Established apartments are selling well as owners take a capital gain. Photo: Geocon.

A patchy Canberra housing market is marking time as prices in most other capitals continue to rise amid an ongoing undersupply of properties.

The September data from CoreLogic shows that overall prices hardly moved, edging up just 0.2 per cent, compared to the national average of 0.8 per cent.

Prices in Sydney (1%), Brisbane (1.3%), Adelaide (1.7%) and Perth (1.3%) were all up by 1 per cent or more to contribute to an eighth consecutive month of increases.

CoreLogic research director Tim Lawless said supply remained the key.

“The three capitals recording the highest capital gain each have advertised supply levels that are around 40 per cent below their previous five-year average,” he said.

“Advertised supply levels across Hobart, where values are still trending lower, have been holding at above-average levels since June last year and were almost 40 per cent above its five-year average.”

Mr Lawless said that there were an above-average number of homes on the market in Canberra.

Prices in Perth and Adelaide were in record territory and Brisbane was likely to join them this month.

Canberra was still 7 per cent below its high from last year, and according to The Property Collective principal Will Honey, the market was tinkering along, with supply and demand evening out.

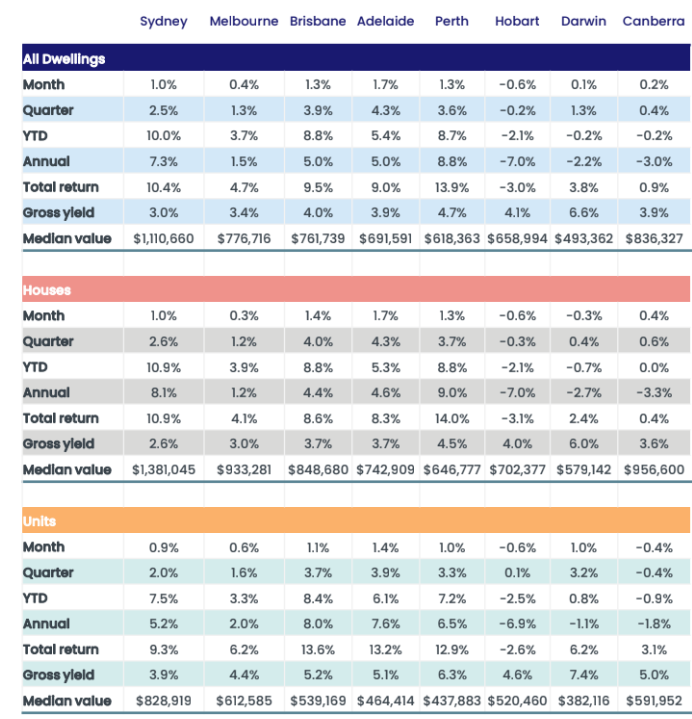

CoreLogic Home Value Index tables. Image: CoreLogic.

Mr Honey said there had been a seasonal uptick in listings, but the market was very patchy and hard to pick.

That patchiness is reflected in the data, which shows prices for freestanding houses rising a further 0.4 per cent after the same increase in August while units and townhouses slipped 0.4 per cent after being flat in August, with the median falling below $600,000.

Mr Honey said buyers, particularly in the apartment sector, were price sensitive and keen to negotiate the best possible price rather than diving in and being prepared to wait for new listings.

A lot of that had to do with interest rate uncertainty and cost of living pressures.

He said there was not a lot of new apartment stock available, but established unit owners who rode the boom were now selling up and taking a profit.

This had provided more choice in that sector and probably contributed to the decline in unit prices.

“They’ve got a capital gain where they are happy to sell at an OK price rather than a great price because they’ve made a lot of money,” Mr Honey said

Numbers at auctions, where clearance rates had fallen, and open houses varied widely, depending very much on particular properties.

Mr Honey said Canberra was like a ghost town on the long weekend, but some agents were still reporting 20 to 30 groups through some properties, while others only had single digits.

He believed Tuesday’s (3 October) Reserve Bank decision to keep rates on hold would provide a lead and confidence to the market.

“We can get back to some level of normality. People can know how much they can borrow, what it is going to look like in the short to medium term,” he said.