Top seller: LJ Hooker Dickson sold 12 Canning Street in Ainslie for $2.75 million last week. Photo: Zango.

A surge in spring listings is giving buyers more choice and keeping a lid on Canberra property prices, according to the latest data from CoreLogic.

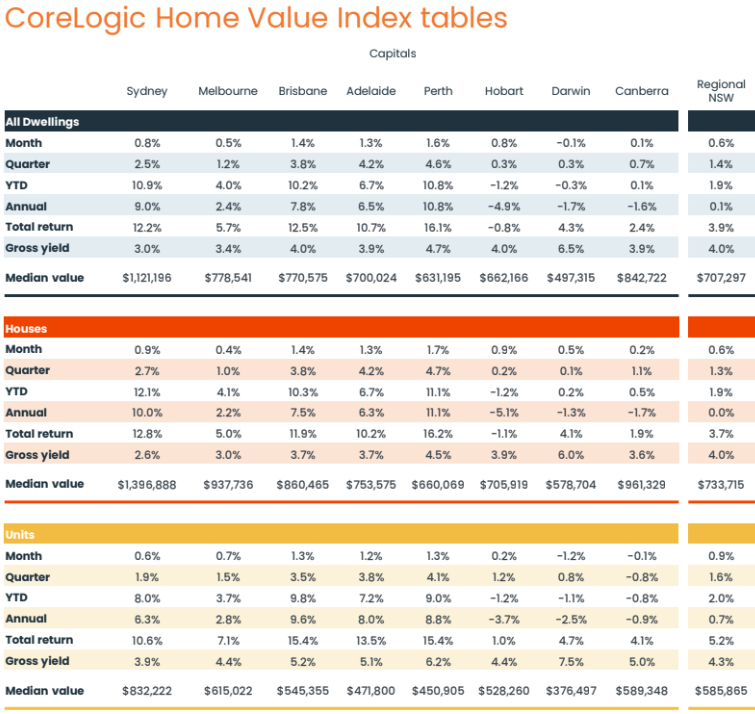

While prices continued to rise in most of the other capitals in October, Canberra remained flat, with CoreLogic’s Home Value Index showing just a 0.1 per cent rise for all properties, the same figure for the year to date.

Over the quarter, prices rose just 0.7 per cent for an October median of $842,722.

Stand-alone houses outperformed units, increasing by just 0.2 per cent for a median of $961,329, while units and townhouses hardly moved with -0.1 per cent slip and a median of $589,348.

House price growth slowed in October, posting a 1.1 per cent increase over the quarter. So far this year, houses have only moved 0.5 per cent.

Units and townhouses remain in negative territory over the quarter, year to date and annual categories, but not by much, showing that there has been little movement in prices.

The other factors are continuing uncertainty about interest rates and the pickup in inflation, firming odds that the Reserve Bank will push up rates on Melbourne Cup Day.

While Canberrans continue to spend, reflected in retail figures showing they lead the nation, the prospects of an increase in mortgage rates is a dampener for both buyers and sellers.

For those in the market, Canberra has offered a welcome boost in homes for sale this spring. The increase in listings of 23 per cent is the biggest in the country.

Listings are up 10.7 per cent across Melbourne and 9.3 per cent across Sydney, while Hobart listings have been well above average for more than a year. Brisbane and Adelaide have hardly budged and Perth is actually down on winter numbers.

Canberra auction numbers show many properties are not meeting their reserves, with Zango reporting more properties being passed in than sold for the week to 29 October.

Of 102 auctions reported, only 45 were sold, 55 were passed in and two were withdrawn, for a clearance rate of 44 per cent. Quite a few were sold either before or after auction.

The top sale was a four-bedroom, three-bathroom home at 12 Canning Street, Ainslie, for $2.75 million. The median price was $980,000.

While prices continued to rise in most capitals in October, Canberra remained flat. Image: CoreLogic.

CoreLogic Head of Research Eliza Owen said the Canberra market was a little soft despite seven months of consecutive growth. That growth had been relatively mild compared with other capitals and the previous upcycle.

She said the new supply outpaced demand, with 2500 new listings compared with 2300 sales over the quarter.

“This could give buyers a little more leverage,” she said.

“With that additional stock, they can afford to be a little more choosey.”

Ms Owen said the time to sell was 39 days, 10 days more than when the market was at its peak, which could mean sellers had to lower their expectations to get a deal done.

She said CoreLogic had also seen an increase in vendor discounting, with the typical rate by which a seller had to discount before a sale deepening from 3.3 per cent at the end of June to 3.4 per cent at the end of October.

The other element influencing the market was the still high price of real estate in Canberra and the difficulty for some in obtaining finance in a relatively high interest rate environment, especially with another rise on the horizon.

The market was 7 per cent from its peak in May 2022 but, taken over the past five years, was still up 40 per cent overall.

“A softer market was probably inevitable after such a run of growth,” Ms Owen said.

Nationally, the Home Value Index rose a further 0.9 per cent in October, accelerating from a 0.7 per cent rise in September (revised down from 0.8%).

Since finding a trough in January, the national HVI has increased 7.6 per cent, leaving the index only o.5 per cent below the historic high recorded in April last year.

CoreLogic research director Tim Lawless said that at this rate of growth, the national HVI would reach a new record high mid-way through November, recovering from the -7.5 per cent drop in values recorded over the recent downturn between May 2022 and January 2023.

However, there had been a clear slowdown in the quarterly growth trend due to higher stock levels.

The outlook was not as positive as a few months ago due to low sentiment, stretched affordability, and the potential for another rate hike.