall level of activity in the residential property market in Australia (since changes in credit reflect accurately rises and falls in price growth).

The Private Housing Credit Impulse (PHCI).

The indicator rebounded strongly in 2017 after a slowdown over 2015-2016, which means buyers are coming back to the market in greater force.

If you examine the above chart in detail you will notice that current developments closely resemble the early 2000’s. If history repeats, then the likelihood of the next couple of years experiencing 20%+ growth in the national property prices is not totally out of the question. However, it is not possible to entirely exclude a situation where market turns in the next few months and prices head down from current levels.

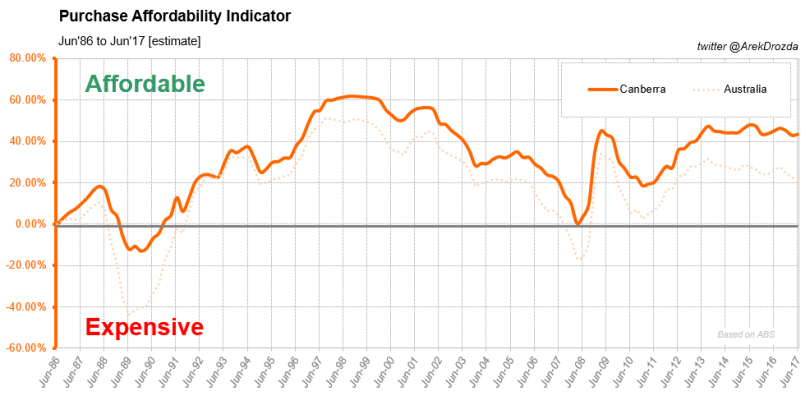

The Purchase Affordability Indicator (PAI) explains that, in historical terms and relative to incomes of Australians working full time, property prices are still very affordable – and this is particularly the case in Canberra. This minimises the downside risk quite significantly.

Relative housing affordability Canberra vs Australia.

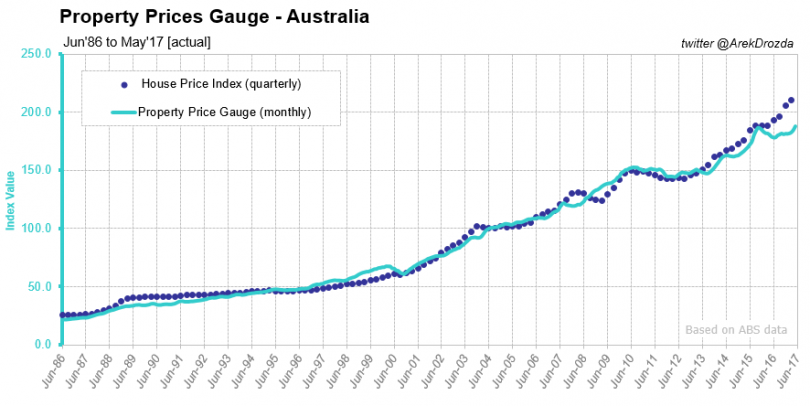

Nevertheless, prices at current levels appear to be ahead of what could be expected based on actual mortgage credit flows.

Property Price Gauge Australia.

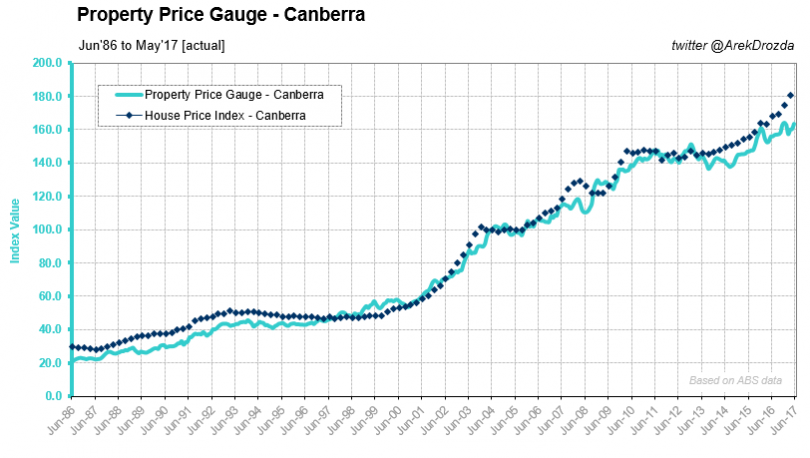

Historically, the Property Price Gauge (PPG) mirrors price movement quite well. However, when it diverges, it signals a slowdown or reversal in the current price trend. So, the current divergence can be ‘eliminated’ by either a drop in prices (as was the case in 2008 on a national level) or a pause in their advancement until PPG ‘catches up’ (as happened in 2003-04, 2010 and 2015 in Canberra).

Property Price Gauge Canberra.

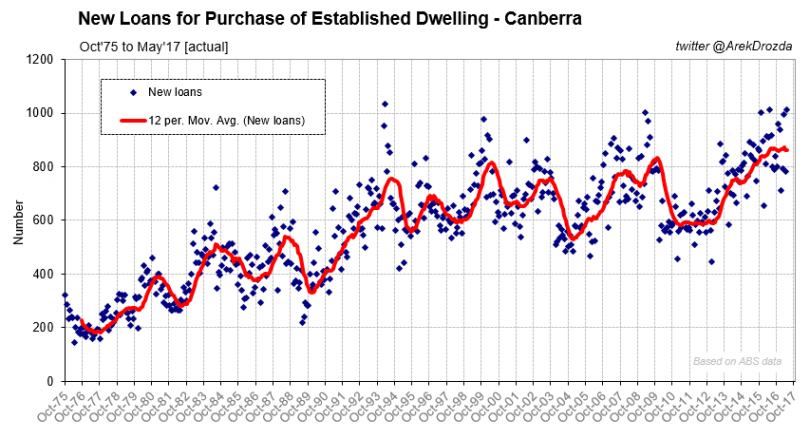

At the same time, volumes of loans in Canberra are historically high and appear to have reached a plateau. This is another strong indication that the local market may take a breather before prices can resume on their upward trajectory.

Volume of property loans Canberra.

To recap, the potential for further growth in Australian property prices is definitely there, no question about it. However, current conditions are less than optimal for uninterrupted price growth. Therefore, the risk that this may not be the right time to buy is elevated. But it does not mean that those planning their exit should rush to sell either, as downside risk is relatively low.

In a final instalment due out next week, we will discuss the optimal timing for buying and selling property, and where we are currently at in the property cycle.

Are you about to commit to your next property purchase? What are your greatest fears? Is the information shared in this series clarifying or clouding the picture for you?