Canberra house prices are inching up but are now third behind Brisbane and Sydney. Photo: Michelle Kroll.

Canberra has lost its status as the second most expensive housing market in the country behind Sydney, but not because of falling prices.

While the national capital market continues to experience stable, incremental growth, booming Brisbane has overtaken it.

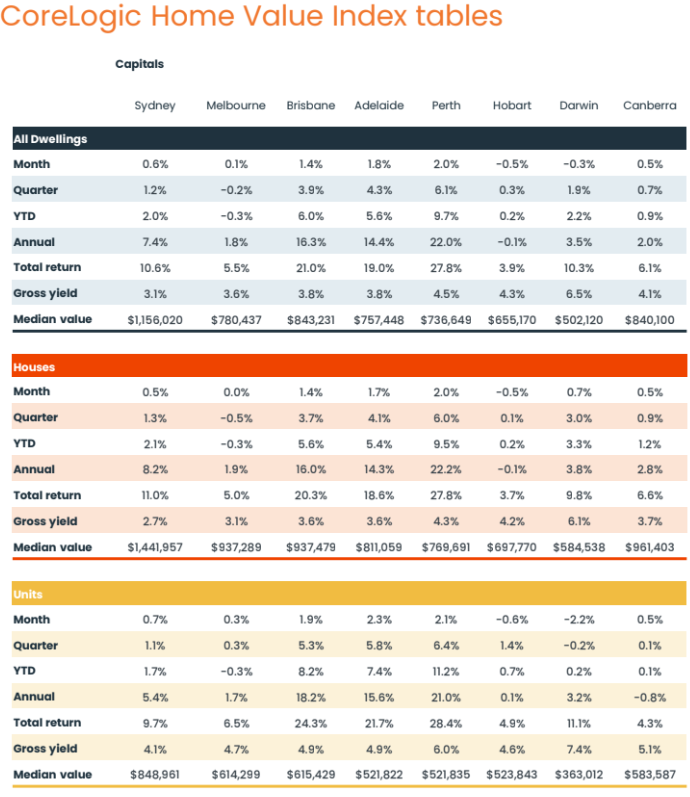

The CoreLogic Home Value Index shows Canberra prices have risen slightly again in May, by 0.5 per cent for detached houses, units and townhouses.

Over the last 12 months, values overall have risen 2 per cent, and 2.8 per cent for houses. Units and townhouses have remained stable.

CoreLogic puts the overall median value of Canberra homes at $840,100, while Brisbane has surged to $843,231 with an overall May rise of 1.4 per cent. Sydney sits atop at $1,156,020.

The median value of Canberra houses remains the second highest in the country at $961,403, while Brisbane has edged out Melbourne in third place. Sydney is in a world of its own at $1,441,957.

The median value of units and townhouses was $583,587, now fourth behind Melbourne ($614,299), Brisbane ($615,429) and Sydney way out in front at $848,961.

On average, across the country, it now takes more than 10 years to save for a 20 per cent deposit. Table: CoreLogic.

Brisbane house values are higher than the median house value across Melbourne for the first time since June 2008.

Coming into the pandemic, Melbourne’s median dwelling value held around a 37 per cent premium over Brisbane’s, and the ACT’s median was about 24 per cent higher.

Brisbane values have increased at more than five times the pace of Melbourne values since the onset of COVID, with growth of 59.8 per cent and 11.2 per cent respectively.

Brisbane has also outpaced growth in the ACT where values are up 31.8 per cent since March 2020.

Nationally, CoreLogic’s Home Value Index rose 0.8 per cent in May, the 16th consecutive month of growth and the largest monthly gain since October last year.

This was driven by the big three – Perth (2%), Adelaide (1.8%) and Brisbane (1.4%).

The Sydney market also reached a new milestone in May, equaling the earlier record high set in January 2022.

Over the year to 31 May, South Canberra continues to lead the growth pack with a median value of $896,291 and a 4.1 per cent increase, followed by Weston Creek ($912,478; 3.8%) and Tuggeranong ($840,991; 3.7%).

It then falls away to just 2.2 per cent in North Canberra ($699,909), 1.4 per cent in Belconnen ($816,315) and Gungahlin ($887,532; 0.4%)

Price growth has flattened in Molonglo Valley ($756,342; 0.0%) over the past 12 months, while Woden Valley has recorded a -0.8 per cent fall ($954,912).

South Canberra continues to deliver big results. 4 Sorell Street, Forrest, sold for $6.1 million. Photo: Blackshaw.

Driving the growth in South Canberra are big sale results for prestige homes in blue ribbon areas such as Forrest and Griffith.

The previous weekend a five bedroom, three-bathroom home with pool and wine cellar on a massive 2570 square metre block at 4 Sorell Street, Forrest sold for $6.1 million.

CoreLogic research director Tim Lawless said the continuing mismatch of demand and supply would mean the market nationally remained insulated from the current interest rate level.

While measures were being taken to boost supply, it would take some time before they could have an impact, he said.

“To say the housing market has been resilient is an understatement,” Mr Lawless said.

“Housing values are continuing to rise across most areas and housing types, with growth accelerating in some markets.”

The saving grace in Canberra has been a relatively high number of listings compared with other capitals, helping to stabilise the market.

Last week, Geocon managing director Nick Georgalis told Region he could not see an end to the housing crisis in Canberra for a decade and warned that there were few projects commencing this year.

CoreLogic said housing affordability was worsening across most markets, with the national dwelling value to income ratio rising to 7.7 in March, and the time it takes to save for a 20 per cent deposit is now 10.3 years, assuming households can save 15 per cent of their gross income.

In its latest Statement on Monetary Policy, the RBA noted it expected affordability constraints and high construction costs to continue weighing on dwelling investment in 2025 and 2026 but that it should pick up around the middle of next year.