Canberra’s median house price is down $17,000 in a month. Second-hand apartment prices are also down. Photo: Michelle Kroll.

Canberra home prices slipped 0.4 per cent in August, the largest capital city fall in the nation as an abundance of supply tipped the national capital into a buyer’s market, particularly in the unit and townhouse sector.

The spring selling season is expected to bring even more properties onto the market, and the lower prices should bring buyers out who may have been waiting in vain for an interest rate cut.

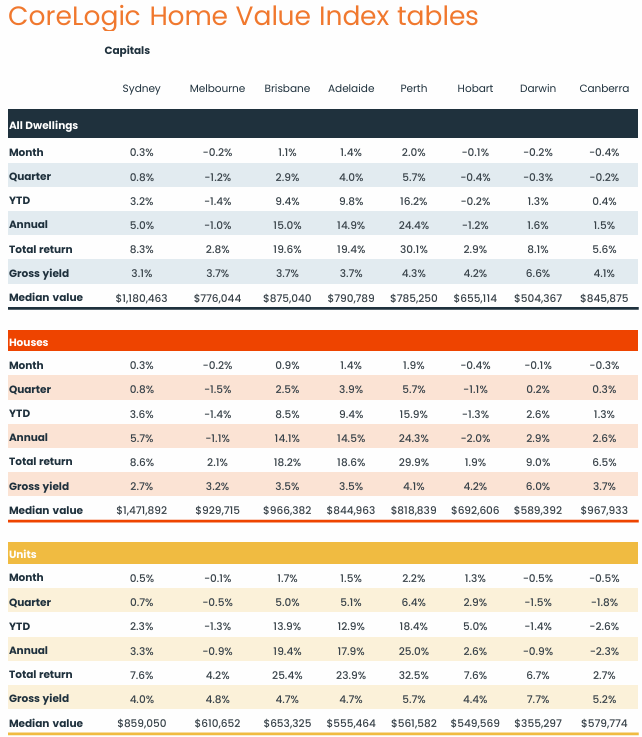

According to CoreLogic’s Home Value Index, the median home price of almost $846,000 is third highest in the country behind Brisbane, where a miserly supply, like in Perth and Adelaide, has produced a boom, although that is now starting to lose steam.

The past quarter shaved 0.2 per cent off Canberra prices, but over the 12 months, they are still in the black at 1.5 per cent.

The market is two-paced, with detached houses down just 0.3 per cent in August, compared with units at -0.5 per cent, but it is the annual figures that show this more clearly, with houses growing 2.6 per cent and units down 2.3 per cent.

The median house values show a surge in Brisbane, now comparable with Canberra, and unit values are fourth overall behind Sydney, Brisbane, and Melbourne.

Canberra’s median house value is now $17,000 less than a month ago.

The past quarter shaved o.2 per cent off Canberra prices, but over the 12 months, they are still in the black at 1.5 per cent. Tables: CoreLogic.

The Property Collective Director of Sales and Projects, Will Honey, said now was the time to buy, particularly in the second-hand apartment market, which has been boosted by the completion of projects and investors looking to offload immediately.

Mr Honey said owners were cutting their asking prices in that sector more than he had ever seen before.

“It just means that there’s a bit of supply that hasn’t been taken up and buyers can come in with offers and potentially buy a bargain property,” he said.

Mr Honey said turnkey, well-presented homes with little to do were still selling quickly, but buyers had the luxury of choice at present and could afford to wait.

“Buyers are just taking their time so they’ll go and look at other ones rather than jumping,” he said.

Sellers had also adjusted their expectations, and those who had sat on their hands over the winter were now more likely to put their properties on the market for the spring when they looked their best.

While buyers could be picky, they were also coping with a reduced borrowing capacity after the climb in interest rates.

Some had left the market altogether while others were working with lower budgets and did not want extra costs after a purchase.

Mr Honey said what the Reserve Bank would do with interest rates was anyone’s guess, but he felt it was more likely to keep interest rates as they were rather than cut them.

One trend emerging in the slower market was the increase in private treaty sales, as auctions failed to deliver a quick result and clearance rates start to drop.

CoreLogic has Tuggeranong leading Canberra’s price growth over the past 12 months with a median of $835,743 and growth of 3.4 per cent.

Then follows Weston Creek ($928,211 and 3.0%), Belconnen ($819,520 and 2.1%), North Canberra ($802,248 and 1.8%), Woden Valley ($978,336 and 1.6%) and South Canberra ($769,488 and 0.1%).

Molonglo and Gungahlin slipped 1.0 and 1.1 per cent over that period for medians of $753,034 and $885,832 respectively.